High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Nvidia trades above and below 100 day MA. Key level at $128.06.

US major indices are lower with the Dow down for the 9th consecutive day. The Nasdaq closed at a record level yesterday but with no help from Nvidia which is now in correction mode after falling more than 10% from its all-time high reached on November 21 at $157.89....

Semiconductor weakness persists: Tech faces challenges as communication stocks rise

Stock heatmap by FinViz.com Tue, 17 Dec 2024 14:46:02 GMTStock Market Snapshot: A Tale of Diverging Fortunes in Tech and CommunicationThe stock market today is a mixed bag, reflecting a complex landscape of gains and losses across sectors. While semiconductor stocks...

We’re back to the ‘cash is trash’ era and that’s a warning sign

Bank of America is out with its latest fund manager survey and it's littered with red flags about a crowded stock market, particularly in US equities.This chart might stand out the most as it indicates that cash allocations are the lowest since January 2002.Combine...

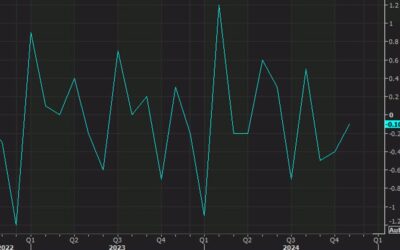

New Zealand GDT dairy price index -2.8%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

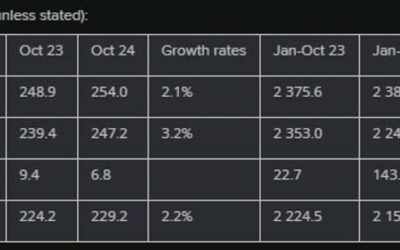

US November industrial production -0.1% vs +0.3% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

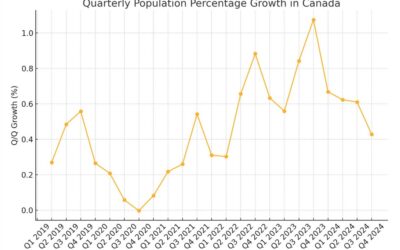

Canadian population growth slowed +0.4% in Q3

Canadian population growth has been a major reason for the ongoing downfall of Prime Minister Justin Trudeau, though his government is now trying to reverse it.Statistics Canada is out with the Q3 population report and it shows:Quarterly growth of 176,699 people...

Canada November new housing price index +0.1% vs -0.4% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Xterio Partners with Reka to Build Emotionally Intelligent AI Agents for Gaming and Beyond

In an era where artificial intelligence is reshaping industries, Xterio is taking a bold step forward by partnering with Reka, a leading AI startup, to develop emotionally intelligent AI agents that promise to transform gaming, Web3, and beyond. These agents, powered...

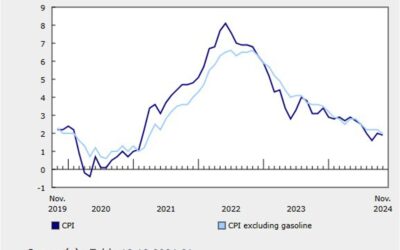

Canada CPI for November 0.0% versus 0.1% estimate

Prior month 0.4%CPI MoM 0.0% versus 0.1% estimateCore CPI MoM 0.1% versus 0.4% last monthCPI YoY 1.9% versus 2.0% YoY est. Prior month 2.0%CPI Median 2.6% versus 2.4% estimate. Last month 2.5% revised higher to 2.6%CPI Trim 2.7% versus 2.5% estimate. Last month 2.6%...

US November retail sales control group +0.4% vs +0.4% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Kickstart the FX trading day with a technical look at the EURUSD, USDJPY and GBPUSD

The DZY index is trading up 0.9% in early US trading with mixed results. Versus the major currencies:EUR up 0.12%JPY down -0.21%GBP down -0.17%CHF up 0.29%CAD up 0.37%AUD up 0.46%NZD of 0.40%Below is a technical look to kickstart the trading day with a technical look...

US retail sales and Canadian CPI light up the calendar

The final piece of the Fed puzzle will be released today with the November retail sales report. This is a tricky one and it could disappoint because Thanksgiving and the Black Friday weekend were so late in November. Of course, that contrasts with a secular trend...

Profiting From the Crypto Boom: Octa Broker’s Guide to Leveraged Trading

With Bitcoin going through the roof in 2024 and the entire crypto market showing substantial growth, retail investors' interest in this asset class also peaked. But how best to profit from the changes occurring in the crypto market and what avenues of investment to...

AUDUSD Technical Analysis – The greenback remains supported into the FOMC

Fundamental OverviewThe USD continues to consolidate around the highs except against the commodity currencies where it’s been having the upper hand. The US inflation data last week was once again a disappointment although the data that feeds into the Core PCE was...

Floki Expands Presence in UAE as Sponsor of the 2024 World Tennis League

Held at the Etihad Arena in Abu Dhabi from December 19 to December 22, this year’s event combines world-class tennis with live music, set to captivate millions of fans worldwide.The 2024 WTL boasts a roster of top-ranked athletes, including: Aryna Sabalenka, Iga...

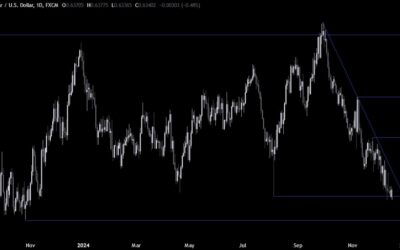

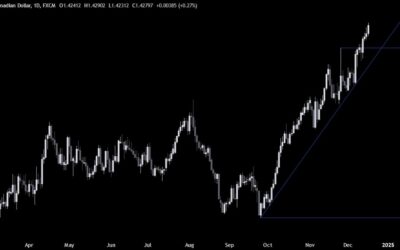

USDCAD Technical Analysis – A look at the chart ahead of the Canadian CPI

Fundamental OverviewThe USD continues to consolidate around the highs except against the commodity currencies where it’s been having the upper hand. The US inflation data last week was once again a disappointment although the data that feeds into the Core PCE was...

Germany December ZEW survey current conditions -93.1 vs -93.0 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Eurozone October trade balance €6.8 billion vs €12.5 billion prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Kazimir: We will discuss neutral rate once we near 2.5%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...