High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China president Xi: We must be fully prepared to achieve next year’s economic targets

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China promise for even bigger easing lifts risk sentiment

The announcement here is reverberating across broader markets as Beijing promises to step up monetary policy easing even more going into next year, alongside vowing for more fiscal spending. The headline came after the close for Chinese domestic markets but there are...

China’s Politburo says will implement a more moderately loose monetary policy

Will implement more proactive fiscal policy and moderately loose monetary policyTo enrich and improve policy toolboxMust expand domestic demand in all directionsMust vigorously boost consumptionTo expand opening up to the outside world, stabilise foreign trade and...

Dollar holds steadier to start the session

There isn't too much happening in the major currencies space to start the new week. The US jobs report on Friday here served to reaffirm a 25 bps rate cut by the Fed this month. And that's basically the signal that market players are having to work with right now. The...

Taiwan steps up military alert ahead of China drills

A Taiwan security source has informed Reuters that China has nearly 90 navy and coast guard ships in waters near Taiwan and the surrounding region. In terms of warships, the number is reportedly nearly doubled from 8 to 14 over the weekend.For some context, China has...

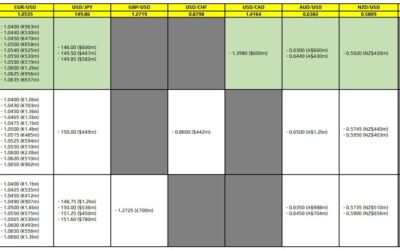

FX option expiries for 9 December 10am New York cut

There aren't any major expiries to take note of on the day. As such, trading sentiment will start to move towards focusing on the US inflation data later this week as well as key central bank meetings over coming two weeks. The dollar remains vulnerable after the...

ForexLive Asia-Pacific FX news wrap: USD ticks a little higher

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Oil ICYMI – Saudi Aramco reduced January 2025 pricing for Arab Light crude oil for Asia

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Reserve Bank of Australia meeting on Tuesday, December 10, 2024 – Statement/Bullock focus

The Reserve Bank of Australia policy statement will be released at 2.30pm Sydney time on Tuesday, December 10, 2024. 0330 GMT / 2230 US Eastern time on MondayReserve Bank of Australia Governor Bullock will hold her press conference an hour laterAccording to the...

Bank of England Deputy Governor Dave Ramsden is speaking on Monday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand PM Luxon says committed to continuing efforts to lower inflation and rates

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

South Korea’s benchmark equity index has fallen to its lowest since late April 2020

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Goldman Sachs’ inflation projections for China are significantly lower than the consensus

We had soft inflation figures from China for November out an hour or ago:Looking ahead, Goldman Sachs' inflation projections for China in 2025 are significantly lower than the consensus among economists, according to a research note. The firm forecasts Consumer Price...

[테슬라 전고점 돌파?? 500 산타랠리 폭등? 2025년, 3개 필수!! 비트코인 + 이것 꼭!! ]#3.1경제독립tv

https://www.youtube.com/watch?v=xRGAuAMnbEU [테슬라 전고점 돌파?? 500 산타랠리 폭등? 2025년, 3개 필수!! 비트코인 + 이것 꼭!! ]#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요!...

China’s Inflation Data: November Trends and Projections

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China’s annual central economic work conference is set to convene this week

China’s annual central economic work conference is set to convene this weekChinese leaders will convene for up to three daysits a closed-door conference will set out next year’s major policy goals and concrete tasks during the central economic work conference.its...

China November CPI +0.2% y/y (expected +0.5%) PPI -2.5% y/y (expected -2.8%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate for today at 7.1870 (vs. estimate at 7.2627)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fitch has slashed its 2025 and 2026 China economic growth forecasts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[테슬라 전고점 돌파?? 500 산타랠리 폭등? 2025년, 3개 필수!! 비트코인 + 이것 꼭!! ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/12/ed858cec8aaceb9dbc-eca084eab3a0eca090-eb8f8ced8c8c-500-ec82b0ed8380eb9ea0eba6ac-ed8fadeb93b1-2025eb8584-3eab09c-ed9584ec8898-ebb984-400x250.jpg)