The Reserve Bank of Australia left its cash rate unchanged yesterday at 4.35%, its highest in 13 years:Reserve Bank of Australia Governor Bullock spoke extensively at her press conference following the Statement, links here:ING have assessed what we got from the Bank...

AUD expected to show recovery vs. NZD

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Kiwi Manufacturers Decline in Sales Volume in Q3 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Oil – private survey of inventory shows headline crude oil build vs. draw expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Forexlive Americas FX news wrap: USD/JPY rallies for a second day, AUD struggles after RBA

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

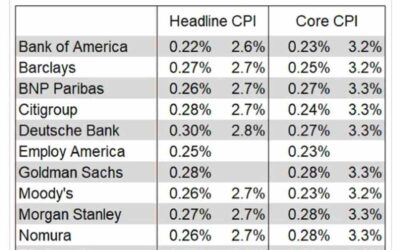

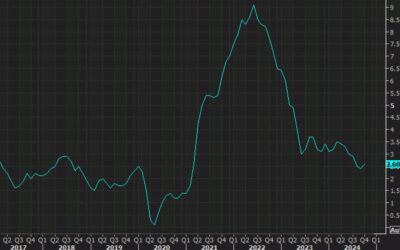

US November CPI data due Wednesday, December 11 – expected to be higher than in October

In October 2024, the U.S. Consumer Price Index (CPI) increased by 0.2% from the previous month, marking the fourth consecutive month with this rate of growth. On an annual basis, the CPI rose by 2.6%, up from 2.4% in September.The core CPI, which excludes volatile...

Down day for the major US indices today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of Canada preview: The storm clouds are gathering in the Canadian economy

There is no reason for the Bank of Canada overnight target rate to be at 3.75% any longer.The economy is sliding and unemployment has risen to 6.8% from a low of 4.8%. The housing market is slumping in much of the country and population growth is slated to go into...

Economic calendar in Asia Wednesday, December 11, 2024 – Japan data, RBA speaker

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trade ideas thread – Wednesday, 11 December, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EURUSD moves back up to test the 100 bar MA on the 4-hour chart

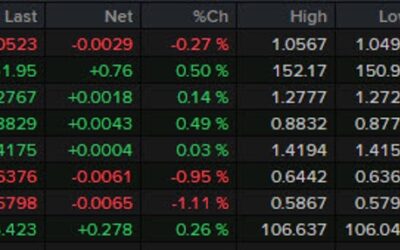

The EURUSD moved lower and below an upward sloping trend line in the process, but selling stalled and the price rose. The move up has returned to the lower of 3 moving averages starting with the 100-bar MA on the 4-hour chart at 1.0530200-hour MA at 1.05385100-hour mA...

Report blames BLS leadership for poorly-protected US economic data releases

Earlier this year, the BLS reported that a subset of files were released prior to the April CPI report, leading to a premature move in the Treasury market. Previously, a BLS economys shared undisclosed technical calculations with some 'super-user' economists, also...

Preview: What to expect from Wednesday’s US CPI report

US CPI y/yIs the Federal Reserve stalling in its battle against inflation?That's the question the market will be mulling on Wednesday at 8:30 am ET as November inflation numbers are released in the CPI report. The headline inflation number is expected to tick up to...

Crude oil settles and $68.59

Crude oil futures are settling at $68.59. That is up $0.22 or 0.32%. The high price for the day extended to $69.02. The low price was at $67.74. Looking at the hourly chart, the price tried to stay below its 100-hour moving average (blue line on the chart below), but...

Morgan Stanley says the dollar trade is crowded and it’s time to sell

The US dollar has been a strong performer this year and it's tough to bet against it going forward given the setup for US economic outperformance. That said, it's clearly a crowded trade and Morgan Stanley's David Adams thinks it's too crowded.“Based on our...

The US treasury auctions off $58B of 3-year notes at a high yield of 4.117%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The US treasury to auction $58B of 3-year notes at the top of the hour.

The US treasury will auction off $58B of 3-year notes at the top of the hour. The auction is the first of three this week. The treasury will auction 10 year notes (well 9 year and 11 month) tomorrow and 30 year bonds on Thursday. After trading above 4.20% for most of...

Bitcoin sellers lean against the 200 hour MA.GIves the sellers the go-ahead to push lower.

The price of bitcoin is trading lower with the price now down around -2.7% to $94,700.The low price has reached $94,578.The move lower was foreshadowed by the break and inability to extend back above the broken 200-hour MA at $98244. Buyers turned to sellers.What...

The USDJPY buyers have taken the price above the 200 day MA. Buyers making a play.

The USD/JPY rebounded from an earlier dip in the Asian Pacific session, hitting new weekly highs and testing the 38.2% retracement level at 151.736 in the London morning session. Sellers stalled the pair near that MA coming into the US session with the price trading...

EIA forecasts global oil production will rise 1.6m bpd in 2025

The EIA is out with the latest STEO.We expect the Brent crude oil spot price will remain close to its current level in 2025, averaging $74 per barrel for the yearThey see the oil market as 'relatively balanced'US production seen at 13.52 mbpd vs 13.53 mbpd prior (vs...