High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Lane says further monetary policy easing is likely

Philip Lane is the Chief Economist and a member of the Executive Board of the European Central Bank (ECB).European economy still recovering from the pandemicECB baseline for Europe is a recoveryExpects consumption to improve in 2025 More easing from the Bank is...

EURUSD Analysis for Today

TradeCompass: EUR/USD Analysis – Euro FX Futures Today – 13 January 2025Financial Instrument: Euro FX Futures (EUR/USD Futures)Price at the Time of Analysis: 1.0245Key Levels and Trade Scenarios for EUR/USD Futures TodayBullish Above: 1.0265Why Bullish Above:If...

Goldman Sachs says the tightened US, UK sanction on Russian oil could push price above $85

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive Asia-Pacific FX news wrap: US jobs report Asia response, EUR and GBP weak again

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bitcoin Futures Analysis Today

TradeCompass: Bitcoin Futures Analysis Today – 13 January 2025Financial Instrument: Bitcoin FuturesPrice at the Time of Analysis: 94615Key Levels and Trade Scenarios for Bitcoin Futures TodayBullish Above: 96000Why Bullish Above:If Bitcoin futures cross above 96000,...

China intensified efforts on Monday to stabilize the weakening yuan

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China December USD denominated Exports +10.7% y/y (expected +7.3%) Imports +1.0% (-1.5%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

HKMA and PBoC to set up a CNY 100bn liquidity facility for trade finance

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Some Chinese trade data is dribbling out. 2024 total imports +2.3% y/y

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Singapore bans Polymarket

Polymarket is a decentralized, blockchain-based platform for information markets, allowing users to trade on the outcomes of real-world events. Essentially, it enables participants to express their opinions or predictions about various topics—such as politics, sports,...

More on China’s Central Bank, Forex Regulators Pledge to Stabilize Yuan

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[테슬라 지금이 가장 싸다!! 머스크 10배 자신감! 비트코인 2030년, 충격전망 나왔다!!]#재테크#해외주식투자#테슬라#비트코인#3.1경제독립tv

https://www.youtube.com/watch?v=7wBYFVrXlgg [테슬라 지금이 가장 싸다!! 머스크 10배 자신감! 비트코인 2030년, 충격전망 나왔다!!]#재테크#해외주식투자#테슬라#비트코인#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자...

Yen finding a bid on the Japanese market holiday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBoC Gov Pan says interest rate and RRR tools will be utilized to maintain ample liquidity

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Weekend – China’s Ministry of Commerce promised to enhance domestic consumption

The Ministry of Commerce unveiled its primary objectives for 2025 on Sunday, focusing on expanding access to China's market, strengthening global collaboration in supply chain development, and maintaining stability in foreign trade and capital flows.In a statement...

China Foreign Exchange Committee (CFXC) held meeting – pledged to support yuan

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate for today at 7.1885 (vs. estimate at 7.3442)

The news earlier should be yuan supportive:People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC...

PBoC and SAFE move to allow Chinese firms greater access to foreign capital

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

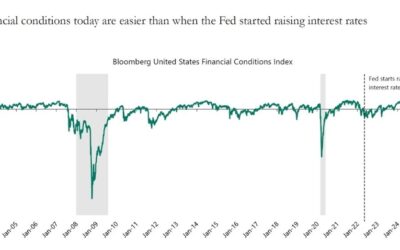

US economy “reaccelerating”, there’s a near coin toss chance of a Fed rate hike this year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[테슬라 지금이 가장 싸다!! 머스크 10배 자신감! 비트코인 2030년, 충격전망 나왔다!!]#재테크#해외주식투자#테슬라#비트코인#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/01/ed858cec8aaceb9dbc-eca780eab888ec9db4-eab080ec9ea5-ec8bb8eb8ba4-eba8b8ec8aa4ed81ac-10ebb0b0-ec9e90ec8ba0eab090-ebb984ed8ab8ecbd94-400x250.jpg)