Although yields have stabilized with the 10 year up 4.7 basis points, stocks continue to come under pressure with the NASDAQ index now down -400 points or -2.05%. The S&P index meanwhile is down -93 point or -1.57%. The small-cap Russell 2000 is also lower by...

Judge sentence Trump to unconditional discharge over hush money case

Judge sentence Trump to unconditional discharge over hush money caseImposes no jail or fine but sentence places a judgment of guilt on Pres. Elects record.Justice Juan M. Merchan sentenced Donald J. Trump to an unconditional discharge, a rare and lenient outcome in...

Fed’s Goolsbee: Jobs report makes me more comfortable that the employment market stable

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

NASDAQ moves down into swing area target

The NASDAQ index moved to a low of 19143.64. That was down over 300 points on the day and in the process has moved within a swing area defined by recent swing lows of swing highs between 19119 and 19208 . A move below that area would open the door for further selling...

UMich January prelim consumer sentiment 73.2 vs 73.8 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Energy stocks rally: Tech and semiconductors face pressure

Stock heatmap by FinViz.com Fri, 10 Jan 2025 14:46:14 GMTEnergy stocks rally: Tech and semiconductors face pressureThe stock market today exhibits a mixed landscape as a resurgence in energy stocks is contrasted sharply by declines in the technology sector,...

Brent breaks $80 as the oil bulls put on the squeeze

CL1Oil is ripping higher today, rising nearly 5% to the best levels since October. WTI crude oil is up $3.60 to $77.49 while Brent has cracked $80.A Reuters report appeared to kick off the move as it says the US will impose sanctions on 180 vessels transporting...

USDJPY moves up to swing area target and backs off. Price stays within swing area.

The USDJPY has been trading within a swing area between 157.66 and 158.86. Looking at the daily chart today, the low price came in just below the low of the swing area and 157.62. The high price reached just above the high of the swing area at 158.86. The swing area...

US stock futures are doing better than I would have expected

S&P 500 futures are down 43 points, or 0.7%, ahead of the open.That's better than I would have thought given the jump in jobs and a rise in 10-year yields to 4.75%, which is the highest since November 2023.The low of the pre-market came on the release but there...

EURUSD moves lower after strong US jobs report. What are the technicals tell traders?

The US jobs report came in stronger than expectations and that has led to yields moving sharply higher. The year is up 9.0 basis points they 10-year is up 8.6 basis points.For the EURUSD it fell to a new low going back to November 2022. The low price reached 1.0212....

AUDUSD rates below 2022 and 2024 lows. Trades at lowest level since April 2020

The AUDUSD is breaking below the 2022 and 2024 lows. On the last day of the trading year, the price moved to a low of 0.61785. That was just above October 2022 low and 0.6170. Yesterday, the price moved to 0.6171 but once again found support buyers. Breaking below...

US dollar jumps after a sizzling December non-farm payrolls report

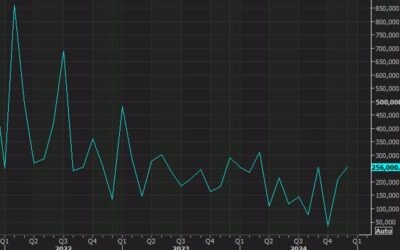

The December jobs report easily beat expectations, highlighting the continued resilience in the US labor market as employers added 256,000 jobs, significantly above the consensus forecast of 160,000. The unemployment rate edged down to 4.1% from 4.2%, coming in below...

US December non-farm payrolls +256K vs +160K expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Canada December employment change 90.9 vs 25.0K estimate

Prior month 50.5KEmployment Change 90.9K vs 25.0K estimate. 3rd gain in the last 4 monthsUnemployment Rate 6.7% vs 6.9% estimate. Last month 6.8%Full time employment 57.5K vs 54.2K last monthPart time employment 33.5K vs -3.6K last month.Average hourly earnings YoY...

What do the seasonal trends say about December non-farm payrolls

The bulk of the pre-non farm payrolls numbers point to a soft reading but I think that's priced into the consensus at +160K compared to +227K prior. The late Thanksgiving doesn't make for an obvious risk but I would suspect it biases it higher, though we didn't see...

What technical levels are in play through the US and Canada jobs reports. Be aware.

It is unemployment day with both the US and Canada jobs reports being released. Economists forecast a rise of 160,000 payroll jobs in December, with the unemployment rate expected to remain at 4.2%.Average hourly earnings growth is projected to cool to 0.3% from the...

ForexLive European FX news wrap: Dollar steady awaiting jobs data

Headlines:Markets:JPY leads, NZD lags on the dayEuropean equities mixed; S&P 500 futures down 0.1%US 10-year yields up 2.1 bps to 4.701%Gold up 0.4% to $2,681.43WTI crude up 3.1% to $76.19Bitcoin up 3.0% to $94,915It was a quiet session for the most part as...

Nasdaq Technical Analysis – The market awaits the US data for direction

Fundamental OverviewThe Nasdaq has been stuck in a big range since the last FOMC decision as the market perceived it as more hawkish than expected. The Fed continues to place a great deal on inflation progress to proceed with further rate cuts as highlighted by Fed’s...

Fed’s Musalem pushes caution on further reducing interest rates

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

S&P 500 Technical Analysis – Awaiting the key US data for the next major move

Fundamental OverviewThe S&P 500 has been stuck in a big range since the last FOMC decision as the market perceived it as more hawkish than expected. The Fed continues to place a great deal on inflation progress to proceed with further rate cuts as highlighted by...