https://www.youtube.com/watch?v=6m7fkw9PbXk [테슬라 10배 아니고...2029년 이렇게 된다!! 일론머스크, 충격 발표!! 한국 폭망했다!!]#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요!...

Coming up soon – Bank of Japan monetary policy statement

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China’s six major national banks will start to implement a new mortgage pricing mechanism.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

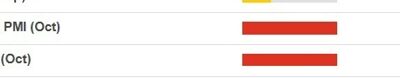

China official PMI data: October Manufacturing 50.1 (expected 50.0)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY central rate at 7.1250 (vs. estimate at 7.1242)

The People's Bank of China set the onshore yuan (CNY) reference rate for the trading session ahead.USD/CNY is the onshore yuan. Its permitted to trade plus or minus 2% from this daily reference rate.CNH is the offshore yuan. USD /CNH has no restrictions on its trading...

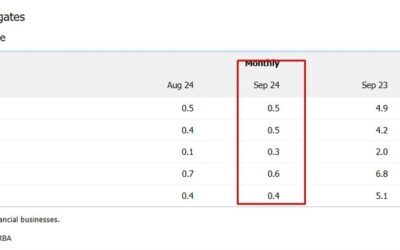

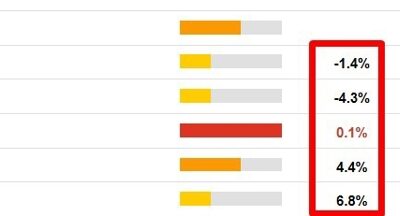

Australian September 2024 Private Sector Credit +0.5% m/m (expected +0.5%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australia retail sales (September) +0.1% m/m (expected +0.3%) & +0.5% q/q (prior -0.3%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian September building permits +4.4% m/m (prior -6.1%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian Export price index -4.3% q/q & import -1.4% q/q

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.1242 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

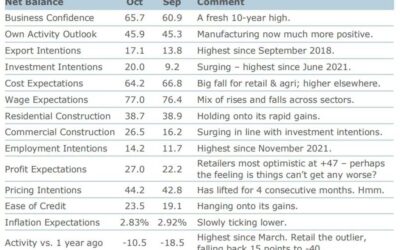

New Zealand data – ANZ October Business Confidence 65.7 (prior 60.9)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan September Retail Sales +0.5% y/y (expected 2.3%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan Industrial Production (preliminary, September 2024) +1.4% m/m (expected +1.0%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

TSMC have activated typhoon preparations at Taiwan locations

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Barclays looking for a 125K nonfarm payroll headline

Synopsis:Barclays forecasts a deceleration in October's nonfarm payrolls to 125k, down from September's 254k, with employment impacted by the Boeing strike and recent hurricanes. Wage growth is expected to remain steady, while the unemployment rate may tick up due to...

USD/JPY continues to track more or less sideways ahead of the Bank of Japan statement

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

North Korea have fired off another ballistic missile

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

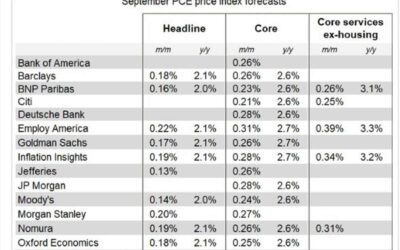

18 investment bank (and others) forecasts for US inflation- centre on 2.1% y/y (headline)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Goldman Sachs quants says S&P 500 to swing +/- 2% on a wild election day

A heads up via a Goldman Sachs derivatives research note.Citing options markets, GS says it'll be a volatile election day (November 5):SPX options pricing implies a plus/minus 2.1% move on the dayoptions on the top 25 macro ETFs which imply an average move of +/- 5.3%...

RBNZ says home buyers remain cautious, market subdued

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[테슬라 10배 아니고…2029년 이렇게 된다!! 일론머스크, 충격 발표!! 한국 폭망했다!!]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/10/ed858cec8aaceb9dbc-10ebb0b0-ec9584eb8b88eab3a0-2029eb8584-ec9db4eba087eab28c-eb909ceb8ba4-ec9dbceba1a0eba8b8ec8aa4ed81ac-ecb6a9eab2a9-400x250.jpg)