High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Draft of Lebanon-Israel 60-day ceasefire leaked

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Rising yields underpin a bounce in the dollar

US 10s intradayUS Treasury yields are at the highs of the day across the curve on a small jump in the past 15 minutes. US 10s are now up 1 bps on the day to 4.28% after falling as low as 4.20% earlier.It's not clear what the catalyst is because there are conflicting...

USDJPY close technical levels are getting closer together. Traders looking for a break.

The USDJPY is lower on the day, but has been able to points for buyers against its rising 100-hour moving average. That moving average, comes at 152.826. A move below that level would have traders targeting the rising 200-hour moving average of 151.972. There's other...

HSBC: EUR/USD likely to see short-lived rally on Harris win, followed by gradual decline

EURUSD dailyHSBC anticipates a knee-jerk rally in EUR/USD if Kamala Harris wins the US election, driven by initial USD weakness. However, they expect this rally to be temporary, with the pair likely resuming a downward trajectory as monetary policy differences...

US dollar bounces around as the election cloud looms

Today was a busy day of economic data that featured a strong ADP jobs report and a softer-than-expected GDP report that contained some very strong details. We also got a blockbuster pending home sales report.Normally that combination would lead to some US dollar...

Bitcoin can’t extend to new highs on the first test. Backs off.

Bitcoin moved sharply higher yesterday and reached an intraday high of $73,600. That was within $200 of the all-time high reached back in March at $73,794. The price has backed off today and trades down by $738 or -1.01% at $71,991.The move to the upside extended into...

Another record for Gold. Moves up to a channel trend line.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BofA: What we expect from the US jobs report on Friday

Bank of America forecasts a 100k increase in October nonfarm payrolls, affected by Hurricane Milton and the Boeing strike, with average hourly earnings growth rising to 0.5% m/m. Despite potential data distortions, BofA expects the Fed to proceed with a 25bps cut at...

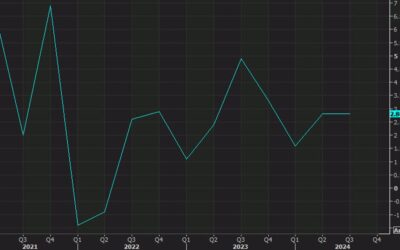

Why 3% GDP growth won’t overheat the US economy — CIBC

US GDP quarterlyThe US posted another impressive GDP report today, though slightly less than expected. Growth of 2.8% fell short of the 3.0% consensus but the details in this report were impressive, with consumer spending offsetting a drag from net trade.The important...

USDCAD continues the stretch toward 2024 high but falls just short

USDCAD Technical AnalysisThe USDCAD has experienced a volatile month, with one day remaining. Key milestones include:Monthly low: 1.3472 (October 2)Monthly high: 1.3938 (today)Trading range: 466 pips, second-largest since December 2022Uptrend dominant throughout the...

ECBs Villeroy:ECB does not have to react to short-term deviations from inflation target

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EURUSD trades to a new high, and enters topside resistance area between 1.0864 – 1.08725

After testing the 10810 level and finding buyers near that level early in the US session, the price has snapped back to the upside and has entered into a topside resistance area between 1.0864 and 1.08725. That area is defined by the 100-bar moving average on a four...

Traders price a 48% chance of further 25 basis point cut in December. Down from 63%.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Blast Royale to Launch $NOOB Low FDV Community Offering for First Gaming x Meme Token

Blast Royale has announced the upcoming pre-sale of its Low FDV Community Offering (LCO) for the $NOOB token, scheduled for November 6th. As a community-focused initiative, this offering aims to integrate players and supporters, marking a significant move in the...

More from ECBs Schnabel: We expect wage growth remains high this year and rather bumpy

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUDUSD stays below 100 hour MA on first test

The AUDUSD reached a new low earlier today at 0.6536, but has since bounced higher. The run higher has extended back above the broken 61.8% of the move up from the July low at 0.6570, and after trading above and below that level in the European session and into the US...

ECB’s Schnabel: Disinflation remains on track, but inflation fight is not yet won

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

GBPUSD pushes back above the 1.3000 level and the 100 bar MA level

The GBPUSD early in the US session retested the low price from Monday's trade at 1.2938. That level was also a swing level going back in time to July and August. Support held and the price was able to rebound back above its 100 day moving average of 1.29742. Sellers...

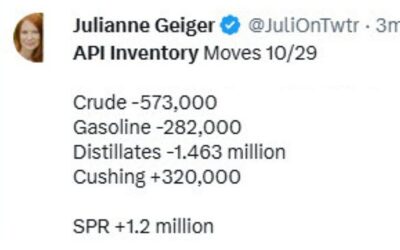

US crude oil inventory for the current week -0.515M vs 2.300M estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...