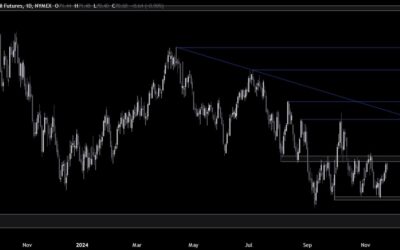

Fundamental OverviewCrude oil remains confined in a range between the 72.00 resistance and the 67.00 support as the market continues to weigh the future scenarios. On one hand, we have the Trump’s victory which might be seen as bearish in the short term for fear of...

BOE’s Lombardelli: I support a gradual removal of monetary policy restriction

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

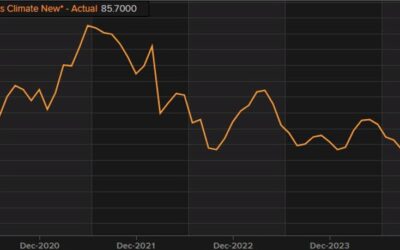

Germany November Ifo business climate index 85.7 vs 86.0 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

SNB total sight deposits w.e. 22 November CHF 459.4 bn vs CHF 463.4 bn prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Market Outlook for the Week of 25th – 29th November

The week ahead features several key economic events to watch. On Tuesday, the U.S. will release the CB consumer confidence index, new home sales, and the Richmond manufacturing index, providing updates on consumer sentiment and economic activity. Wednesday’s attention...

Please mind the gap..

The greenback is recovering losses to start European morning trade, as it starts to chew into the opening gap lower today. USD/JPY is now up to 154.60 levels, just a few pips shy of closing its opening gap lower:USD/JPY hourly chartBesides that, the commodity...

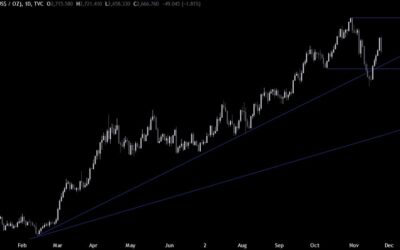

Gold Technical Analysis – The Treasury Secretary pick weighs on the market

Fundamental OverviewGold saw a quick drop today during the Asian session with the news of Scott Bessent nomination for Treasury secretary as the most likely culprit. Bessent is a fiscal hawk, and the market views him as a great pick for the job. In fact, one of the...

European indices build on the Friday jump to be up at the open today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Lane: Monetary policy should not remain restrictive for too long

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Reminder: It will be a holiday-shortened week in the US

AI imageAnd typically, that means broader markets will likely observe a more quiet and slower trading period as well. Even though Thanksgiving falls on Thursday and markets will be open again on Friday, the festive period usually sees many US businesses and offices in...

Dollar down as Trump picks Scott Bessent for role of Treasury secretary

The initial reaction seems to be that billionaire Scott Bessent is a "markets guy". Wall Street is reacting favourably with US futures gapping higher while bonds are also bid, dampening the dollar. So, why exactly are markets responding to Bessent in such a way? Let's...

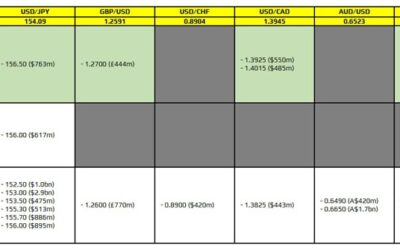

FX option expiries for 25 November 10am New York cut

There are just a couple to take note of, as highlighted in bold.They are for EUR/USD at the 1.0440 and 1.0485 levels. The pair opened with a gap higher today amid a weaker dollar and has been sticking thereabouts since. Offers layered closer to the 1.0500 mark are...

ForexLive Asia-Pacific FX news wrap: US Treasuries yield falls, USD falls

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bessent said his policy priority will be to deliver on Trump’s various tax-cut pledges

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

UBS target US$2,900 gold year-end 2025 – preferred hedge against geopolitical tensions

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of England Dhingra and Lombardelli speaking on Monday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

People’s Bank of China shift to the MLF as the main policy tool – drain today facilitates

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

European Central Bank speakers Monday include Lane, Makhlouf

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC net drain 550bn via MLF. Rate unchanged at 2%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Still waiting on any People’s Bank of China Medium-term Lending Facility (MLF) announcemnt

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...