High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate today at 7.1918 (vs. estimate at 7.2257): 25 November

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[테슬라 + 비트코인!! 2030년 충격, 정말 이렇게 된다고?? 소름 돋는 미래온다!! ]#3.1경제독립tv

https://www.youtube.com/watch?v=ol8TQS1W0dk [테슬라 + 비트코인!! 2030년 충격, 정말 이렇게 된다고?? 소름 돋는 미래온다!! ]#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요!...

Republican Senators warn Canada, Britain, Germany, France: Help ICC, we crush your economy

US Republican Senators Lindsey Graham and Tom Cotton have started to draft a package of sanctions on the International Criminal Court (ICC). Graham spoke on Fox, warning US allies:“To any Ally: Canada, Britain, Germany, France, if you try to help the ICC, we are gonna...

Goldman Sachs on 2025: When the Fed cuts, bond market where investors should want to be

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.2257 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

ICYMI – Financial markets have become more susceptible to liquidity shortages (BIS report)

The Bank for International Settlements have published research showing fnancial markets have become more susceptible to liquidity shortages. Citing the rise of algorithmic trading and increased market fragmentation.From the BIS report, in brief:average bid-ask spread...

ICYMI – Cboe to launch cash-settled Bitcoin ETF options from next week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US futures trade open for the new week – equity indexes up, bonds up

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

FX gaps remain in early Tokyo trade

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Reserve Bank of New Zealand rate cut expected on Wednesday 27 November – preview

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand Q3 retail sales -0.1% q/q (expected -0.5%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Weekend – Trump nominated Scott Bessent to serve as Treasury Department secretary

Bessent and ex-Fed Warsh were two front runners, Bessent has been given the nod. Bessent background, in brief:was the CIO of Soros Fund Managementfounder of Key Square Capital Management, a hedge fundcame out for the MAGA movement after working for Sorosdonated to...

Reserve Bank of New Zealand (RBNZ) Shadow Board recommend a 50bp cash rate cut this week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

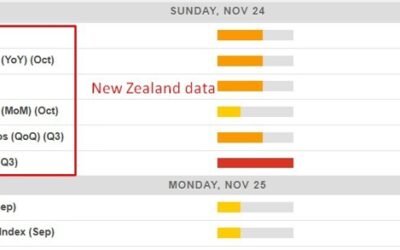

Economic calendar in Asia Monday, November 25, 2024

New Zealand retail sales data for Q3 is the highlight. Retail spending in NZ has been pressured by high rates and a weak economy, and this is expected to show in the data again today, despite the RBNZ kicking off its easing cycle in August:The RBNZ reduced the...

Economic calendar in Asia Monday, November 25, 2024

New Zealand retail sales data for Q3 is the highlight. Retail spending in NZ has been pressured by high rates and a weak economy, and this is expected to show in the data again today, despite the RBNZ kicking off its easing cycle in August:The RBNZ reduced the...

Trade ideas thread – Monday, 25 November, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Monday morning open levels – indicative forex prices – 25 November 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Monday morning open levels – indicative forex prices – 25 November 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Newsquawk Week Ahead: US PCE, FOMC Minutes, RBNZ rate decision, EZ HICP, and Aussie CPI

Mon: German Ifo (Nov), US National Activity Index (Oct)Tue: FOMC Minutes (Nov); US New Home Sales (Oct), Richmond Fed (Nov)Wed: RBNZ Policy Announcement; Australian CPI (Oct), German GfK (Dec), US GDP 2nd (Q3), PCE Prices Prelim. (Q3), PCE Price Index (Oct), Initial...

![[테슬라 + 비트코인!! 2030년 충격, 정말 이렇게 된다고?? 소름 돋는 미래온다!! ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/11/ed858cec8aaceb9dbc-ebb984ed8ab8ecbd94ec9db8-2030eb8584-ecb6a9eab2a9-eca095eba790-ec9db4eba087eab28c-eb909ceb8ba4eab3a0-ec868ceba684-400x250.jpg)