Mon: Eurogroup Meeting; Chinese CPI & PPI (Nov), EZ Sentix (Dec), US Employment Trends (Nov)Tue: RBA Policy Announcement, EIA STEO; German Final CPI (Nov), Norwegian CPI (Nov), US NFIB (Nov), Chinese Trade Balance (Nov), Chinese Central Economic Work...

[남들은 반 값!! 나만 손해 봤네요.. 돈되는 이것, 꼭 확인하세요!!]#3.1경제독립tv

https://www.youtube.com/watch?v=c_-iJ1s1MWM [남들은 반 값!! 나만 손해 봤네요.. 돈되는 이것, 꼭 확인하세요!!]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

[2025 테슬라 대박! 1,000찍고 1:10주식분할까지! 머스크 꿈 현실로! 비트코인 어디가지 오를까? ]#3.1경제독립tv

https://www.youtube.com/watch?v=mqfiGwvX_UA [2025 테슬라 대박! 1,000찍고 1:10주식분할까지! 머스크 꿈 현실로! 비트코인 어디가지 오를까? ]#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더...

Forexlive Americas FX news wrap: Rate cut odds ramp up after US and Canadian jobs data

Market moves:WTI crude oil down $1.20 to $67.10US 10-year yields down 2.9 bps to 4.15%Bitcoin up $2544 to $101,540Gold up $1 to $2633S&P 500 up 0.2%JPY leads, AUD lagsThe theme all week is that it's been tough to tie market moves to economic news/data and today...

US equity close: Another day, another record

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The Fed blackout begins at midnight

Federal Reserve officials are barred from commenting on monetary policy from midnight Friday until after the December 18 FOMC decision. Given the late date for the final FOMC meeting, it could be quiet for the remainder of the month as the Christmas doldrums will...

Morgan Stanley: Tactical FX views on USD, EUR, and GBP

Morgan Stanley shares a tactically bullish stance on the USD, citing strong US data and trade policy risks. The EUR faces headwinds from weak domestic growth and tariff-related risks, while the GBP benefits from fiscal-driven growth and high rate differentials.Key...

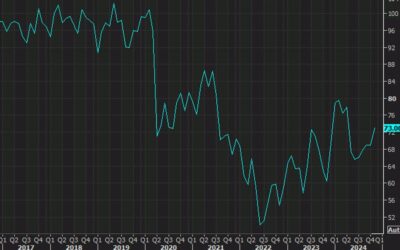

Tough week for oil as OPEC+ actions fail to deliver gains

WTI crude oil weeklyWTI crude oil settled lower by $1.10 to $67.20 in the second day of selling following the OPEC+ decision to delay barrels through Q1 and bring them on more-slowly afterwards.Oil is still within the range of the past month but is dangerously close...

What’s coming up on the US economic calendar for the second week of December

Powell checks the calendar (AI image)This week ahead includes CPI and PPI and with some notable Treasury auctions. The Fed goes into blackout at midnight on Friday so it will be considerably quieter on that front. The FOMC decision is December 18.Here’s a day-by-day...

Canadian employment headline strength masks weakness underneath. Expect 50 bps – CIBC

CIBC is out with a review of today's Canadian jobs report:Despite strong headline job numbers, the underlying details were mostly negativeThey cite: Largely public sector job gains, highest unemployment rate since 2016, wage growth lowest since June 2023The weakening...

Fed’s Daly: The labor market remains in a good place, is balanced

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fed’s Goolsbee: Hope the Fed will get the to range of neutral by the end of 2025

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bitcoin busts back above $100,000

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Hammack Q&A: ‘Really focused’ on getting inflation back to target

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fed’s Hammack: We are ‘at or near’ the time to slow rate cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

MUFG Trade Of The Week: We go long USD/CAD

USDCAD weekly chartMUFG Research added a long USD/CAD position to its ToTW portfolio targeting a move towards 1.4550, with a stop at 1.3850."We are recommending a new long USD/CAD trade idea. We still see room for the CAD to weaken further against the USD heading into...

European equity close: German DAX flat today but up 3.8% on the week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fed’s Goolsbee: On average it feels like the jobs market cooling from a very hot level

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

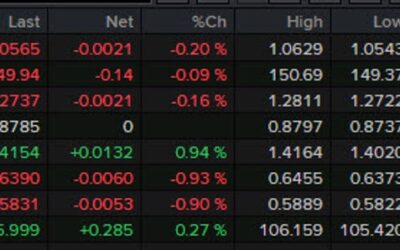

US dollar rebounds after non-farm payrolls. What’s driving it

The US dollar has recouped the non-farm payrolls declines and -- in most cases -- even more.EUR/USD is down to 1.0560 from a high of 1.0630.EUR/USD 10 minsI think -- or at least hope -- that most of this is on a deeper dive into non-farm payrolls. You essentially have...

UMich December prelim consumer sentiment 74.0 vs 73.0 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[남들은 반 값!! 나만 손해 봤네요.. 돈되는 이것, 꼭 확인하세요!!]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/12/eb82a8eb93a4ec9d80-ebb098-eab092-eb8298eba78c-ec8690ed95b4-ebb4a4eb84a4ec9a94-eb8f88eb9098eb8a94-ec9db4eab283-eabcad-ed9995ec9db8-400x250.jpg)

![[2025 테슬라 대박! 1,000찍고 1:10주식분할까지! 머스크 꿈 현실로! 비트코인 어디가지 오를까? ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/12/2025-ed858cec8aaceb9dbc-eb8c80ebb095-1000ecb08deab3a0-110eca3bcec8b9debb684ed95a0eab98ceca780-eba8b8ec8aa4ed81ac-eabf88-ed9884ec8ba4-400x250.jpg)