https://www.youtube.com/watch?v=g-NtBdXqgLI 재택 부업을 비롯해, 그동안 다양한 돈버는 직장인 부업과 투잡을 소개해드렸는데요, 오늘은 집에서 매달 자동 수익을 벌 수 있는 부수입 파이프라인을 만드는 새로운 방법을 한가지 더 소개하려고 합니다 집에서도 실행 가능하고, 학력 경력 무관 한데다, 직장인, 주부, 자영업자, 학생 등 누구나 쉽게 도전해볼 수 있는 부업인데요, 0원으로 시작할 수 있고, 영상에 나온 가이드를 한 번만 따라해 보면,...

easyMarkets Launches xBar Cup 2025 with Grand Finale at Real Madrid Valdebebas

Real Madrid football legend Roberto Carlos and trading pioneers easyMarkets announce the return ofthe xBar Cup at the Dubai Expo 2024.This year’s challenge takes a new turn by spotlighting elite football Freestylers with a strong social media presence, a strategic...

Fedspeak and housing starts highlight the economic calendar

Christoper WallerHappy Friday.September housing starts are due at the bottom of the hour and they are the only notable economic indicator in today's North American session. The consensus is a dip to 1.350m from 1.356m but I doubt the report will move the broader...

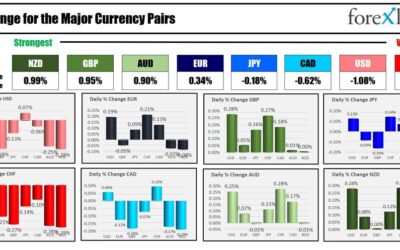

As the NA session begins, the NZD is the strongest and the CHF is the weakest

TGIF. As the North American session begins, the NZD is the strongest and the CHF is the weakest. China's economy grew at a slower pace in the third quarter, with GDP expanding by 4.6% year-on-year, down from 4.7% in the previous quarter and marking the lowest reading...

ForexLive European FX news wrap: Dollar gains ease up, gold holds above $2,700

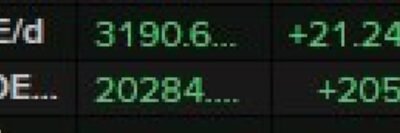

Headlines:Markets:GBP leads, CHF lags on the dayEuropean equities higher; S&P 500 futures up 0.2%US 10-year yields up 1.2 bps to 4.108%Gold up 0.6% to $2,709.82WTI crude down 0.4% to $70.40Bitcoin up 0.6% to $67,809It was another quiet session with some light...

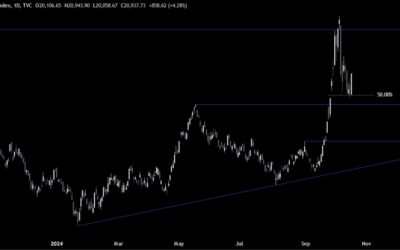

USD/JPY lower on the day but buyers stay in control for now

When put into context to the near-term chart below, the quick 30 pip drop earlier isn't that meaningful. As our reader Alex pointed out, there were some headlines noting that the BOJ is said to see "little need to rush an October rate hike" and that they are "mulling...

NZDUSD Technical Analysis – The rangebound price action continues

Fundamental OverviewThe bullish momentum in the US Dollar seems to be waning as GBPUSD couldn’t print a new low despite another set of strong US data. In fact, the US Retail Sales beat expectations across the board by a big margin and the US Jobless Claims came out...

North Korean troops reportedly shipped to Russian bases for training and likely for combat

Just a bit of a geopolitical update as it looks like North Korea is now getting involved with the war between Russia and Ukraine. It is being reported that North Korean troops have been shipped to Russian bases in the far east for training and adjustment. Following...

GBPUSD Technical Analysis – The USD fails to extend the run on strong data

Fundamental OverviewThe bullish momentum in the US Dollar seems to be waning as GBPUSD couldn’t print a new low despite another set of strong US data. In fact, the US Retail Sales beat expectations across the board by a big margin and the US Jobless Claims came out...

Gold Technical Analysis – Yet another all-time high

Fundamental OverviewYesterday, gold managed to rally into a new all-time high despite some strong US data as Retail Sales and Jobless Claims beat expectations across the board. In the bigger picture, gold remains in a bullish trend as real yields will likely continue...

A quicker return to 2% inflation target on the cards for the ECB?

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

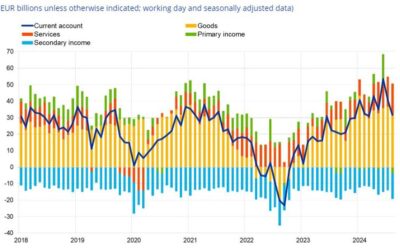

Eurozone August current account balance €31.5 billion vs €39.6 billion prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

European indices in a mixed mood at the open today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan’s largest union group Rengo targets wage hikes of at least 5% for next year

It's a bullish case scenario for the BOJ, if and only if this can be pulled off. Newly appointed Japan prime minister Ishiba will be supportive of that but as inflation stabilises, it might be tough to repeat a similar feat seen last year. For some context, Japanese...

Hang Seng Index Technical Analysis – New easing measures announced

Fundamental OverviewThe PBoC tonight announced new easing measures which included further rate cuts and stock buyback funding. Moreover, we got some positive economic data with Retail Sales and Industrial Production beating expectations by a big margin. These...

BOJ governor Ueda remarks that Japanese economy is recovering moderately

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

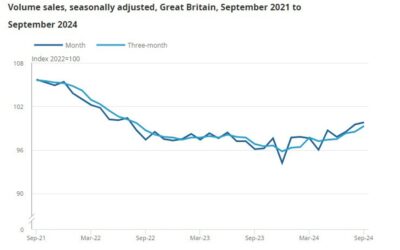

UK September retail sales +0.3% vs -0.3% m/m expected

Prior +1.0%Retail sales +3.9% vs +3.2% y/y expectedPrior +2.5%; revised to +2.3%Retail sales (ex autos, fuel) +0.3% vs -0.3% m/m expectedPrior +1.1%Retail sales (ex autos, fuel) +4.0% vs +3.2% y/y expectedPrior +2.3%; revised to +2.2%It's a welcome sight for the BOE...

ForexLive Asia-Pacific FX news wrap: China launches stock buyback funding

JPY verbal intervention:China:Other Let’s get Japan and the yen out of the way first and then on to China. Inflation data from Japan for September kicked the session off. All three of the main measures came in at or above the Bank of Japan 2% target, although two of...

PBOC Governor says 7-day reverse repo rate will be lowered by 0.2%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC has officially ramped up support for the stock market, relending facility launched

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[24.10월 새로운 자동 부업] 8분만 ‘이렇게’ 해보세요! 매달 자동으로 돈이 들어옵니다 (막히기 전에 이건 꼭 하세요! 무료로 자동 부수입 만들기)](https://my.blogtop10.com/wp-content/uploads/2024/10/24-10ec9b94-ec8388eba19cec9ab4-ec9e90eb8f99-ebb680ec9785-8ebb684eba78c-ec9db4eba087eab28c-ed95b4ebb3b4ec84b8ec9a94-eba7a4-400x250.jpg)