High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.0565 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

Fed Vice-chair Jefferson says Bank has not changed its approach to monetary policy

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

RBA Assistant Gov Kent speech on Term Funding Facility

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fed Vice-chair Jefferson says will watch incoming data, making decision meeting by meeting

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Guggenheim CIO says inflation of up to 4% could be a new normal

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan – Reuters Tankan report for October: Manufacturing sentiment rises from 7 month low

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US inflation data is due this week – here are 14 investment bank forecasts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

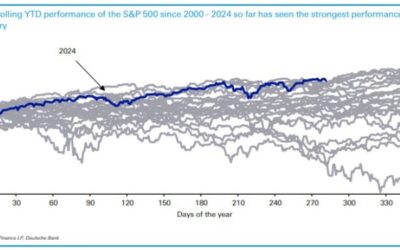

Deutsche Bank on S&P 500: “October in a presidential election year might be a struggle”

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

FX option expiries for Wednesday 9 October 10am New York cut

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Economic calendar in Asia Wednesday, October 9, 2024 – Reserve Bank of New Zealand day

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Forexlive Americas FX news wrap 8 Oct:Some of the major currency pair following technicals

As the day comes to a close in the US, the NZD is ending as a shows the major currency pairs, while the CHF is the weakest. The NZD gains come after declines seen over the last 4/5 trading days, and also ahead of the RBNZ a rate decision in the new trading day (9 PM...

Trade ideas thread – Wednesday, 9 October, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Oil survey of inventory shows a headline crude oil build much larger than expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

More from Fed’s Collins: Labor markets are in a good place overall

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Rebound. Major indices close higher.

The major US indices are in a saw-tooth pattern over the last 3 days. Looking at the major indices, the changes showed:Dow Industrial Average: Up 341 points. Down -398. Up 126.13.S&P: Up 51 points. Down 55.13 points . Up 55.21 pointsNasdaq. Up 219 points. Down...

Fed’s Collins says Fed predicts 50bp of cuts into year end

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Advanced talks are underway to hold a phone call between Biden and Israel’s Netanyahu

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Crude oil settles at $73.57

Crude oil futures are settling down $73.57. That's down $3.57 or -4.63%.The high price today reached $78.42. The low price extended to $72.73.Looking at the daily chart, the low price stalled right at its 50 day moving average (at $72.73), and also just above its...

Israel’s defense minister Gallant will not be traveling to Washington

Buckle up.Israel has informed the Pentagon that Israeli Defense Minister Gallant will not be traveling to Washington.Earlier today there was a report that the US was concerned that Israel would attack Iran while Israel defense minister Gallant was visiting in...