I don't know what people were thinking with the Chinese market and global growth trades yesterday.They rallied huge yesterday despite Trump winning the election. The hope -- evidently -- was that Beijing was going to deliver larger stimulus.The thing is, the stimulus...

Canada October employment change +14.5K vs +25.0K expected

Prior month +46.7KUnemployment rate 6.5%vs 6.6% expected (prior 6.5%)Full-time employment +25.6K vs +112.0K priorPart-time employment -11.2K vs -65.3K priorParticipation rate 64.8% vs 64.9% priorAverage hourly wages y/y 4.9% vs 4.5% priorPrivate sector employment...

What technicals are driving the major currency pairs to start the US sessoin

The major indices are set to open mixed/lower after the broader S&P and Nasdaq closed at record levels. The indices are up strongly this week as the market cheer the Trump victory along with a Fed that cut rates and is favored to cut in December too. Yields are...

BOE’s Pill: There is scope fore more rate cuts if disinflation continues

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive European FX news wrap: Dollar keeps steadier, China disappoints again

Headlines:Markets:JPY leads, AUD lags on the dayEuropean equities lower; S&P 500 futures down 0.1%US 10-year yields down 2.5 bps to 4.317%Gold down 0.7% to $2,687.42WTI crude down 1.1% to $71.52Bitcoin up 0.1% to $76,066The post-election musings are continuing in...

NZDUSD Technical Analysis – The USD does the opposite of what it was supposed to do

Fundamental OverviewThe US Dollar is now lower across the board as the market erased most of the greenback’s gains following Trump’s victory. This has been a puzzling reaction as Trump’s policies are likely to spur growth and potentially end the Fed’s easing cycle...

Barclays now sees the BOE holding bank rate unchanged in December

On the revision, Barclays cites the BOE's more cautious tone that emphasised uncertainty and gradual policy moves."The main messaging from the press conference was repeated emphasis on the extent of uncertainty at the current juncture: uncertainty around the impact of...

The post-election tussle continues to play out

The post-election trade in the dollar hasn't been too straightforward over the last two days to say the least. The greenback saw gains abate yesterday but is looking to recover back some ground again in trading today. But even then, it isn't that convincing with the...

AUDUSD Technical Analysis – We got a “sell the fact” reaction on Trump’s victory

Fundamental OverviewThe US Dollar is now lower across the board as the market erased most of the greenback’s gains following Trump’s victory. This has been a puzzling reaction as Trump’s policies are likely to spur growth and potentially end the Fed’s easing cycle...

USDCHF Technical Analysis – The strong rally in the US Dollar stalls

Fundamental OverviewThe US Dollar is now lower across the board as the market erased most of the greenback’s gains following Trump’s victory. This has been a puzzling reaction as Trump’s policies are likely to spur growth and potentially end the Fed’s easing cycle...

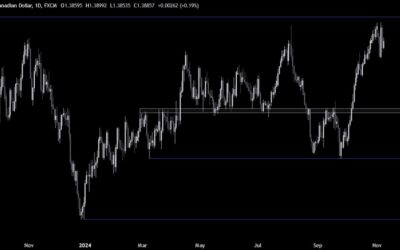

USDCAD Technical Analysis – Is this just a pullback or a reversal?

Fundamental OverviewThe US Dollar is now lower across the board as the market erased most of the greenback’s gains following Trump’s victory. This has been a puzzling reaction as Trump’s policies are likely to spur growth and potentially end the Fed’s easing cycle...

PBOC says will continue with supportive monetary policy

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

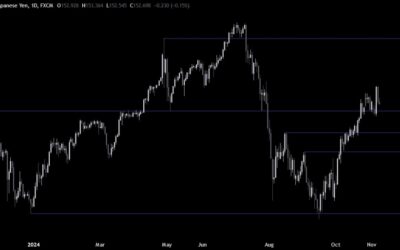

USDJPY Technical Analysis – Interesting reversal in the US Dollar

Fundamental OverviewThe US Dollar is now lower across the board as the market erased most of the greenback’s gains following Trump’s victory. This has been a puzzling reaction as Trump’s policies are likely to spur growth and potentially end the Fed’s easing cycle...

Silver futures prediction: Potential 17% drop ahead. Warning to Silver Longs ⚠️

Silver futures warning: bear flag signals potential 17% drop ahead ⚠️Traders and investors in silver futures, silver-related ETFs, and XAG/USD should keep a close watch as silver faces a potential breakdown, highlighted in the 4-hour chart. After a period of...

Chinese yuan falls as NPC announcement lacks oomph so far

Once again, Beijing is finding out that they have a rather tough crowd to please. After the conclusion of the NPC meeting today, officials announced a ¥6 trillion plan to refinance local government debt (added context) as seen here. The figure there is as expected,...

China claims that “hidden debt” totaled at roughly ¥14 trillion at the end of 2023

As mentioned earlier in the week here, the IMF estimates that China's "hidden debt" to be above ¥60 trillion as of last year. But Chinese officials are now out saying that they only have ¥14.3 trillion in "hidden debt" as of the same period. It's a stark contrast in...

China’s top lawmakers approve plan to swap local government debt

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

France September trade balance -€8.27 billion vs -€7.37 billion prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Chinese equities end lower as investors hold caution ahead of key briefing

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China officials to hold a briefing later at 0800 GMT

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...