High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

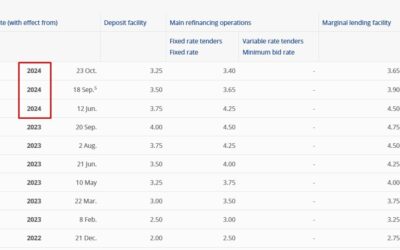

ECB’s Holzmann sees no reason not to cut rates in December

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fed’s Kashkari: Fed wants to have confidence inflation will go all the way back to 2%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

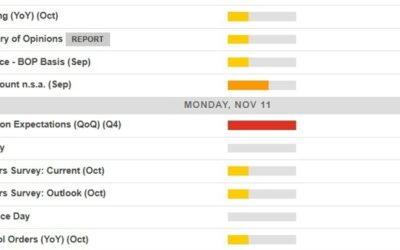

Economic calendar in Asia Monday, November 11, 2024

Reserve Bank of New Zealand inflation expectations data can move the NZD a little. Keep an eye on the two year horizon. This is the important one for the Reserve Bank of New Zealand. The bank views this as as a reasonable time frame over which its policy changes...

Trade ideas thread – Monday, 11 November, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Monday morning open levels – indicative forex prices – 11 November 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Weekly Market Outlook (11-15 November)

UPCOMING EVENTS:Monday: BoJ Summary of Opinions. (US Holiday)Tuesday: UK Labour Market report, Eurozone ZEW, US NFIB Small Business Optimism Index, Fed’s SLOOS.Wednesday: Japan PPI, Australia Wage Price Index, US CPI.Thursday: Australia Labour Market report, UK GDP,...

주변 여성에게! 자녀 키우는 가정에! 이거 꼭 알려주세요!!

https://www.youtube.com/watch?v=IuyUn7XvosE 어린이와 청소년을 키우는 가정, 여자친구가 있는 분들, 여성 혼자 살고 있는 주변 지인이 있다면 오늘 영상 꼭 공유해 주시면 좋겠습니다. #속보 #뉴스 MoneyMaker FX EA Trading...

Newsquawk Week Ahead: US and China CPI, US Retail Sales, UK and Australian Jobs

Mon: US Holiday: Veterans Day. BoJ SOO (Oct), BoC SLOS; Norwegian CPI (Oct)Tue: Fed SLOOS, OPEC MOMR; German CPI (Final), ZEW (Nov), UK Unemployment/Weekly Earnings (Sep), US NFIB (Oct)Wed: Riksbank Minutes (Nov), EIA STEO; Australian Wage Price Index (Q3), US CPI...

[테슬라 450돌파! 최대 1만달러 간다! 머스크+트럼프 충격적! 4년후 미국 이렇게 된다]#3.1경제독립tv

https://www.youtube.com/watch?v=wmvs_RtOyLI [테슬라 450돌파! 최대 1만달러 간다! 머스크+트럼프 충격적! 4년후 미국 이렇게 된다]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

[속보-2부]테슬라폭등!321달러 찢었다! 400달러 돌파 임박! 폭풍랠리 계속된다.2025년 테슬라 주가는 이렇게 된다]#1부 영상 이어서 보셔요#3.1경제독립tv

https://www.youtube.com/watch?v=PxhGzkqmKH8 [속보-2부]테슬라폭등!321달러 찢었다! 400달러 돌파 임박! 폭풍랠리 계속된다. 2025년 테슬라 주가 이렇게 된다]#1부 영상 이어서 보셔요#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세,...

바뀌는 육아휴직! 이렇게까지 해준다고? 앞으로 육아휴직 이렇게 꼭 쓰세요!!

https://www.youtube.com/watch?v=_pyQDemeNkU 8세 이하 영유아가 있는 근로자라면 한 번 쯤 육아휴직 생각해 본 적 있으신가요? 최대 1년을 휴직할 수 있어서 아이를 양육하기에 좋은 제도이지만, 실제로 육아휴직 사용률이 높지 않다고 합니다. 2025년부터 앞으로 육아휴직을 사업주 동의 없이도, 돈도 더 많이 주는 쪽으로 이렇게 지원한다고 합니다. 영상에서 자세한 내용 설명드리겠습니다. #뉴스 #육아휴직 #2025육아휴직 MoneyMaker FX...

China October CPI +0.3% y/y (expected +0.4%, prior +0.4%), deflation prospect lingers

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Forexlive Americas FX news wrap: US dollar climbs, yields retreat

Markets:S&P 500 up 0.4%WTI crude oil down $1.88 to $70.48Gold down $24 to $2683US 10-year yields down 4 bps to 4.30%JPY leads, AUD lagsChina set the table for US markets on Friday as the stimulus announcements disappointed, leading to a 5.5% decline in US-listed...

Trump’s Treasury Secretary will be a George Soros disciple or a gold bug – report

John PaulsonAn earlier report highlighted John Paulson and Scott Bessent as possible candidates for Treasury Secretary and now Reuters sources say those are the leading candidates.I wrote about Paulson earlier in the week and emphasized that he's a major gold bull....

What technical levels are key for the major currrency pairs for the week starting Nov 11

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US stock markets notch records: Russell 2000 weekly gain is the largest since 2000

When Trump autographed a stock chartClosing changes on the day:S&P 500 +0.4% - record closeNasdaq Comp +0.1%DJIA +0.6%Russell 2000 +0.7%Toronto TSX Comp -0.4%Closing changes on the week:S&P 500 +4.7%Nasdaq Comp +5.7%Russell 2000 +8.6%Toronto TSX Comp...

USDCHF bounces off the 38.2% retracement level today. Why is that important?

The USDCHF moved lower to start the trading week but found willing sellers near a key swing area between 0.86078 and 0.8619. The low held on Tuesday ahead of the election results. Those results sent the pair moving sharply higher. The run higher, extended back above...

MUFG: FX Trump trade to resume

MUFG anticipates a resumption of USD appreciation over the coming months, following a brief pullback post-election. President-elect Trump’s strong mandate and planned policies on trade tariffs, tax cuts, and increased fiscal spending are expected to support higher...

The bond market isn’t sure where it lands on the deficit, growth and inflation debate

We had a red sweep in the US election. That's an outcome that was consensus bond bearish, on assumed larger deficits, inflationary tariffs and growth-boosting tax cuts.The initial reaction was about what you would expect, with 10-year yields rising 24 bps at the peak...

![[테슬라 450돌파! 최대 1만달러 간다! 머스크+트럼프 충격적! 4년후 미국 이렇게 된다]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/11/ed858cec8aaceb9dbc-450eb8f8ced8c8c-ecb59ceb8c80-1eba78ceb8baceb9fac-eab084eb8ba4-eba8b8ec8aa4ed81aced8ab8eb9fbced9484-ecb6a9eab2a9-400x250.jpg)

![[속보-2부]테슬라폭등!321달러 찢었다! 400달러 돌파 임박! 폭풍랠리 계속된다.2025년 테슬라 주가는 이렇게 된다]#1부 영상 이어서 보셔요#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/11/ec868debb3b4-2ebb680ed858cec8aaceb9dbced8fadeb93b1321eb8baceb9fac-ecb0a2ec9788eb8ba4-400eb8baceb9fac-eb8f8ced8c8c-ec9e84ebb095-ed8fad-400x250.jpg)