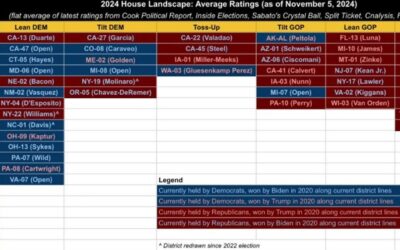

The US economic calendar is bare today aside from weekly oil inventory data. That will give markets a chance to trade around the election results. Eyes continue to be on House races, as it currently looks like Republicans will have a 2-seat majority, though there are...

Goldman Sachs lowers euro area 2025 GDP growth forecast to 0.8% from 1.1% previously

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EUR/USD extends fall, poised for biggest daily decline since 2016

EUR/USD daily chartThe drop today brings the pair down to its lowest levels since June, with the daily decline itself set to even eclipse that seen in March 2020. The over 2% drop now is going to be the worst daily decline for EUR/USD since June 2016 amid the Brexit...

ForexLive European FX news wrap: Dollar soars as Trump wins US presidential election

US election:Headlines:Markets:USD leads, EUR lags on the dayEuropean equities higher; S&P 500 futures up 2.1%US 10-year yields up 18 bps to 4.46%Gold down 1.6% to $2,700.79WTI crude down 1.4% to $70.98Bitcoin up 7.7% to $74,467Donald Trump has been elected the...

Octa Broker Explains Early Market Reaction Following Trump Victory

What we know so farAs of 7:00 a.m. UTC, most data providers, including ABC, CBS, NBC, and CNN, projected that Donald Trump would become the next president of the United States. However, even as Trump’s victory looks almost guaranteed at this point, it is the balance...

US MBA mortgage applications w.e. 1 November -10.8% vs -0.1% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

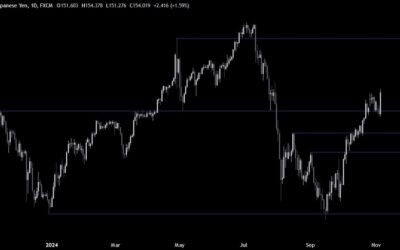

Treasury yields nudge towards the highs for the day as Trump confirmed as election winner

US Treasury 10-year yields (%) daily chartThat is the highest level in four months and carries on from the surging run since October. And this is in part fueling the dollar gains on the day with EUR/USD now down nearly 2% at 1.0715 and USD/JPY up 1.7% to 154.15...

The calls are officially out now, Trump has won the US presidential election

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Gold Technical Analysis – Is this the beginning of a bigger pullback?

Fundamental OverviewGold is trading lower today as Trump got elected President of the US. The Republicans won the Senate, and they just need the House now to get a red sweep. That is the most bearish scenario for gold in the short-term as it would make the tax cuts...

Eurozone September PPI -0.6% vs -0.6% m/m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The race for control of the House is playing out accordingly for the most part thus far

The NYT projection has Republicans with 194 seats and Democrats with 173 seats at the moment. And among the key 'competitive' districts here, there are still 45 left to officially report. That said, some of the votes are likely to be called imminently. So, let's take...

Crypto Cities: Futures vs. Options in Crypto Markets

The cryptocurrency market is evolving rapidly, and with it, advanced financial instruments like futures and options have emerged as popular tools for traders seeking to maximize their investment strategies. While these derivatives allow for speculative trades and...

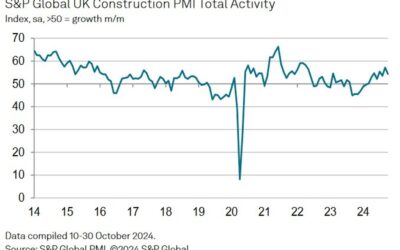

UK October construction PMI 54.3 vs 55.5 expected

Construction PMI 54.3 vs 55.5 expected and 57.2 prior.Key findings:Civil engineering remains best-performing category, followed by commercial work. Renewed decline in house building. Business optimism slips to ten-month low.Comment:Tim Moore, Economics Director at...

Dollar sits comfortably higher but takes its foot off the gas pedal for now

The dollar continues to hold higher across the board but not really pushing further upside in European morning trade. USD/JPY is up 1.5% to 153.95 with the earlier high touching 154.37. Meanwhile, EUR/USD is seen down 1.5% to 1.0765 but well off lows of 1.0702 when...

Polkadot and SP Negócios Collaborate to Enhance Crypto Economy Development

SP Negócios, São Paulo’s investment and export promotion agency, has partnered with Polkadot to foster innovation among companies in São Paulo.Driven by the growing market demand, Polkadot is increasingly positioning itself as an ally for businesses looking to grow in...

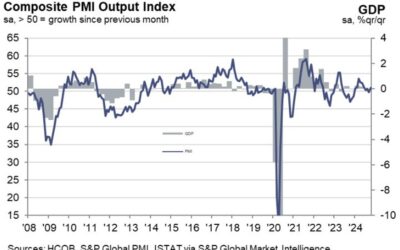

Eurozone October final services PMI 51.6 vs 51.2 prelim

Prior 51.4Composite PMI 50.0 vs 49.7 prelimPrior 49.6The euro area economy kicks start Q4 in stagnation mode with heavyweights Germany and France dragging down the overall performance. A further weakening in demand conditions is to blame but just be wary that...

Germany October final services PMI 51.6 vs 51.4 prelim

Final Services PMI 51.6 vs. 51.4 expected and 50.6 prior.Final Composite PMI 48.6 vs. 48.4 expected and 47.5 prior.Key findings:HCOB Germany Services PMI Business Activity Index at 51.6 (Sep: 50.6). 3-month high. HCOB Germany Composite PMI Output Index at 48.6 (Sep:...

France October final services PMI 49.2 vs 48.3 prelim

Prior 49.6Composite PMI 48.1 vs 47.3 prelimPrior 48.6The revisions are positive but still marks a drop from September. The details reveal the sharpest drop in new business since January with growth expectations also declining markedly compared to the month before....

Italy October services PMI 52.4 vs 50.5 expected

Services PMI 52.4 vs. 50.5 expected and 50.5 prior.Composite PMI 51.0 vs. 49.7 prior.Key findings:New business rises modestly following two successive months of decline. Activity growth accelerates to four-month high. Employment levels broadly unchanged in...

USDJPY Technical Analysis – Trump is 47th President of the US

Fundamental OverviewThe US Dollar is higher across the board today as Trump got elected President of the US. The Republicans won the Senate, and they just need the House now to get a red sweep. That is the most bullish scenario for the greenback as it would make the...