Looking at the S&P 500 index, it is down by -59.03 pointer -1.02% at 5702.88 . The low price for the day extended to 5681.28. The high price is at 5757.73. On the downside, the rising 100-hour moving average comes in at 5675.06. So the low price at 5681.28, got...

Missiles have been launched from Iran toward Israel. Missiles entering airspace in TelAviv

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECBs Kazaks: Very much agree with market pricing on ECB’s o October interest-rate decision

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Israeli assassinates commander in charge of the weapons transfer from Iran to Hezbollah

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

September did not disappoint

A difficult start does not always lead to a dismal end, especially in the markets. September started on a bleak note, but by the end of the month, the indices had performed surprisingly well.To clarify, they stumbled after hearing that the manufacturing sector had...

More from SNBs Schlegel: Last week we did not rule out further interest rate cuts

Have respect for all exporters, I know the strong Frank makes situation difficult for them.The main problem first was exporters is the lower demand abroad.Last week we did not rule out further interest rate cuts.Cannot rule out any measures, but nobody likes negative...

Iran informed ‘international parties’ of the size and timing of its strike

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The AUDUSD/NZDUSD are moving lower w/geopolitical and risk-off sentiment the catalyst

The AUDUSD and the NZDUSD are both lower as risk-off sentiment and geopolitical tensions hurt what has been a bullish bias in the pairs.The AUDUSD reached the highest level for the year yesterday forming a double top in the process (going back to February 2023). The...

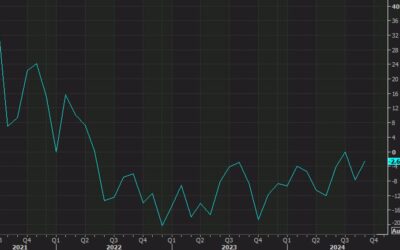

Atlanta Fed Q3 GDPNow cut to 2.5% from 3.1%

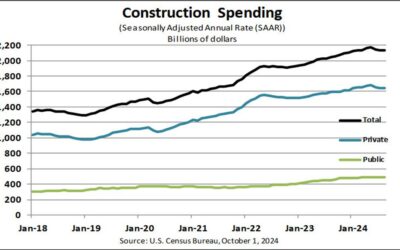

The GDP tracker was boosted in the prior release but it's been reeled back in."After this morning’s construction spending release from the US Census Bureau and the Manufacturing ISM Report On Business from the Institute for Supply Management, the nowcasts of...

SNB’s Schlegel: Reason for last week’s rate cut was lower inflationary pressure

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand GDT price index +1.2%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Iran expected to attack with high-speed missiles – report

There has been another hiccup in risk trades in the past few minutes, though less so in bonds. It could be that some fresh details are crossing on Iran's plans to strike imminently.The first is from the Israeli media and says:Three Israeli officials quoted anonymously...

Fed’s Cook predicts AI-fueled productivity gains

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

GBPUSD falls to new lows as traders focus on the 38.2% of the move up from September

The GBPUSD is moving to a new low an din the process is moving further away from swing area above between 1.33308 and 1.33393. On the downside, the 38.2% is the next key target for traders which comes in at 1.32683. Below that and the rising 100 bar MA on the 4-hour...

Dallas Fed September service sector outlook index -2.6 vs -7.7 prior

Prior was -7.7Revenue index +10.1 vs +8.7 prior (highest in 13 months)Employment +2.0 vs +0.6 priorCompany outlook +1.2 vs -3.1 priorSix month index +17.4vs +12.4 priorComments in the report:Utilities I feel the economy is getting better.Professional, scientific and...

USDCAD moves lower to test rising 100 hour MA

The USDCAD pair has moved lower during the North American session as declining US yields and rising oil prices weigh on the pair. Technically, the price has fallen below the 200-hour moving average at 1.3509, while finding support near the rising 100-hour moving...

US expects Iran attack similar in scope to April strike

In April, Iran launched around 170 drones, over 30 cruise missiles, and more than 120 ballistic missiles towards Israel. Most were shot down while a few landed near Israeli military facilities.CNN cites a senior White House correspondent saying the attack looks to be...

US August construction spending -0.1% vs +0.1% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

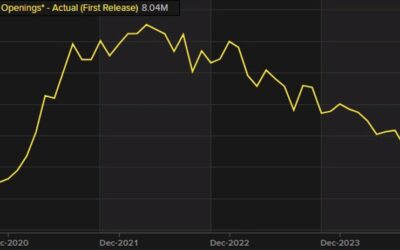

JOLTS job openings 8.040M vs 7.660M estimate

Prior month 7.673M revised to 7.711MJob openings 8.040M. Vacancy rate 4.8% versus 4.6% last month Quits rate 1.9% versus 2.0% last month (revised from 2.1%)Separations rate 3.1% versus 3.2% last monthDetails:1.3 million fewer openings than the previous yearIncreases...

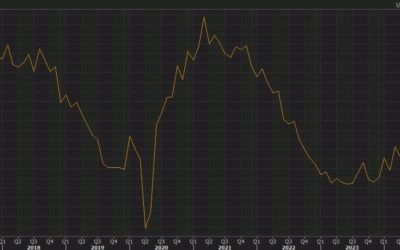

US September ISM manufacturing index 47.2 vs 47.5 expected

ISM manufacturingPrior was 47.2Prices paid 48.3 vs 54.0 priorEmployment 43.9 vs 46.0 priorNew orders 46.1 vs 44.6 priorProduction 49.8 vs 44.8 priorSupplier deliveries 52.2 vs 50.5 priorInventories 43.9 vs 50.3 priorBacklog of orders 44.1 vs 43.6 priorNew export...