The major US stock indices are moving lower from the get-go led by the NASDAQ index which is down -0.64%. The price opened at 18220, and is currently trading 100 points lower at 18120.A snapshot of the major indices currently shows:Dow industrial average -174.39...

Trading 2024 US Elections Market Volatility with Plus500

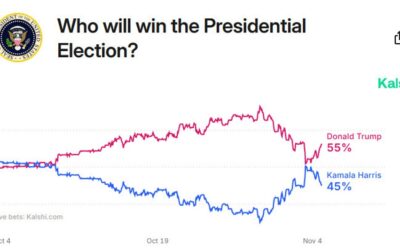

All eyes will be on the United States on Tuesday, 5 November 2024, as the world awaits the outcome of the contest between Kamala Harris and Donald Trump. With the countdown clock to the 2024 US elections beginning to tick down towards polling day, markets are starting...

Kickstart the FX trading day for Nov 4 w/a technical look at EURUSD, USDJPY and GBPUSD

The USD is lower to start the trading week (helped by the Pres. Polls over the weekend). The moves in the 3 major currency pairs did move to corresponding technical targets and stalled.EURUSD: For the EURUSD, it move up to test the 50% midpoint of the move up from...

OPEC+ delay does the trick for oil as it climbs to a one-week high

Oil is off to a strong start to the week. It gapped 80-cents higher at the Asian open and has continued higher. It's up $1.91 to $71.40, which is the highest since October 25.The main driver is the OPEC+ decision to extend voluntary production curbs for an additional...

Election angst is the driver from here

It's election week.It doesn't get any bigger than this in US politics and polls show this will be a razor-tight race. At this time last week, Trump looked to have an edge but some polling numbers over the weekend upended that and highlighted the possibility that...

US dollar is lower to start the new week after Harris jump in poll

The influential Selzer poll out of Iowa showed a Harris lead over the weekend. That is not supposed to happen, and led to the USD moviing lower on the news. The US yields are lower. The US stocks are trading mixed (Dow modestly lower, S&P and Nasdaq modestly...

ForexLive European FX news wrap: Dollar stays lower on tighter US election race odds

Headlines:Markets:JPY leads, USD lags on the dayEuropean equities lightly higher; S&P 500 futures flatUS 10-year yields down 9 bps to 4.29%Gold up 0.2% to $2,740.83WTI crude up 3.0% to $71.57Bitcoin down 0.5% to $68,855As we get the new week underway, the focus in...

Dollar stays pinned down alongside yields ahead of US trading

After a bit of a lackluster start to the session in Europe, we're starting to see things pick up again now nearing US trading. The dollar opened with a gap lower with focus on the US election tomorrow and is now starting to track back to the lows for the day. USD/JPY...

OPEC secretary general Al Ghais: We are very positive on demand

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China are reportedly reviewing a bill to raise local government debt ceilings

The move here is to largely deal with "hidden debt" or what is intricately known as debt arising from local government financing vehicles (LGFV). These are off-balance sheet debt that are incurred by local governments to finance big projects and infrastructure. For...

Crude Oil Technical Analysis – Positive gap on OPEC+ production hike delay

Fundamental OverviewCrude oil opened the day with a positive gap today following the weekend news of OPEC+ delaying the December production hike. In the big picture, central bank easing generally leads the manufacturing cycle, so we can expect global growth to pick up...

Xlence Sets New Standard in Online Trading

With its recent launch, Xlence is quickly positioning itself as a promising option in the online trading world. This new platform emphasizes transparency, education, and accessibility, aiming to make trading a simpler and more empowering experience for users. In a...

Deribit and SignalPlus Launch $200,000 Winter Trading Competition

Deribit, the world’s premier Bitcoin and Ethereum options exchange, in partnership with SignalPlus, a leading options trading dashboard and analytics hub, is excited to unveil the second edition of the Winter Trading Competition 2024.This year's competition offers...

Eurozone November Sentix investor confidence -12.8 vs -12.5 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

FP Markets Secures Three Major Honours at the Inaugural Finance Magnates Annual Award Gala

Australian-founded broker FP Markets further cemented its position as a market leader, winning ‘Most Trusted Broker - Global’, ‘Broker of the Year - Asia’, and ‘Fastest Growing Broker - LATAM’ at the inaugural Finance Magnates Annual Award (FMAA) Gala. The event was...

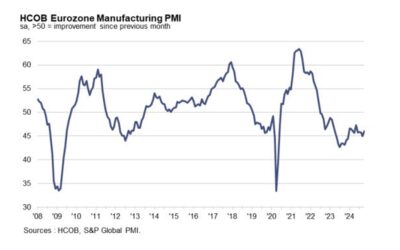

Eurozone October final manufacturing PMI 46.0 vs 45.9 prelim

Prior 45.0The headline reading is a 5-month high with the output reading also improving to a 2-month high. A slight improvement in fortunes in Germany helped but the real carry is Spain, with manufacturing activity there seen at a 32-month high. That being said,...

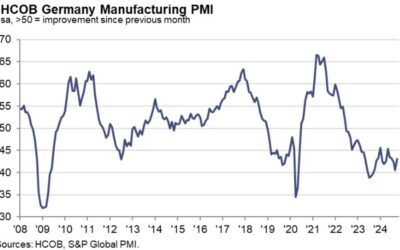

Germany October final manufacturing PMI 43.0 vs 42.6 prelim

Final Manufacturing PMI 43.0 vs. 42.6 expected and 40.6 prior.Key findings:HCOB Germany Manufacturing PMI at 43.0 (Sep: 40.6). 3-month high. HCOB Germany Manufacturing PMI Output Index at 42.8 (Sep: 41.3). 2-month high. Deeper cuts to output prices signalled amid...

USD/JPY pullback stalls near key technical support again for now

USD/JPY daily chartThe dollar opened with a gap lower today before keeping lower since Asia trading. The needle hasn't really moved since we got to European morning trade, with market players waiting on potentially more developments in the polls later in US. In the...

France October final manufacturing PMI 44.5 vs 44.5 prelim

Prior 44.6No change to the initial estimate as the French manufacturing sector stays in contraction territory. New orders observed an accelerated pace of decline with employment conditions also starting to be hit harder. The latter will be a concern to watch if it...

Italy October manufacturing PMI 46.9 vs 48.6 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...