High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trade ideas thread – Tuesday, 24 September, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

NZDUSD runs higher after dip to the 100 hour MA found buyers.

The NZDUSD is moving higher today after the dip lower in the Asian/early European session found willing buyers near the 100 hour MA. Buyers have been leaning near that MA over the last 6 or so trading days. There have been some small break (on Friday and also on...

USDJPY moves closer to the rising 100 hour MA

The USDJPY has had its share of ups and downs in trading today.In the NY session the high reached up toward resistance at 144.58.That level represents the 50% of the pair trading range from the January 2023 low (see the chart above). The high price in the Asian...

Crude oil futures is settling $70.37

The price of crude oil futures are settling down -$0.63 or -0.89% at $70.37.The low price for the day reached $69.52 while the high price was at $71.78. At session lows, the price is at its rising 200-hour moving average (green line on the chart below). The price...

USDCHF break below MA cluster

The USDCHF has extended to the downside after holding the 38.2% of the move down from the mid-August high at 0.85172. As outlined in the video from earlier today, if the price could get below the cluster of MAs defined by the 100/200 hour MAs and the 100 bar MA on the...

More Geopolitics: Iran Pres says US policies support & encourage Israel

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The GBPUSD found seller near the 1.3358 target as outlined earlier today

Earlier today in the kickstart video, I spoke about the GBPUSD price action and the next target. As a review, I said the following:At the time, the price was trading at 1.3324. So what happened?The price did move above the 1.3338 and the price did move to the swing...

AUDUSD buyers try to extend higher for the 3rd day in a row. Can they keep the momentum?

The AUDUSD has been trying to extend to the upside over the last few trading days but has seen resistance even thoughnew highs have been made. Today is another try. The price has extended above the high price from last weekend at 0.6838. Also, it has moved above the...

Geopolitics: Israeli military is now targeting Beirut

Geopolitics: Israeli military says it is now targeting BeirutHezbollah also stated it's top commander Ahmed Wahbi was killed during Israelis strike on Beirut suburbsIsreal attack targeted Hezbollah leader Ali Karaki Iran warned Israel of “dangerous consequences”...

European equities end mixed, US shares edge higher

Major European indices closed mostly higher to start the week, but the gains were modest. The gains and mostly indices come despite weaker S&P/Global PMI flash data.A snapshot of the closing levels show:German Dax, +0.58%France's CAC, +0.06%UK FTSE 100,...

USDCAD makes a break for it to the downside. What was the catalyst? What next?

The USDCAD last week had some buying against the 100 bar MA on the 4-hour chart last week (currently at 1.35548) and also some failed breaks that quickly failed.In trading today, that MA did hold support in the last Asian Pacific/early European market and rallied....

More from Goolsbee: Until the rate, falling inflation has meant Fed has been tightening

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The consolidation in USDCHF trading continues. What should traders look for going forward?

The USDCHF has been consolidating since August 20 or so with most of the price action between 0.8400 and 0.8537. That's not alot of trading range over that time period. Buyers and sellers are battling it out.In the shorter-term, the price action on Friday and again...

Fed’s Goolsbee: ‘Many more cuts’ likely needed over the next year

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EURUSD finds willing sellers at the 100 hour MA

The EURUSD moved higher to test the 100 hour MA, but did find willing sellers. The flash PMI was weaker but the inflation data was higher with S&P Global saying, the "prices charged for goods and services are both rising at the fastest rate support six months"....

Tech sector stabilizes: Microsoft slides while Nvidia and Meta rise

Stock heatmap by FinViz.com Mon, 23 Sep 2024 13:46:06 GMTSector OverviewThe US stock market heatmap today highlights mixed performances across various sectors. The technology sector is showing neutral to positive movements with Nvidia (NVDA) gaining 0.30% and Meta...

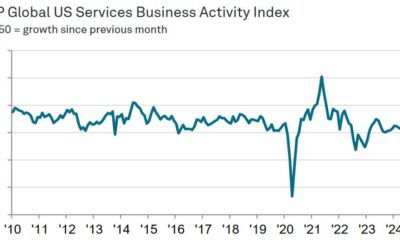

US September flash S&P Global Services PMI 55.4 vs 55.2 expected

Prior was 55.7 (best in two years)Manufacturing 47.0 vs 48.5 expectedPrior manufacturing 47.9Composite 54.4 vs 54.6 prioraverage prices charged for goods and services rising at the fastest rate since MarchRates of selling price inflation moved up to six-month highs in...

Major US indices trade mixed to start take new trading week

The major indices are trading mixed to start taking new trading day and the new trading week: Dow industrial average -2.89 points or -0.01% at 42060.47S&P index up 5.69 points or 0.10% at 5708.24NASDAQ index up 23.13 points or 0.13% at 17971.45.The small-cap...

The market is too optimistic on the euro – Deutsche Bank

EURUSD dailyDeutsche Bank expects the euro to fall back to 1.08 by year end.They mainly take issue with the dollar side of the trade, noting that most G10 central banks are priced to converge to a terminal rate of around 2-3%. By virtue of the Fed having the most to...