Prior +0.2%The slight bump in August owes mostly to energy prices (+0.8%). If you strip that out, producer prices were actually flat on the month in Germany. Looking at the other individual breakdowns, intermediate goods prices fell by 0.3%, capital goods prices rose...

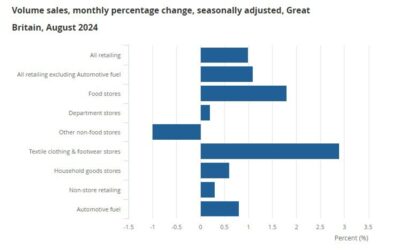

UK August retail sales +1.0% vs +0.4% m/m expected

Prior +0.5%; revised to +0.7%Retail sales +2.5% vs +1.4% y/y expectedPrior +1.4%; revised to +1.5%Retail sales (ex autos, fuel) +1.1% vs +0.5% m/m expectedPrior +0.7%; revised to +1.0%Retail sales (ex autos, fuel) +2.3% vs +1.1% y/y expectedPrior +1.4%UK retail sales...

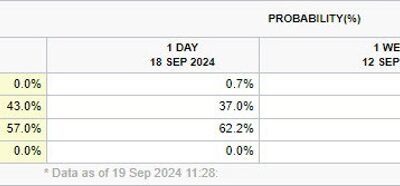

Fed fund futures suggest November is starting to resemble a coin flip again

Fed fund futures probability for 7 November meetingThe Fed might be signaling that they intend to cut by just 25 bps each in November and December. However, they've shown this week that they can be bullied into a decision by markets. The onus now lies on economic data...

BOJ rounds off the central bonanza for the week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive Asia-Pacific FX news wrap: USD/JPY loses a little ground

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bloomberg: China Weighs Removing Major Homebuying Curbs to Boost Demand

Bloomberg carry the report saying that China is considering removing some of the largest remaining restrictions on home purchases. Measures are said to include tier 1 cities to relax restrictions for non-local buyers.Bloomberg add that 'after previous measures failed...

Federal Reserve Bank of Philadelphia President Harker speaking on Friday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China’s electricity consumption rose 8.9% year on year in August

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

RBA meting next week – preview – to leave the cash rate on hold at 4.35%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of Japan leaves rates unchanged, as widely expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Reports of China state banks buying USD/CNY

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of Japan policy statement due soon – no change expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand PM Luxon says constrained by limited fiscal space

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of Canada Governor Tiff Macklem will speak on AI on Friday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate for today at 7.0644 (vs. estimate at 7.0637)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China leaves 1- and 5-year Loan Prime Rates (LPR) unchanged

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[신청안해서 못받은 지원금 충격! 131만원, 115만원, 60만원! 지금 신청해도 받는다! 3가지 체크!!]#3.1경제독립tv

https://www.youtube.com/watch?v=_4W9nAV7GFA [신청안해서 못받은 지원금 충격! 131만원, 115만원, 60만원! 지금 신청해도 받는다! 3가지 체크!!]#3.1경제독립tv [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나? https://youtu.be/6U8BR4kcPAo...

Bank of England Monetary Policy Committee member Mann speaking Friday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

People’s Bank of China rate cuts are expected today: LPRs, repo

The People's Bank of China is expected to cut its main policy reverse repo rate, along with its Loan Prime Rates (LPRs) today. The rate cut from the Federal Reserve this week is expected ease the way for cuts from the PBOC.The PBOC has shifted to the 7 day repo rate...

PBOC is expected to set the USD/CNY reference rate at 7.0637 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

![[신청안해서 못받은 지원금 충격! 131만원, 115만원, 60만원! 지금 신청해도 받는다! 3가지 체크!!]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/09/ec8ba0ecb2adec9588ed95b4ec849c-ebaabbebb09bec9d80-eca780ec9b90eab888-ecb6a9eab2a9-131eba78cec9b90-115eba78cec9b90-60eba78cec9b90-eca780-400x250.jpg)