Earlier in the US session, I posted: The price did bounce off the 100-hour MA, and after getting above the 1.1140 level, has extended up to a corrective high of 1.1167. The next target comes in at the high for the day at 1.1178. Above that and the high from yesterday...

The long end is key for the US dollar now

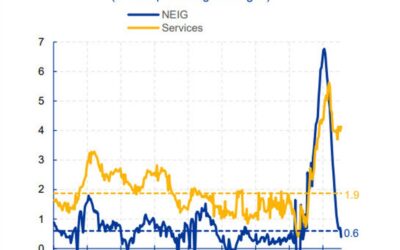

The head of US fixed income from Wells Fargo was on CNBC today and he made the point that sub-3.5% in US 10s is too low for the environment we're in. The Fed is now cutting and prepared to cut aggressively to preserve US economic strength.Sub-3.5% with Fed funds at...

The AUDUSD tests a key area on the daily chart. Buyers and sellers be on alert.

The AUDUSD is trading higher today, boosted by risk-on sentiment as US stocks surge. The Dow is up 633 points (1.52%), while the S&P 500 and Nasdaq have gained 2.00% and 2.95%, respectively. In the European session, the AUDUSD reached a new high, but struggled to...

Will oil get on the global growth bandwagon?

WTI crude oil dailyThe market is frothy at the thought of a soft landing today after Powell pledged to preserve the strength of the economy yesterday and delivered a half-point cut. Fed projections are for 4.4% unemployment through next year and -- presumably --...

NZDUSD has it’s share of ups and downs, but buyers are in control. I will tell & show why.

The NZDUSD continues to experience volatile price action following the FOMC rate decision, with today's trading seeing an initial move to the downside. The fall took the price briefly below its 100-hour moving average, marking a departure from the recent trend....

S&P 500 extends gain to 2%, Nasdaq up 3%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Canadian consumer spending struggled in August – RBC tracker

RBC's Canadian consumer spending tracker is a good measure of real-time spending based on credit card data. Usually it's released around the 10th of the month and I've been checking it daily, wondering why the long wait. It's finally out and shows that August retail...

US 30 year mortgage rates up 6 bps since Fed Rate cut to 6.17%

The Federal Reserve cut rates by 50 basis points yesterday, but since then, the US 30 year mortgage rate has moved up six basis points to 6.17%.Of course the Fed funds rate is a shorter-term overnight lending rate that the Fed targets in its monetary policy.Meanwhile,...

The NASDAQ index is leading the way higher.

The NASDAQ index is leading the way to the upside today with a gain of 490 points or 2.8% at 18064. The high price reached 18078.20. That took the index up 504.90 points on the day. At session lows today the price was still up 336.45 points.Although surging, the price...

Volkswagen may cut 30,000-100,000 jobs

The economic woes for Germany are coming from every direction. High energy prices and competition from China are undermining its manufacturing and export-oriented economy.The problems at Volkswagen are apparently worse than previously assumed, according to...

USDCHF is not escaping the up and down volatility. Testing a key technical target.

The USDCHF continues to experience volatile price action, with the current move testing a crucial downside target. After failing to break above the 38.2% retracement level of the decline from the mid-August high to the September low, the price has rotated back to the...

7 Things to Know About 50K.Trade Investing App

Since its launch in April 2024, mobile-first trading platform 50K.Trade has revolutionized personal finance and investing for Europeans. With its user-friendly interface, commission-free trading, and high interest rates on unused cash, it is creating a buzz,...

Three takeaways from the BOE decision from Deustche Bank

The Bank of England held rates at 5.00% today in a move that wasn't certain but wasn't entirely expected. Economists at Deutsche Bank forecast no change and after the announcement spike, the pound gave back gains.DB highlighted three takeaways from the...

EURUSD moves down to the 100 hour MA. Key intraday downside target.

The volatility in the EURUSD continues as the price has rotated back down after a spike lower in the Asian session, and a spike higher in the European session. The price is currently testing its 100-hour moving average of 1.1117. This represents a target on the...

US stocks extend to the best levels of the day as soft-landing trades sizzle

The S&P 500 has extended gains to 103 points, or 1.8%. The Nasdaq is up 2.8%.The weekly chart of the S&P 500 is looking awfully good if it can get through Friday at these levels.SPX weeklyThe FX market isn't quite as enthusiastic but that's because the bond...

The USDCAD price action is volatile as the market digests Fed/data. What next?

The USDCAD price action is experiencing high volatility in today's trading, following yesterday's bounce between support and resistance levels. Initially, the price moved upward, breaking above the 38.2% retracement level of the decline from the August high, which...

Hezbollah chief: Israel violated red lines with pager attack

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

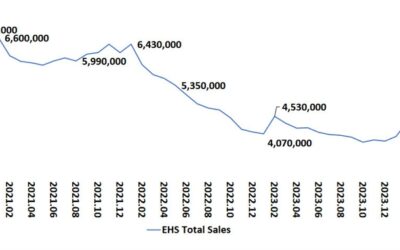

US August existing home sales 3.86m vs 3.90m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Schnabel: Inflation outlook remains challenging, policy vigilance needed

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Tech and consumer stocks soar: A break from market fluctuations

Stock heatmap by FinViz.com Thu, 19 Sep 2024 13:46:04 GMTSector OverviewThe US stock market is experiencing a strong upward momentum today, with significant gains across major sectors. Notably, the technology and consumer cyclical sectors are posting impressive...