Fed's BowmanFed Michelle Bowman is speaking and says:Expect inflation to decline but upside risks remain.Need greater confidence in falling inflation before cutting rates again.Patience on rate cuts will allow more clarity on impact of administration policies.Labor...

Russia Ushakov: Talks with US/Russia have been in a business like mood

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

More Harker Q&A: Labor market looks pretty solid

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fed Harker: Current economy argues for steady rate policy for now

Fed's HarkerPhiladelphia Fed Pres. Harker is speaking and says: Current economy argues for stay rate policy for nowmonetary policy into place right now.Future Fed rate policy choices will be data-driven. The Fed policy stance should continue to lower...

France’s finance minister Lombard: France is doing its job on defense spending in Europe

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

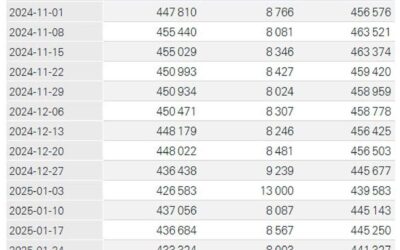

Canadian Securities (Canadians $3.77B vs1 $17.65B last month

Securities Canadians C$ 3.77 billion versus C$17.65 billion last monthSecurities foreigners C$ 14.37 billion versus C$13.84 billion last monthForeign investors increased their exposure to Canadian securities by $14.37 billion in December, mainly in debt securities....

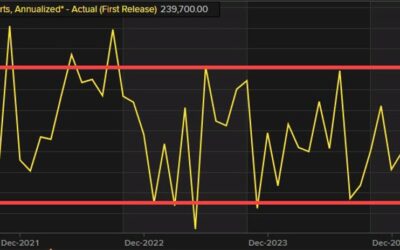

Canada Housing starts for January come in at 239.7K vs 252.5K est (annuallzed)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

It’s a holiday in the US today. No stock or bond trading.

to The US and bond markets will be closed in the US today in observance of President's Day (combined Washington's and Lincoln's Birthday's for those wondering). Canada will release Housing starts for January (8:15 AM ET), and Domestic and Foreign Security holdings...

ForexLive European FX news wrap: Yen holds firm in quieter start to the new week

Headlines:Markets:JPY leads, CHF lags on the dayEuropean equities mostly higherGold up 0.4% to $2,896.14WTI crude flat at $70.50Bitcoin up 0.2% to $96,357It's a quiet start to the new week with it being a long weekend in the US.Both the stock market and bond market...

China’s NPC standing committee to hold 14th meeting session next week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Russia’s Novak denies talk about delaying return of OPEC+ supply

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

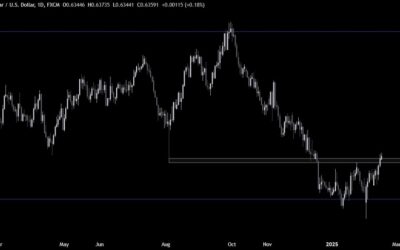

AUDUSD Technical Analysis – A look at the chart ahead of the RBA’s decision

Fundamental OverviewThe US Dollar fell across the board in the final part of last week for two main reasons. The US PPI report came in higher than expected but the focus was on the details that feed into the Core PCE index, which is what the Fed focuses on. Those...

OPEC+ reportedly mulling pushing back oil supply increases that are due in April

That won't make Trump too happy as he wants lower oil prices. The report says that the bloc is viewing that the oil market remains "too fragile" in order to revive production now. That said, no final call has been made on the matter and members are believed to be...

Eurozone December trade balance €15.5 billion vs €16.4 billion prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BOE’s Bailey: We still see gradual disinflation going on

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The Impact of Political Endorsements on Cryptocurrency Valuations and Forex Markets

Political endorsements have always had an impact on financial markets especially in recent years. For digital assets, the impact sends shock waves throughout the industry since it is not yet fully matured, as such, any potential policy change could have a ripple...

RBA Poised to Reduce Cash Rate by 25 Basis Points

The Reserve Bank of Australia (RBA) will meet this Tuesday and is widely anticipated to deliver its first rate cut in four years amid easing inflationary pressures. I am ‘reasonably’ convinced that the central bank will reduce the Cash Rate this week, a belief based...

RBNZ Set to Continue Easing This Week; NZD/USD Eyeing Resistance

Following the RBNZ cutting its Official Cash Rate (OCR) by 50 basis points (bps) in November 2024, economists and investors expect another bumper 50 bp rate reduction on Wednesday this week – with an outside chance of a more minor 25 bp reduction. A 50 bp (25 bp)...

SNB total sight deposits w.e. 14 February CHF 432.5 bn vs CHF 438.1 bn prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCHF Technical Analysis – The USD comes under pressure once again

Fundamental OverviewThe US Dollar fell across the board in the final part of last week for two main reasons. The US PPI report came in higher than expected but the focus was on the details that feed into the Core PCE index, which is what the Fed focuses on. Those...