Reuters Tankan is a monthly report whereas the Bank of Japan Tankan is quarterly (more on these two surveys below).Respondents citing worries over China and ... wait for it ... high inflation. November manufacturing index +5prior +7 in OctoberNon-manufacturing +19 in...

Some other poll information: 67% see economy not so good or poor

Some other poll results looking at the economy.NOTE that 31% of the voters viewed the economy as the most important issue.Conditions of the nations Economy:5% Excellernt28% Good35% Not so good32% PoorDespite the US stock indices near all time highs and up over 20% for...

New Zealand employment report recap – nothing to shift the RBNZ’s view

The data is here:Westpac have a handy summary up, we don’t think that there’s anything in today’s figures that would shift the RBNZ’s thinking for its next policy decision at the end of this monthLink to the full piece is here.My really concise summary of their piece...

Australian Treasury official speaking – headline inflation slowing … but

Secretary to the Australian Treasury, Dr Steven Kennedy, is giving testimony in the Australian parliament, at the Senate Budget Estimates, Economics Legislation Committee.You can view the live event here.In brief:Interest rates will come down, but not to pre-pandemic...

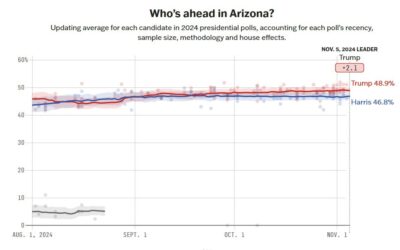

Preliminary Exit poll results from Arizona from Edison Research. Higher Hispanic voters

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The first US exit poll is out: Women voted at a higher rate than in 2024

The first exit poll from Edison Research is out and it focuses on the demographics of voters:53% of voters women vs 52% in 2020 71% white vs 67% in 202057% no college degree vs 59% in 202045% said personal finances were worse than 4 years ago vs 20% in 202031% said...

Forexlive Americas FX news wrap 5 Nov: Stocks rise, USD moves down. Mkts await election.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand Q3 unemployment rate 4.8% (expected 5.0%, prior 4.6%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Private survey of oil inventories shows headline crude build much larger than expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Major indices close near the high of the day as US voter go to the polls

The major US indices close near highs as the US voters go to the polls. The general rule was that stocks would benefit more from a Trump victory, but who really knows. Share of Trump Media is closing the day down -1.16% and is down -3.0% in after-hours trading at...

Economic calendar in Asia Wednesday, November 6, 2024 – Harris vs. Trump the focus

Harris vs. Trump day here in Asia. Counting will commence around 6pm US Eastern time and I suspect we won't get a definitive result before most of the US goes to bed. Apart from the election there are a few items of interest on the calendar here in the region. The New...

Trade ideas thread – Wednesday, 6 November, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

EURUSD buyers take the price to new highs and approaches a cluster of resistance

The EURUSD is continuing its move to the upside despite stronger services ISM nonmanufacturing data today. Employment moved higher as well. New orders were lower and prices paid was lower as well. Of course the election voting is ongoing with the results still hours...

Crude oil futures settle at $71.99

Crude oil futures are settling at $71.99, that is up $0.52 or 0.73%.Some influences:OPEC+ delayed 180,000 barrels per day of monthly production increases to January.US election uncertainty: Vice-President Kamala Harris and former president Donald Trump are neck and...

BOC Meeting minutes: BOC felt upside pressure on inflation will continue to decline

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

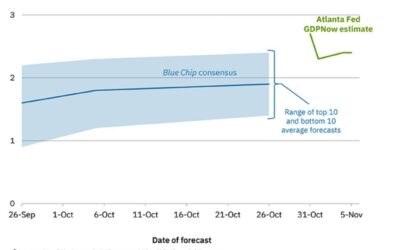

The Atlanta Fed GDPNow growth estimate 2.4% vs 2.3% last

The Atlanta Fed GDPNow growth estimate for Q4 came in marginally higher at 2.4% vs 2.3% last. In their own words:he GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2024 is 2.4 percent on November 5, up from 2.3...

USDCHF falls below 100 bar MA on 4-hour and stays below, but support holds at swing area.

The USDCHF is trading up and down in trading today as the pair buys time ahead of the election results. The low for the price action has found support buyers in a key swing area between 0.86078 and 0.8619. That area also held support on Monday. On the upside, the 100...

US sells 10-year notes at 4.347% vs 4.350% WI

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCAD moves lower as the election day continues. Tests 100 bar MA and swing area.

The USDCAD is moving lower in sympathy with the overall US dollar weakness ahead of the election vote and results (at least some of them) later today. The move lower was also helped by the failure to keep the upside momentum going after breaking to a new high for the...

US 10-year auction risks a buyers strike ahead of the election

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...