High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive Asia-Pacific FX news wrap: Waiting on the NFP

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

이제부터 육아휴직! 이렇게까지 해준다고? 바뀌는 육아휴직 이렇게 꼭 쓰세요!!

https://www.youtube.com/watch?v=_pyQDemeNkU 8세 이하 영유아가 있는 근로자라면 한 번 쯤 육아휴직 생각해 본 적 있으신가요? 최대 1년을 휴직할 수 있어서 아이를 양육하기에 좋은 제도이지만, 실제로 육아휴직 사용률이 높지 않다고 합니다. 2025년부터 앞으로 육아휴직을 사업주 동의 없이도, 돈도 더 많이 주는 쪽으로 이렇게 지원한다고 합니다. 영상에서 자세한 내용 설명드리겠습니다. #뉴스 #육아휴직 #2025육아휴직 MoneyMaker FX...

FX option expiries for 01 November 2024 at the 10am New York cut

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Stock market based model shows a nearly 70% chance of who will win the US election

Its not my model. I'm posting it for info. If you don't like the post, feel free to ... chill out a bit. This is from Mark Hulbert at Market Watch:This stock-market prediction model is not complicated. It exploits the historical tendency for the incumbent political...

Heads up for US and Canada clocks changing this weekend – goodbye daylight saving

A heads up for those trading US markets.If you are offshore from the US or Canada you may need to adjust your trading times. For Sydney in Australia, for example, NYSE RTH hours will begin at 1.30 am local time, Tuesday to Saturday. Yeah, I know. You're welcome...

Dallas Fed’s Logan is speaking on Friday – won’t mention the economy or monetary policy

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[테슬라+비트코인!! 월 450 결국, 10년 10억?? 머스크 충격 전망! 폭망 한국 희망될까??]#3.1경제독립tv

https://www.youtube.com/watch?v=tLJcODjqySA [테슬라+비트코인!! 월 450 결국, 10년 10억?? 머스크 충격 전망! 폭망 한국 희망될까??]#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요!...

China Caixin Manufacturing PMI for October 50.3 (expected 49.7, prior 49.3)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Senior IMF official warns of tit-for-tat tariffs, China property sector, yen intervention

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan chief cabinet secretary Hayashi: expects BOJ to work closely with government

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

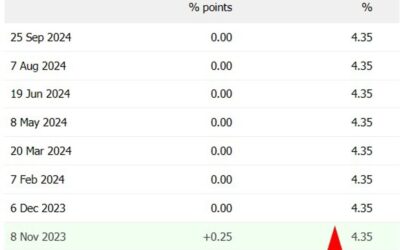

Its unanimous, Reserve Bank of Australia to hold cash rate at 4.35% at next week’s meeting

Reuters poll of economists finds:RBA on hold in November and DecemberAll 30 economists in the poll expected the RBA to hold at 4.35% at the November 4-5 meetingAll but one expect a hold at the December meeting20 of 29, expected a 25 basis point cut in February8...

PBOC sets USD/ CNY reference rate for today at 7.1135 (vs. estimate at 7.1122)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian housing finance data (September 2024) comes in at a miss

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian Q3 PPI +0.9% q/q (expected +0.7%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan final manufacturing PMIs (October 2024 ): 49.2 (prior 49.7)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Here’s another forecaster moving back expectations for Bank of Japan rate hikes to 2025

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Asian FX & rates could be especially sensitive to the US election result

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of Japan to hike rates in January despite (because of?) politics

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The RBA meeting next week marks a year of unchanged cash rate at 4.35% – no cut until 2025

On Wednesday we had Q3 inflation data from Australia:After the data the Commonwealth Bank of Australia changed its forecast for Reserve Bank of Australia rate cuts. Analysts at the bank had been expecting a December rate cut, but pushed it back to a February cut. The...

![[테슬라+비트코인!! 월 450 결국, 10년 10억?? 머스크 충격 전망! 폭망 한국 희망될까??]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/11/ed858cec8aaceb9dbcebb984ed8ab8ecbd94ec9db8-ec9b94-450-eab2b0eab5ad-10eb8584-10ec96b5-eba8b8ec8aa4ed81ac-ecb6a9eab2a9-eca084eba79d-400x250.jpg)