The Bank of Canada rate decision will take place at 9:45 AM ET. The expectations are for a 50 basis point cut.Adam summarized the decision here. Key takeaways:Bank of Canada is expected to cut rates by 50 bps on Wednesday, marking the first significant cut in the...

US equities set for a soft start. Texas Instruments highlights struggling industrial econ

SPX dailyS&P 500 futures are down 0.4% ahead of the open in what's become a familiar pattern. Over the past week, stock futures have been weak only to see buying throughout the day and decent closes.The index hit a record high on Thursday but has seen some mild...

Kickstart the FX trading day for Oct 23 w/a technical look at the EURUSD, USDJPY & GBPUSD

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

No comments from the Fed’s Bowman in initial remarks

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Canadian National Railway highlights soft macro backdrop

I've been listening to corporate conference calls closely for hints about macroeconomic weakness. Railways have great insight into the goods macroeconomy, which has been struggling since the covid boom. Some comments in the conference call yesterday highlight caution...

Bank of Canada decision highlights the economic calendar as USD soars

USD/JPY has soared 200 pips today in its fourth day of gains as the FX market recalibrates to a stronger US dollar and US economy. The move brings the pair back into line with Treasury yields, which have also erased the decline that started in late July.USDJPY...

The USD continues its run to the upside led by the USDJPY. US stocks lower. Yields higher

The forex markets has the USD moving higher as the NA sesssion begins. The moves are being led by the USDJPY (and JPY crosses) with a gain of 1.24% after it broke back above its 200-day MA for the first time since July 31. After moving down from 161.94 to 139.57 from...

ECB’s Holzmann: I see a soft landing for Europe as guaranteed

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Centeno: Downside risks to growth are accumulating

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Knot: I’m pretty confident inflation will hit 2% in 2025

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive European FX news wrap: USD/JPY ramps higher, BOC up next

Headlines:Markets:USD leads, JPY lags on the dayEuropean equities lower; S&P 500 futures down 0.2%US 10-year yields up 1.4 bps to 4.219%Gold up 0.1% to $2,752.09WTI crude down 1.9% to $70.38Bitcoin down 1.5% to $66,491The standout mover on the day is the Japanese...

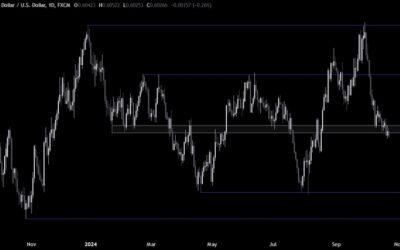

EUR/USD continues its descent to test the early August low

EUR/USD daily chartThe break below the 200-day moving average (blue line) last week turned the bias in the pair to being more bearish. And sellers reaffirmed that by holding at the key level amid some pushing and pulling towards the end of last week. Flip over to the...

Nasdaq Technical Analysis – The consolidation continues amid lack of catalysts

Fundamental OverviewThe Nasdaq has been consolidating around the all-time high as the lack of catalysts and the pressure from rising Treasury yields kept the market at bay.We are now near the US elections and it’s going to be a major event for the market. A Trump...

US MBA mortgage applications w.e. 18 October -6.7% vs -17.0% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

S&P 500 Technical Analysis – Lack of catalysts keeps the market rangebound

Fundamental OverviewThe S&P 500 has been consolidating around the all-time high as the lack of catalysts and the pressure from rising Treasury yields kept the market at bay.We are now near the US elections and it’s going to be a major event for the market. A Trump...

Equities stay more sluggish as rising yields keeps optimism in check

Here's a snapshot of thing currently:Eurostoxx -0.2%Germany DAX -0.1%France CAC 40 -0.4%UK FTSE -0.2%S&P 500 futures -0.2%Nasdaq futures -0.2%Dow futures -0.4%The declines aren't anything too significant and can still be seen as investors just taking some off the...

Germany turns to India as their next bet to reduce China reliance

Scholz will be leading a high-level delegation for government consultations, but it is clear that the major forum will be to work out more business between Germany and India. It comes at a delicate time, especially with the German economy struggling and still largely...

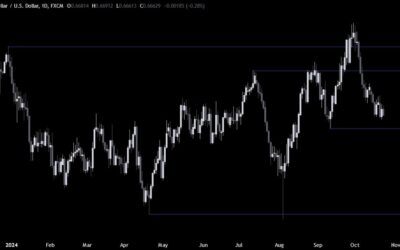

NZDUSD Technical Analysis – New highs in Treasury yields boost the USD further

Fundamental OverviewThe USD continues to reign supreme despite the lack of catalysts. The main culprit for the recent strength in the US Dollar has been the rally in long term Treasury yields. The yield curve is bear flattening which is what you would expect with...

Peanut Protocol releases instant offramp

Peanut launches the first self-custodial offramp, allowing users to directly cash out any token on 20+ EVM chains to their bank accounts—without relying on centralized exchanges. This beta feature is being rolled out in the EU and US first.This new beta feature...

AUDUSD Technical Analysis – The greenback remains in the driving seat

Fundamental OverviewThe USD continues to reign supreme despite the lack of catalysts. The main culprit for the recent strength in the US Dollar has been the rally in long term Treasury yields. The yield curve is bear flattening which is what you would expect with...