High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDJPY moves lower after PPI data. Sellers in control.

The US PPI data was more or less as expected. It did not change any projections for Fed policy decision next week which is centered on a 25 basis point cut.Nevertheless, the USDJPY has been moving back to the downside. Helping the bias is the inability to stay above...

Highlights of the ECB press conference for September 2024

The EURUSD is trading at 1.1026 as the press conference begins. The high for the day has reached 1.1032 after the decision. The 100 hour MA looms above at 1.10416Headlines from commentary: Recovery is facing headwindsExpect the recovery to strengthen.Fading monetary...

To watch ECB Press conference LIVE

To watch the Press conference live, click above.The Full statement:The Governing Council today decided to lower the deposit facility rate – the rate through which it steers the monetary policy stance – by 25 basis points. Based on the Governing Council’s updated...

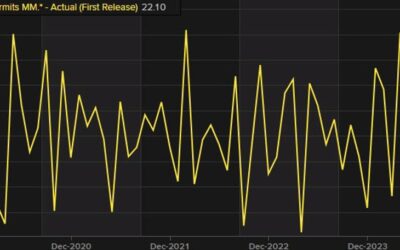

Canada Building permits for July 22.1% vs 7.1% estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

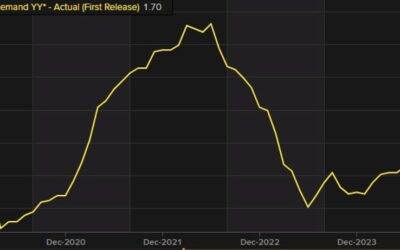

US PPI final demand MoM for August YoY 1.7% vs 1.8% estimate. MoM 0.2% vs 0.1% est.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

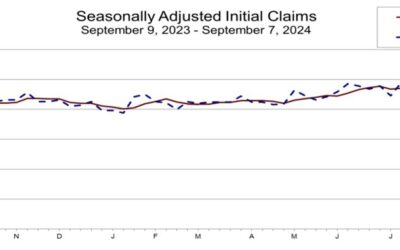

US weekly initial jobless claims 230K vs 230K expected

Prior 227K; revised to 228K4-week moving average 231KPrior 230KContinuing claims 1.850M vs 1.850M expectedPrior 1.838M; revised to 1.845MThe headline figure continues to keep somewhat steady but at least down from the high of 250K last month. Continuing claims rose...

Comparing the ECB August statement to the September statement

18 July12 September 2024The Governing Council today decided to keeplower the three key ECB interest rates unchanged. The incoming information broadly supportsdeposit facility rate – the rate through which it steers the monetary policy stance – by 25 basis points....

ECB cuts deposit rate by 25 bps in September monetary policy decision, as expected

Prior decisionDeposit facility rate 3.50% vs 3.50% expectedPrior 3.75%Main refinancing rate 3.65% vs 3.65% expectedPrior 4.25%Marginal lending facility 3.90%Prior 4.50%It is now appropriate to take another step in moderating the degree of monetary policy...

ForexLive European FX news wrap: Light movements ahead of ECB decision, more US data

Headlines:Markets:AUD leads, CHF lags on the dayEuropean equities higher; S&P 500 futures up 0.1%US 10-year yields up 1.7 bps to 3.670%Gold up 0.2% to $2,516.57WTI crude up 1.7% to $68.45Bitcoin up 1.0% to $58,057It was a quieter session as markets are lacking any...

S&P 500 Technical Analysis – Back inside the old range

Fundamental OverviewYesterday, we got the US CPI report and, although as expected it didn’t have the same large impact as it used to, the core m/m figure surprised to the upside. The data triggered a repricing in interest rates expectations with the market now seeing...

Euro remains boxed in ahead of the ECB later

In FX, the changes are light overall with dollar pairs keeping in relatively narrow ranges thus far today. The euro is in focus amid the ECB later but there shouldn't be any real surprises from the decision itself. EUR/USD is trapped today in a 17 pips range and...

IEA warns that China slowdown will continue to weigh on global oil demand growth

The IEA kept their forecasts for global oil demand broadly unchanged, seen at 900k bpd this year and 950k bpd for next year. That said, these numbers are way more pessimistic than other forecasters. That especially when you compare to OPEC, as seen here, even with...

이제부터 이곳에서 흡연하면 10만원, 500만원 과태료 냅니다!

https://www.youtube.com/watch?v=lDEBel5Dyhg 길을 걷는 도중에 혹은 잠깐 휴식하기 위해 야외에서 흡연하시는 분들 계실 텐데요. 이제부터 금연하는 구역도 바뀌고 과태료 금액도 크게 달라집니다. 그래서 최근에 변경된 금연 구역과 어떨때 과태료를 내게 되는지 알려드릴게요. #과태료 #뉴스 MoneyMaker FX EA Trading...

Nasdaq Technical Analysis – Incredible rally after the US CPI report

Fundamental OverviewYesterday, we got the US CPI report and, although as expected it didn’t have the same large impact as it used to, the core m/m figure surprised to the upside. The data triggered a repricing in interest rates expectations with the market now seeing...

China reportedly to cut interest rates on $5 trillion mortgages as soon as this month

This is mainly to further reduce borrowing costs and to try and bolster consumption activity. Domestic demand conditions in China have suffered greatly ever since the Covid pandemic and there hasn't been much of a revival in that area despite the world returning back...

USDCHF Technical Analysis – The US CPI triggers a repricing in expectations

Fundamental OverviewYesterday, we got the US CPI report and, although as expected it didn’t have the same large impact as it used to, the core m/m figure surprised to the upside. The shelter component re-accelerated and that’s something to keep an eye on given the...

Gold Technical Analysis – Can’t get out of this range

Fundamental OverviewYesterday, we got the US CPI report and, although as expected it didn’t have the same impact as it used to, the core m/m figure surprised to the upside. The shelter component re-accelerated and that’s something to keep an eye on given the imminent...

Spain August final CPI +2.3% vs +2.2% y/y prelim

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Eurostoxx futures +1.3% in early European trading

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...