A quick summary of the meeting dates among major central banks and what is expected of them in terms of market pricing:6 March - European Central Bank: 25 bps rate cut (100% priced in)12 March - Bank of Canada: Toss up (~51% odds of a 25 bps rate cut)19 March - Bank...

A new week and new month but same old episode of drama

It's tough not to begin by commenting about what transpired in the Oval Office on Friday. Absolutely surreal. Putin will be smiling from ear to ear and it looks like the path for the Russia-Ukraine conflict to end just took a bad turn. But with that being whatever it...

Tesla Stock – Prices to Watch for Next

Introduction: Why Key Price Levels MatterFor day traders, short-term swing traders, and investors, understanding key price levels is critical for making informed trading decisions rather than chasing price or trading randomly. These levels are widely followed by...

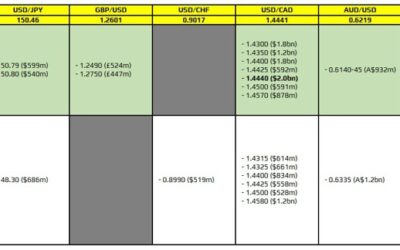

FX option expiries for 3 March 10am New York cut

There is just one to take note of on the day, as highlighted in bold.That being for USD/CAD at the 1.4440 level. It's not one that ties to any technical significance and with the dollar and loonie now, a lot will ride on Trump's tariffs plan in the next 24 hours. So,...

Market Outlook for the Week of 3rd – 7th March

It will be a busy week ahead with numerous economic events. Monday kicks off with manufacturing PMI releases for the eurozone, Switzerland, the U.K., and Canada. However, special attention will be on the U.S. ISM manufacturing PMI and ISM manufacturing prices. On...

Monday: Federal Reserve Bank of St. Louis President Musalem speaks on the economy & policy

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

More on China’s reciprocal tariffs on the US – targeting US Agriculture

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive Asia-Pacific FX news wrap: BTC rocketed higher on Trump endorsing crypto reserve

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

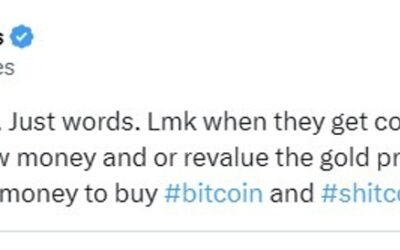

Arthur Hayes, co-founder of BitMEX, dismisses Trump’s Bitcoin reserve – “just words”

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[속보]테슬라10배간다-머스크 폭탄발언! 트럼프 한마디에 비트코인 난리났다]#3.1경제독립tv

https://www.youtube.com/watch?v=reDGtP3wynM [속보]테슬라10배간다-머스크 폭탄발언! 트럼프 한마디에 비트코인 난리났다]#3.1경제독립tv *본 채널은 투자에 대한 조언을 드리지만, 투자는 전적으로 본인의 판단하에 진행하고, 투자에 대한 책임도 전적으로 본인에게 있다는 점을 명심하셔야 합니다 [3년뒤 10억부자 3.1경제독립tv필독 추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요!...

China says its studying countermeasures in response to Trump’s March 4 tariffs

China is reportedly evaluating countermeasures in response to the March 4 tariff threat from the United States. According to sources, the measures will likely include a combination of tariffs and non-tariff restrictions, with U.S. agricultural and food products...

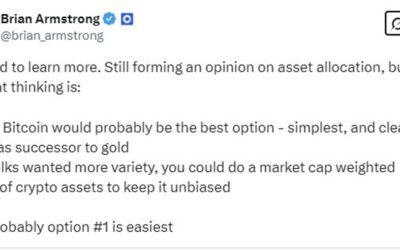

Coinbase CEO Armstrong supports Bitcoin as the best choice Trump’s US Crypto Reserve

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB Supervisory Board Claudia Maria Buch speaking Monday, March 3, 2025

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australia: Qantas flight forced to return to Sydney after smoke detected in cockpit

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Caixin China Manufacturing PMI (February 2025) 50.8 vs. expected 50.3

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[기초연금 2명중 1명만 받는다! 충격! 노인연령70세 상향 폭풍온다! 지금 국민연금도 깨야 할까]#3.1경제독립tv

https://www.youtube.com/watch?v=NsTHieJbBwM [기초연금 2명중 1명만 받는다! 충격! 노인연령70세 상향 폭풍온다! 지금 국민연금도 깨야 할까]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독 추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

PBOC sets USD/ CNY reference rate for today at 7.1745 (vs. estimate at 7.2857)

The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate system that allows the value of the yuan to fluctuate within a certain...

Australian Q4 2024 Business Inventories +0.1% q/q (expected 0.0%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan final February Manufacturing PMI 49.0 (prior 47.7)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.2857 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

![[속보]테슬라10배간다-머스크 폭탄발언! 트럼프 한마디에 비트코인 난리났다]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/03/ec868debb3b4ed858cec8aaceb9dbc10ebb0b0eab084eb8ba4-eba8b8ec8aa4ed81ac-ed8faded8384ebb09cec96b8-ed8ab8eb9fbced9484-ed959ceba788eb9494-400x250.jpg)

![[기초연금 2명중 1명만 받는다! 충격! 노인연령70세 상향 폭풍온다! 지금 국민연금도 깨야 할까]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/03/eab8b0ecb488ec97b0eab888-2ebaa85eca491-1ebaa85eba78c-ebb09beb8a94eb8ba4-ecb6a9eab2a9-eb85b8ec9db8ec97b0eba0b970ec84b8-ec8381ed96a5-400x250.jpg)