The full statement from the Bank of Canada on September 4, 2024:The Bank of Canada today reduced its target for the overnight rate to 4¼%, with the Bank Rate at 4½% and the deposit rate at 4¼%. The Bank is continuing its policy of balance sheet normalization.The...

Bank of Canada interest rate decision: Rates lowered by 25 basis points

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Major US stock indices open lower. Declines add to the woes from yesterday

The major US stock indices are opening lower and adding to the woes from yesterday when the NASDAQ index fell -3.4% led by Nvidia which fell over 9.4% yesterday.A snapshot of the market currently shows: Dow industrial average is near unchanged at 40,940S&P index...

Kickstart the FX trading day w/ a technical look at some of the major currency pairs

In the kickstart video for September 4, I take a technical look at the EURUSD, USDJPY, GBPUSD and a special technical look at the USDCAD ahead of their interest rate decision at 9:45 AM ET. For the EURUSD, it rose to test a trend line on the hourly chart and the...

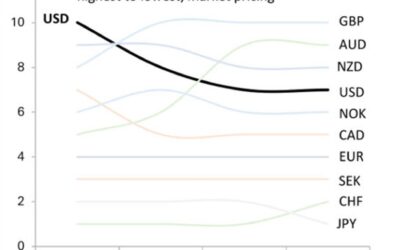

Dollar strength tied to yield ranking, but market pricing shift raises questions

Deutsche Bank is out with a note and it illustrates the big question on the US dollar: "As long as the dollar remains a high-yielder, there is very convincing evidence that it stays strong," writes George Saravelos.But as the chart above shows, it's priced to fall...

US equity futures climb from the lows but still underwater

SPX dailyEyes are on Nvidia shares again today after the 9.5% fall yesterday led to the largest one-day market-cap decline in the history of markets. The DOJ issued an anti-trust subpeona after the close and that's led to a further 1.4% decline in shares in the...

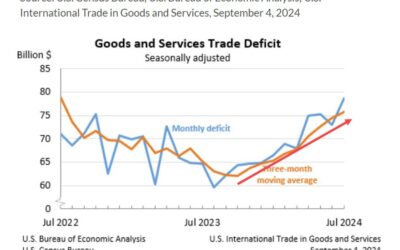

US international trade balance for July $-78.8 billion versus – $-79.0 billion estimate

Prior month $-73.1 billion revised to $-73.0 billionGoods trade balance $-102.84 billion versus $-96.56 billionServices surplus $24.3 billion versus $24.2 billion last monthOther details: Exports +0.5% versus +1.7% last month.Imports +2.1% versus +0.6% last...

Canada July trade balance +0.68B vs +0.80B expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Goldman Sachs: Three reasons to buy gold

gold dailyGoldman Sachs maintains a bullish outlook on gold, targeting $2,700 per ounce for early 2025. The firm recommends going long on gold due to increasing central bank purchases, anticipated Fed rate cuts, and gold's role as a hedge against geopolitical...

The Bank of Canada has an opportunity to surprise

The Bank of Canada under Governor Tiff Macklem hasn't been afraid to surprise markets and his latest opportunity comes today at 9:45 am ET.The Canadian housing market is hitting tough times and consumer spending is slowing, that means that the 4.50% overnight rate is...

ForexLive European FX news wrap: FX mostly little changed, stocks hold lower; BOC up next

Headlines:Markets:JPY leads, USD and CAD lag on the dayEuropean equities lower; S&P 500 futures down 0.4%US 10-year yields down 3.8 bps to 3.806%Gold down 0.2% to $2,489.13WTI crude up 1.0% to $70.86Bitcoin down 2.9% to $56,510It was a bit of a draggy session for...

US MBA mortgage applications w.e. 30 August +1.6% vs +0.5% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Oil jumps amid report that OPEC+ is discussing a delay to planned output hike in October

WTI crude oil 15-minute chartReuters is out with the headline, citing three OPEC+ sources in saying that the bloc is discussing a delay to its planned output hike in October. It looks like they are finally not being stubborn about it but it took oil prices falling to...

A Harris win will provide a stronger boost to the US economy – Goldman Sachs

That opposed to a Trump victory of course, according to Goldman Sachs. The firm argues that economic output will take a hit next year under the Trump banner. And that is mostly from increased tariffs on imports and tighter immigration policies. Adding that jobs growth...

NZDUSD Technical Analysis – We are testing a key trendline

Fundamental OverviewYesterday, we got the US ISM Manufacturing PMI and even though the headline number missed expectations, under the hood the report was better than the prior month. The bad news was new orders falling further into contraction, which is a proxy for...

UBS warns that oil prices are likely to stay volatile in the short-term

UBS argues that the oil market is undersupplied despite weak Chinese oil demand, with demand elsewhere making up for it. They also add that supply growth did disappoint in some non-OPEC+ states, contributing to the situation.As such, they are retaining a positive...

Gold Technical Analysis – We are testing the bottom of the range

Fundamental OverviewYesterday, we got the US ISM Manufacturing PMI and even though the headline number missed expectations, under the hood the report was better than the prior month. The bad news was new orders falling further into contraction, which is a proxy for...

Eurozone July PPI +0.8% vs +0.3% m/m expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

German trade lobby sounds warning as recession clouds circle

The BGA trade lobby group warned that German exporters in particular are facing up against a recession in foreign trade, no thanks to the government. They said that the direction in which Berlin has leaned towards in recent years are not helping. 70% of businesses...

UK August final services PMI 53.7 vs 53.3 prelim

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...