easyMarkets is excited to announce the launch of the Pro Trader Altitude Club in Australia, a premium trading membership designed to offer unparalleled access to exclusive financial tools and trading conditions plus the opulence and thrill of VIP networking...

Novak: Russia to cut production to required level under OPEC+ deal by end of August

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Buch: Europe’s banking sector has shown resilience

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

It’s Labor Day in North America

Remember: Safety first in the forex marketHappy Monday, especially for those of you who get the day off.It's Labor Day and that means that markets are closed in the United States and Canada. The FX market has been quiet throughout the world today, with the exception...

[충격]9월 추석명절지원금 425만원 받는데 내통장 입금 금액은? 전국 지역별 명절지원금 이렇게 됩니다]#3.1경제독립tv

https://www.youtube.com/watch?v=aQCABBgjwgU [충격]9월 추석명절지원금 425만원 받는데 내통장 입금 금액은? 전국 지역별 명절지원금 이렇게 됩니다]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

Gold Technical Analysis – The calm before the storm?

Fundamental OverviewGold continues to trade in a tight range as the market awaits the key catalysts this week. As a reminder, the Fed is now very focused on the labour market as Fed Chair Powell said that they will not welcome any more weakness and will do everything...

AUD/USD buyers stay hopeful for another run at 0.6800

AUD/USD daily chartThe dollar battled in month-end trading last week and that kept a lid on AUD/USD, with sellers also holding at the July high around the figure level. The key level there will remain a focus this week, especially with the dollar side of the equation...

FP Markets Wins Double at FMPS 2024

Multi-asset Forex and CFD broker, FP Markets, further cemented its position as one of the industry’s global leaders, claiming two prestigious awards at the Finance Magnates Pacific Summit (fmps:24). The company won ‘Best Forex Spreads APAC’ and ‘Best Trading...

Weekly update on interest rates expectations

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

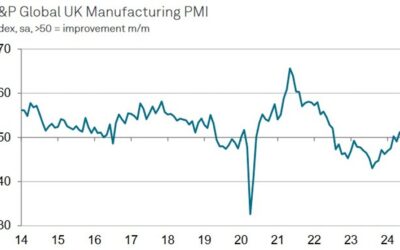

UK August final manufacturing PMI 52.5 vs. 52.5 prelim

Final Manufacturing PMI 52.5 vs. 52.5 expected and 52.1 prior.Key findings:Manufacturing PMI at 52.5 in August. Broad-based growth by sector. Domestic market drives new contract wins.Comment:Rob Dobson, Director at S&P Global Market Intelligence “The UK...

Market Outlook for the Week of 2nd – 6th September

It's a busy week ahead in terms of economic events. Monday kicks off with a few notable releases, including the final manufacturing PMI for the eurozone. It’s also a bank holiday in Canada and the U.S. in observance of Labor Day. On Tuesday, Switzerland will release...

SNB total sight deposits w.e. 30 August CHF 456.7 bn vs CHF 463.6 bn prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

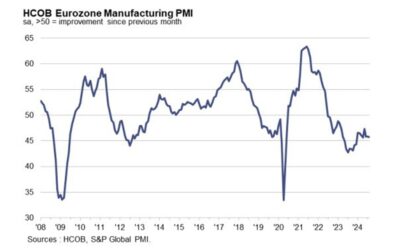

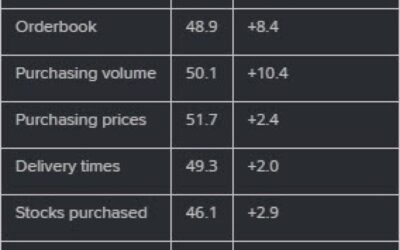

Eurozone August final manufacturing PMI 45.8 vs 45.6 prelim

Prior 45.8The positive revision is just masking the troubles that are continuing to surface in the Eurozone manufacturing sector. Output continues to suffer while new order inflows fell at the quickest pace this year so far in August. Employment conditions are also...

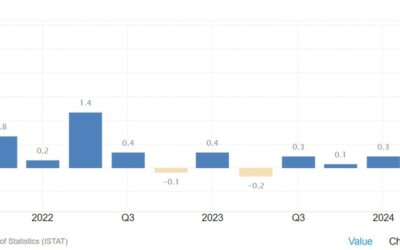

Italy Q2 final GDP 0.2% vs 0.2% Q/Q expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

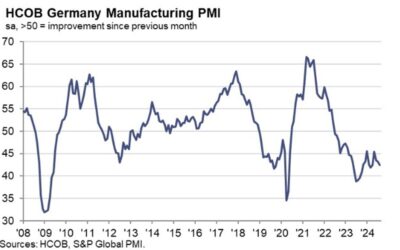

Germany August final manufacturing PMI 42.4 vs 42.1 prelim

Final Manufacturing PMI 42.4 vs. 42.1 expected and 43.2 prior.Key findings:HCOB Germany Manufacturing PMI at 42.4 (Jul: 43.2). 5-month low. HCOB Germany Manufacturing PMI Output Index at 42.8 (Jul: 42.5). 2-month high. New orders drop at quickest rate for nine...

The Amega App: A Bold Step into the Future of Trading and Account Management

Amega’s reputation as a reliable brokerage firm has been meticulously built on three simple principles: unwavering dedication, complete transparency, and unrelenting innovation.These ideals have been imprinted in the company’s DNA since day one, becoming not only the...

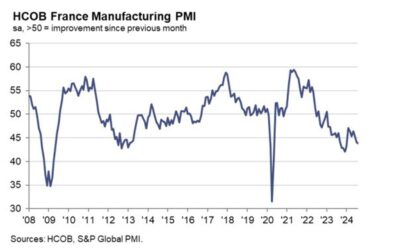

France August final manufacturing PMI 43.9 vs 42.1 prelim

Prior 44.0Despite a positive revision, the figure is still a mild drop compared to the July reading. That continues to mark a poor state of affairs for French manufacturing in Q3. HCOB notes that:"The state of the French manufacturing sector is deteriorating. What...

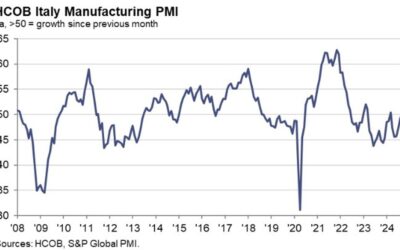

Italy August manufacturing PMI 49.4 vs 48.5 expected

Manufacturing PMI 49.4 vs. 48.5 expected and 47.4 prior.Key findings:Declines in production and new orders only modest in August. Firms raise staffing levels for first time since April as outlook brightens. Charge inflation returns after nearly a year-and-a-half of...

Switzerland August manufacturing PMI 49.0 vs 43.5 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

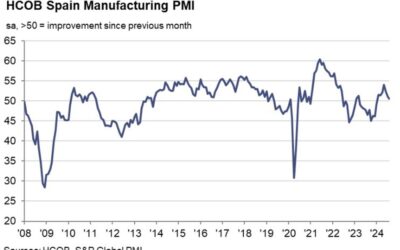

Spain August manufacturing PMI 50.5 vs 51.5 expected

Manufacturing PMI 50.5 vs. 51.5 expected and 51.0 prior.Key findings:Increase in new work registered.Output and employment both decline. Confidence in the outlook sinks to lowest of year so far.Comment:Commenting on the PMI data, Jonas Feldhusen, Junior Economist at...

![[충격]9월 추석명절지원금 425만원 받는데 내통장 입금 금액은? 전국 지역별 명절지원금 이렇게 됩니다]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/09/ecb6a9eab2a99ec9b94-ecb694ec849debaa85eca088eca780ec9b90eab888-425eba78cec9b90-ebb09beb8a94eb8db0-eb82b4ed86b5ec9ea5-ec9e85eab888-400x250.jpg)