· Kuady expands its digital wallet services to Argentina, offering secure and efficient digital payment solutions· Following successful launches in Peru and Chile, Kuady continues its Latin American expansion, with further regional and global growth plannedOpen...

USDJPY Technical Analysis – All eyes on the ISM Manufacturing PMI

Fundamental OverviewThe USDJPY pair eventually erased the entire drop following the more dovish than expected Powell’s speech at the Jackson Hole Symposium. The focus is now on the key data this week with the ISM Manufacturing PMI and the NFP reports in the spotlight....

European equities open a little higher to start the day

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

SNB has just about the right excuse to do a little bit more later this month

SNB chairman Thomas Jordan last week said that the strong franc was not making things easier for the Swiss economy. And when you hear comments like that, it stands to reason that the central bank is watching things closely and might plot their next move based on how...

Switzerland Q2 GDP +0.7% vs +0.5% q/q expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USD/JPY erases the advance from yesterday to start the session

USD/JPY hourly chartThe high earlier in the day was around 147.20 and tested the overnight high as well. Sellers held and since then, it's been one-way traffic now as we get into European morning trade. USD/JPY is back down to near 146.00, although buyers are very...

Switzerland August CPI +1.1% vs +1.2% y/y expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

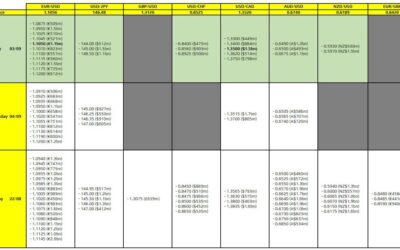

FX option expiries for 3 September 10am New York cut

There are a couple to take note of, as highlighted in bold.The first being for EUR/USD at the 1.1050 mark. And that could perhaps limit price action and make things a bit stickier in the session ahead before we get to the US open. Similarly, the one for USD/CAD at the...

Swiss data in focus in the session ahead

The dollar is keeping in a decent spot to start the day, with risk sentiment a little more sluggish to start the month. S&P 500 futures are down 0.2% and Nasdaq futures down 0.4% currently. But it's stilly early in the week, with plenty of US data to work...

China to launch anti-dumping investigation into Canadian chemical products

These will also include canola imports as well as rapeseed, with the latter being a major export for Canada to China. The retaliatory move by China comes after the Canadian government announced a decision to impose 100% tariffs on Chinese EVs last week. They also...

ForexLive Asia-Pacific FX news wrap: USD/JPY heads up to 147.20, drops back under 147.00

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of England Deputy Governor Breeden speaking on Tuesday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB speakers on Tuesday may be light on comments re the economy and monetary policy

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan will spend nearly a trillion yen to cover energy subsidies

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[나만 몰랐다고?? 고속도로 통행료 반 값.. 이렇게 통과 하세요!! 전국민 100%대상!! ]#3.1경제독립tv

https://www.youtube.com/watch?v=KWua-KtbFZE [나만 몰랐다고?? 고속도로 통행료 반 값.. 이렇게 통과 하세요!! 전국민 100%대상!! ]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

Australian data – Q2 net export contribution to GDP +0.2% (expected 0.6%)

Current Account data from Australia for the April to June quarter of 2024Australia Current Account AUD -10.7bn, a huge missexpected -5.0bn, prior -4.9bnAustralia Net Exports Contribution 0.2% ... a big miss and a big hit to Q2 GDPexpected 0.6% prior -0.9%Public sector...

PBOC sets USD/ CNY central rate at 7.1112 (vs. estimate at 7.1120)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USD/JPY is back above 147.00

USD/JPY traded higher on Monday in Europe. It tracked pretty much sideways during the US holiday that followed. Asian morning trade is testing the Monday high. The backdrop is solid uptrend on the hourly chart, but note the prior tops around this area from the week of...

US President Biden to speak on Tuesday at 2pm US Eastern time

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of Korea sees inflation maintaining its current stable trend for the time being

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[나만 몰랐다고?? 고속도로 통행료 반 값.. 이렇게 통과 하세요!! 전국민 100%대상!! ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/09/eb8298eba78c-ebaab0eb9e90eb8ba4eab3a0-eab3a0ec868deb8f84eba19c-ed86b5ed9689eba38c-ebb098-eab092-ec9db4eba087eab28c-ed86b5eab3bc-400x250.jpg)