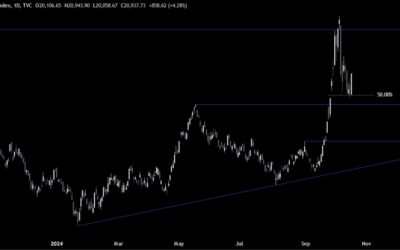

Fundamental OverviewThe PBoC tonight announced new easing measures which included further rate cuts and stock buyback funding. Moreover, we got some positive economic data with Retail Sales and Industrial Production beating expectations by a big margin. These...

BOJ governor Ueda remarks that Japanese economy is recovering moderately

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

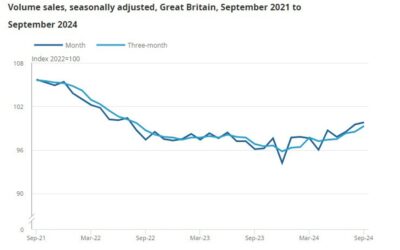

UK September retail sales +0.3% vs -0.3% m/m expected

Prior +1.0%Retail sales +3.9% vs +3.2% y/y expectedPrior +2.5%; revised to +2.3%Retail sales (ex autos, fuel) +0.3% vs -0.3% m/m expectedPrior +1.1%Retail sales (ex autos, fuel) +4.0% vs +3.2% y/y expectedPrior +2.3%; revised to +2.2%It's a welcome sight for the BOE...

ForexLive Asia-Pacific FX news wrap: China launches stock buyback funding

JPY verbal intervention:China:Other Let’s get Japan and the yen out of the way first and then on to China. Inflation data from Japan for September kicked the session off. All three of the main measures came in at or above the Bank of Japan 2% target, although two of...

PBOC Governor says 7-day reverse repo rate will be lowered by 0.2%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC has officially ramped up support for the stock market, relending facility launched

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China National Bureau of Statistics (NBS) official says economic indicators positve change

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan govmt says closely watching speculative FX moves

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC Governor provides directions for stock buybacks

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

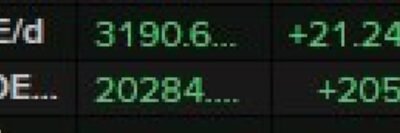

China Sept: Retail sales +3.2% y/y (expected +2.5) Industrial production +5.4% y/y (4.6)

The data is in the screen shot below.More:the unemployment rate in 31 cities was 5.1%January - September property investment was down 10.1% y/yJanuary - September infrastructure investment was +4.1%Offshore yuen is up a little after the data.All three of the major...

China Q3 GDP 4.6% y/y (expected 4.5%) 0.9% q/q (expected 1.0%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[30억 아파트 있어도..월 700만원 벌어도.. 기초연금 40만원 받는다!! 생계급여는 깎이는데??]#3.1경제독립tv

https://www.youtube.com/watch?v=1NO67LZUmV0 [30억 아파트 있어도..월 700만원 벌어도.. 기초연금 40만원 받는다!! 생계급여는 깎이는데??]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

China September new house prices -5.7% y/y (prior -5.3%)

China home price data for September 2024:-5.7% y/yprior -5.3%-0.7% m/mprior also -0.7%We've been banging on all year (more?) about the vicious cycle of lower home prices breeding buyer reluctance (why buy no when prices fall, get it cheaper later) breeding lower...

PBOC sets USD/ CNY reference rate for today at 7.1274 (vs. estimate at 7.1267)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC says its necessary to increase support to the real economy

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US politics – “Big Jack Smith document dump” expected Friday – Trump wanted this blocked

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.1267. – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

Yen intervention comments out of Japan

USD/JPY is down, just above 150.00 as I update. Atsushi Mimura is Japan's vice finance minister for international affairs, AKA 'top currency diplomat'.Japan's finance ministry is the relevant authority in Japan for ordering intervention in the JPY. Mimura has taken...

Confirmation news – China banks cut fixed deposit rates by 25bp

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USD/JPY little changed after Japan’s September inflation data

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[30억 아파트 있어도..월 700만원 벌어도.. 기초연금 40만원 받는다!! 생계급여는 깎이는데??]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/10/30ec96b5-ec9584ed8c8ced8ab8-ec9e88ec96b4eb8f84-ec9b94-700eba78cec9b90-ebb28cec96b4eb8f84-eab8b0ecb488ec97b0eab888-40eba78cec9b90-ebb09b-400x250.jpg)