High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fed’s Bowman and Powell will both speak on Monday. Let the 25 vs. 50 battle (re) commence!

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US politics – US Vice President Harris raises $55 million in California fundraisers

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

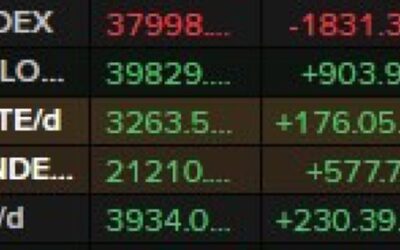

Chinese stocks continue to surge

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of England Monetary Policy Committee member Greene speaks on Monday, late NY time

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan chief cabinet secretary Hayashi says no comment on daily share moves

Hayashi: No comment on daily share movesContinue to monitor economic and financial situation in Japan and overseas with sense of urgencyContinue to work closely with BOJChinese shares are having another strong day as stimulus measures are assessed and new ones get...

China Caixin September Manufacturing PMI 49.3 (prior 50.4) Services 50.3 (prior 51.6)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian August 2024 Private Sector Credit +0.5% m/m (expected +0.5%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China official PMI data: Manufacturing 49.8 (expected 49.5)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate for today at 7.0074 (vs. estimate at 7.0098)

The People's Bank of China set the onshore yuan (CNY) reference rate for the trading session ahead.USD/CNY is the onshore yuan. Its permitted to trade plus or minus 2% from this daily reference rate.CNH is the offshore yuan. USD /CNH has no restrictions on its trading...

[10월부터~정부 지원금 + 보조금!! 빠짐없이 다 받으려면.. 주만센터에서 이것 꼭~신청하세요!! ]#3.1경제독립tv

https://www.youtube.com/watch?v=wxTRiCLu4sc [10월부터~정부 지원금 + 보조금!! 빠짐없이 다 받으려면.. 주만센터에서 이것 꼭~신청하세요!! ]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

Japanese govmt official says industrial output will bounce back in September on autos

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USD/JPY higher to open the week – update after weekend news and Monday data

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.0098 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

New Zealand September business confidence 60.9 (prior 50.6)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan data – August Industrial production -3.3% m/m (expected -0.9%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan August Retail Sales 2.8% y/y (expected 2.3%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The one word reason why Chinese authorities are piling into stimulus right now. Panic.

The 2024 class of university graduates in China is the largest ever, at 11.8mn. They are entering a labour market showing record youth unemployment.Media reports, in summary, outline the cornering situation facing the oldies clinging on to power in the Politburo.Youth...

Rabobank look for GBP to outperform EUR in the months ahead

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Not FX. Legendary singer-songwriter Kris Kristofferson has died.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[10월부터~정부 지원금 + 보조금!! 빠짐없이 다 받으려면.. 주만센터에서 이것 꼭~신청하세요!! ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/09/10ec9b94ebb680ed84b0eca095ebb680-eca780ec9b90eab888-ebb3b4eca1b0eab888-ebb9a0eca790ec9786ec9db4-eb8ba4-ebb09bec9cbceba0a4eba9b4-400x250.jpg)