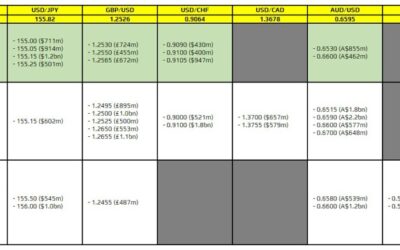

There is just two to take note of, as highlighted in bold.They are both for EUR/USD and layered close by at the 1.0750-55 level. That should see price action keep more compact in and around current levels in the session ahead at least. The 100-hour moving average for...

US data in the spotlight this week

This is one of my favourite strips over the years. And it is still very much relevant. As we look to the new week, it's all about US data that will drive the mood in broader markets. We've already gotten a teaser last week from a couple of smaller releases but this...

This week brings the “most crucial CPI reading of 2024”, a “mini Super Bowl”

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Reserve Bank of New Zealand Q2 2-year Inflation Expectations 2.3% (prior 2.5%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive Asia-Pacific FX news wrap: USD/JPY drops back from 156.00

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Federal Reserve speakers coming up on Monday include Mester and Jefferson

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China to sell 20, 30 and 50 year Treasury bonds

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China’s “weekend’s data add to the probability of a surprise rate cut”

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian April business confidence 1 (prior 1)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australia’s budget (due Tuesday) will assume inflation to return to 2 to 3% by end 2024

Australia's budget papers to be handed down on Tuesday evening Sydney time will show annual headline inflation is expected to ease to 3.5% by June and 2.75% by December.This compares with the latest RBA forecast showing inflation to remain at 3.8% cent until December...

PBOC sets USD/ CNY reference rate for today at 7.1030 (vs. estimate at 7.2284)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan’s Kato says its natural that monetary policy will revert to positive interest rates

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USD/JPY sitting just below 156.00, Japan PM said on Friday he’s closely monitoring the yen

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.2284 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

[5월, 지나면 손해보는..전국민 25만원~64만원!! 한 만 신청하면 끝!! 매월 받아요!! ]#3.1경제독립tv

https://www.youtube.com/watch?v=8-dPOMib7Lw [5월, 지나면 손해보는..전국민 25만원~64만원!! 한 만 신청하면 끝!! 매월 받아요!! ]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

USD/JPY is back at last week’s high already

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Credit in China fell in April for the first time since 2017 (or 2005)

Data from China on credit in April, via Bloomberg Economics (gated), shows it shrank for the first timegovernment bond sales slowed, more government bonds were repaid than sold in the monthloan expansion was worse than expected in a sign of weak demand Aggregate...

UK employers plan to increase wages by 4% in the next 12 months.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Oil trading lower in futures markets to begin the new week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BlackRock says the yen’s weakness is turning foreign investors away from Japanese stocks

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[5월, 지나면 손해보는..전국민 25만원~64만원!! 한 만 신청하면 끝!! 매월 받아요!! ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/05/5ec9b94-eca780eb8298eba9b4-ec8690ed95b4ebb3b4eb8a94-eca084eab5adebafbc-25eba78cec9b9064eba78cec9b90-ed959c-eba78c-ec8ba0ecb2aded9598-400x250.jpg)