Sanae TakaichiThe vote will take place Friday afternoon, with results of the first round scheduled to be announced at 2:20 p.m. There will be a runoff if the top candidate fails to win a majority, with the results to be announced at 3:30 p.m. Tokyo time.MUFG...

NASDAQ index erases its gains

The NASDAQ index was up 245.13 points at its session highs this morning, and moved to down -10.47 points. It is currently trading up 32 points or 0.18% at 18115.90.Helping to contribute to the declines was a report from the Wall Street Journal that Super...

How to Optimize Your Crypto Holdings

Trying to make your crypto holdings better? The main techniques for improving and managing your Bitcoin investments are covered in this article. You will gain knowledge of sophisticated procedures, risk management, tax advice, portfolio analysis, asset...

Fed’s Cook: Optimistic AI can boost productivity

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US 10 year yield rises to the highest level since September 4

The US 10 year yield has risen to its highest level since September 4. The yield is currently at 3.817%. That's up 3.6 basis points on the day.The low yield for September has reached 3.599% (call it 3.60%). Since then, the yield is up 21.7 basis points. The Fed cut...

Treasury Secretary Yellen: There is a bit more slacking labor market than previously

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

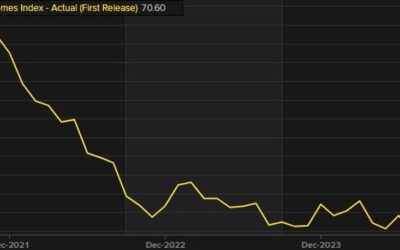

US pending home sales for August 0.6% versus 1.0% expected

Prior month -5.5% Pending home sales for August 0.6% versus 1.0% expectedIndex comes in at 70.6 versus 70.2 last monthMonth over month, contract signings rose in the Midwest, South and West but dropped in the Northeast.Compared to one year ago, pending home sales...

US stocks trades higher. S&P index trades at record levels.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Tech stocks surge while energy sector slides: Navigating today’s market shifts

Stock heatmap by FinViz.com Thu, 26 Sep 2024 13:46:08 GMTTech stocks surge while energy sector slides: Navigating today's market shiftsThe U.S. stock market today paints a vibrant picture of sectoral shifts, with technology stocks outperforming while energy stocks...

Bowman: Discount window is for emergencies

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Kickstart the FX trading day for Sept 26 w/a technical look at the EURUSD, USDJPY & GBPUSD

In the kickstart video for September 26, I take a look at 3 major currency pairs - the EURUSD, USDJPY and GBPUSD. For the EURUSD, the price action today and over the last few trading days, has been up and down volatile. On most days, there are technical levels that...

Fed’s Bowman repeats speech from earlier this week. No policy comments from Powell

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

David Tepper loads up on China with some very bullish comments

David Tepper was on CNBC and made some very bullish comments on China.HE said he has gone over his usual limits. He said he bought more on the PBOC announcements this week and even more overnight today on the fiscal announcements."This is incredible stuff for that...

OPEC+ likely to go ahead with planned Dec oil output increase – report

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

An energy generation company passed Nvidia as the top performer in the S&P 500

VST dailyThe best business to own this year was old-fashioned power generation.It's poetic how an industry that was seen as the epitome of quiet and predictable has just passed the AI-revolutionary defining company as the best performer in the S&P 500 this...

US Q2 final GDP +3.0% vs +3.0% expected

Prelim reading was +3.0%Final Q1 was +1.4% (unrevised)Details:Consumer spending +2.8% vs +2.9% second reading GDP final sales +1.9% vs +2.2% second readingGDP deflator +2.5% vs +2.5% second readingCore PCE +2.8% vs +2.8% second reading Corporate profits after tax...

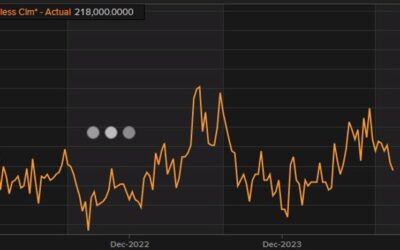

US initial jobless claims 218K versus 225K estimate

Prior week 219K revised to 222KInitial jobless claims 218K vs 225K est4- week moving average initial jobless 224.75 vs 228.25 Continuing claims 1.834M vs 1.838M estimate. Prior week revised to 1.821M from 1.829M prior4-week moving average continuing claims 1.836M...

US August durable goods orders 0.0% vs -2.6% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US initial jobless claims, durable goods and GDP coming up next

We get the 'final' Q2 US GDP report today but that's generally not a market mover as now we're just 4 days away from the end of Q3.More important today are initial jobless claims and durable goods orders. I'd put claims at the top of the list.Here is Parker Ross on...

ForexLive European FX news wrap: China uplifts broader markets; SNB cuts, dollar sluggish

Headlines:Markets:AUD leads, USD lags on the dayEuropean equities higher; S&P 500 futures up 0.8%US 10-year yields down 0.9 bps to 3.771%Gold up 0.8% to $2,678.03WTI crude down 2.8% to $67.77Bitcoin up 1.3% to $64,330China continues to hog the spotlight so far...