The AUDUSD moved lower a week ago on the stronger-than-expected US jobs report. However, the price remained above its 200 bar moving average on the 4-hour chart (green line on the chart below). It wasn't until Monday that the price broke below that level (currently at...

USDCAD is snapping back higher after a stronger jobs report. Buyers back in control

The USDCAD has been trending to the upside since bottoming on October 2 near 1.3472. The momentum over the last eight trading days has taken the price up to a high of 1.37826. That took the price to the low of the next swing area target between 1.3784 and 1.38036...

Fed’s Logan: Less-restrictive policy will still cool inflation

Fed's LoganLess-restrictive policy will still cool inflation Recent inflation data is very welcomeI think that's a very good point in the headline that too many people are missing in pricing in a November pause. Logan is a hawk too.Over at Bloomberg, Joseph Brusuelas...

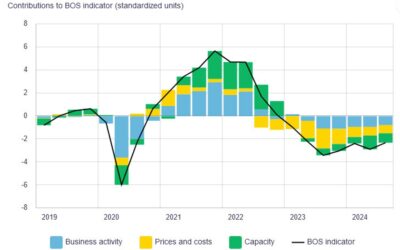

Bank of Canada business outlook survey says “demand is weak”

For me, this is a more-important report than today's jobs data.Business Outlook Survey indicator remains negative, signaling widespread softness" demand is weak, firms have excess capacity, and price growth continues to slow" but little deterioration since last...

EBC Financial Group Enhances Liquidity and Lowers Trading Costs on Major Stock Indices

Amidst a global stock market resurgence, EBC Financial Group (EBC) is enhancing liquidity for five major stock indices, including the U.S. Dow Jones, Nasdaq, S&P 500, the A50 (China), and the Hang Seng Index (Hong Kong). This strategic move aims to provide...

USDCHF this week settles in a higher up and down trading range.

A week ago today, the USDCHF made a break to the upside and out of the "Red Box" that had confined the pair going back to August 20. The US jobs report was the catalyst for the move higher, but by Monday, the price fell back to the high of that "red box" and even...

S&P 500 rises to a fresh record as financials lead, JPM says consumers have troughed

The S&P 500 is up 28 points, or 0.5%, to 5808 in a rise to a fresh record high. The jump at the open bucks futures that were negative shortly before the open.A big tailwind is in financials as J.P. Morgan shares rise 4.5% following earnings.JPM dailyCommentary in...

September Inflation Cools but Remains Sticky

It’s a mixed bag of consumer price data, with the annual inflation rate continuing to cool in September, reaching its lowest level in three years, though the report was slightly hotter than expected.The Labor Department reported on Thursday the consumer price index...

US October UMich prelim consumer sentiment 68.9 vs 70.8 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Tesla shares fall 8% after robotaxi event panned for lack of details

Elon Musk went back to his old playbook with the robotaxi event, teasing untried technology and mixing it with hype. The problem is that he routinely blows through deadlines by an order of magnitude and final pricing doesn't resemble what was promised. There is no...

UMich October preliminary consumer sentiment coming up next

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Mixed signals in tech as Tesla tumbles and financials rally

Stock heatmap by FinViz.com Fri, 11 Oct 2024 13:46:10 GMTMixed signals in tech as Tesla tumbles and financials rallyThe US stock market presents a diverse tapestry of performances today, influenced by varying sentiment across sectors. The heatmap showcases contrasting...

Mixed open for the major indices. For the week the results are modestly higher

As the market digests the PPI data and looks toward the University of Michigan preliminary sentiment data and inflation expectations at the top of the hour, the US stocks are trading mixed. The Dow industrial average is higher along with the S&P. The NASDAQ index...

Kickstart the forex day for Oct 11 with a technical look at the EURUSD, USDJPY & GBPUSD

The US PPI data came out and showed the YoY higher than expectations (but the headline was lower than the revised higher level), but the MoM data was more tame. The short end of the yield curve is a little lower. The long end, not so much. The US stocks are steady but...

Canadian dollar tries to avoid an eight-day losing streak after stronger jobs data

USD/CAD fell after a strong jobs report but remains a dozen pips higher on the day in what could be the eighth straight day of gains.USDCAD dailyThe pair was trading at a session high of 1.3780 just before the data then fell as low as 1.3726 afterwards but has since...

US PPI final demand August YoY 1.8% vs 1.6% est. Ex Food and energy 2.8% vs 2.7% est.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Canada September employment change +46.7K vs +27.0K expected

Prior month +22.1KUnemployment rate 6.5% vs 6.7% expectedPrior month employment rate 6.6%Full-time employment +112.0K vs -43.6K prior (largest since May 2022)Part-time employment -65.3K vs +65.7K priorParticipation rate 64.9% vs 65.1% priorAverage hourly wages y/y...

ForexLive European FX news wrap: Markets quiet, eyes on more US data, Canada jobs

Headlines:Markets:GBP leads, JPY lags on the day European equities slightly higher; S&P 500 future down 0.1%US 10-year yields up 0.4 bps to 4.098%Gold up 0.6% to $2,645.40WTI crude down 0.7% to $75.29Bitcoin up 2.4% to $61,143It was a quieter session as markets...

What is the distribution of forecasts for the US PPI?

The ranges of estimates are important in terms of market reaction because when the actual data deviates from the expectations, it creates a surprise effect. Another important input in market's reaction is the distribution of forecasts. In fact, although we can have a...

What would it really take for a pullback in gold prices?

Even with the dollar having strengthened and traders scaling back to pricing in a 25 bps move for the Fed in the past week or so, it hasn't really fazed gold prices whatsoever. There was a mild dip back towards $2,605 earlier this week but that didn't last with prices...