High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fed’s Collins reiterates support for further Federal Reserve rate cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump could create a ‘Shadow’ Fed Chair – undermine Powell

Info comes via Barrons (may be gated).Scott Bessent is described as "one of Donald Trump’s closest economic advisers". He has proposed that Trump nominate and seek Senate confirmation of Powell’s replacement well over a year before Powell’s term ends in May 2026. In...

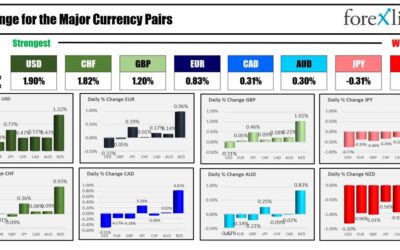

Forexlive Americas FX news wrap 9 Oct: Dollar, yields and stocks move higher ahead of CPI

The RBNZ cut rates by 50 basis points and that sent the NZD lower vs all the major currencies. The largest decline was vs the USD with a decline of -1.32% The USD was the strongest of the major currencies today:Tomorrow the US CPI data will be released with the...

AUD note: Reserve Bank of Australia’s Assistant Governor Economic Hunter speaks later

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

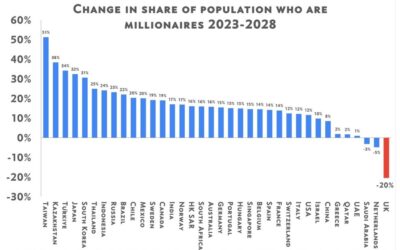

UK losing HNW individuals faster than any other country – worst in the world

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Record close on the S&P and the Dow.

Ahead of the CPI data tomorrow morning at 8:30 AM, US stocks closed higher with the S&P and the Dow industrial average both closing at record levels. The NASDAQ index closed higher as well and is now around 1.9% from it's all time high closing level at 18467.58.A...

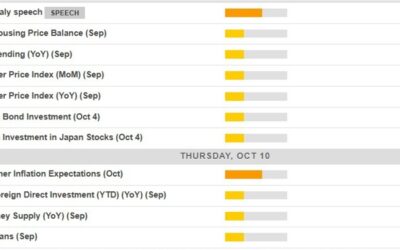

Economic calendar in Asia 10 October 2024 – Japan ‘wholesale’ inflation indicator

From Japan today we get the September Producer Price Index (PPI), also known in Japan as the Corporate Goods Price Index (CGPI)its a measure of the average change over time in the selling prices received by domestic producers for their outputis calculated by the Bank...

Trade ideas thread – Thursday, 10 October, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDJPY tests the high from August

Yields in the US have moved higher with the 10-year yield now up 2.8 basis points and the 2-year yield up 3.2 basis points. In addition, the chance of no change in policy in November reached close to 25% today before rotating back down to 20%. It wasn't long ago that...

Eyes on the Middle East and weather in the hours ahead

The upcoming Asia-Pacific session is likely to be a volatile one.The first fear is that the call between Biden and Netanyahu today will preceed strikes against Iran, including against oil infrastructure. Axios reports that a 'major attack against Iran' could be...

Crude oil futures settled at $73.24

Crude oil futures are settling at $73.24. That is down -$0.33 or -0.45%.The low price today reached $71.58. The high price extended to $74.41.Technically, looking at the daily chart, the price today fell below its 50 day moving average and the broken 38.2% retracement...

In the age of AI, here’s an old reminder that technology can advance at lightning speed

Jeffrey HintonDon't bet against human invention.Most, if not virtually all people still have little grasp on how much change generative artificial intelligence will bring. Yesterday, the Nobel Prize for physics was awarded to Jeffrey Hinton. Just three years ago, he...

What did a few, some, several, many, a substantial majority of Fed officials agree on

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The NZDUSD continued the fall that started last week after the RBNZ rate cut. What next?

The NZDUSD traded to the highest level in 2024 just last week (eight trading days ago). The high price reached 0.63778. Today after they are beyond the cut rates by 50 basis points, the price low traded to 0.60516. That's 327 pips in a trading days.Technically the...

FOMC Minutes: A substantial majority of participants supported a 50 basis point cut

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USD/CAD gains for the seventh consecutive day

USDCAD dailySeven straight days of USD/CAD gains speaks to a strong rejection of what looked like it could be a breakdown in August and September. The chart is a big of a nightmare for technical analysis as it had a break, then a lower low then a snap-back rally into...

MUFG: What to expect from today’s FOMC Minutes?

MUFG anticipates that the minutes from the September FOMC meeting will provide insights into the level of support for the 50bps rate cut and the current sentiment regarding inflation and the dual mandate.Key Points:Support for the Rate Cut:Market participants will be...

US sells 10-year notes at 4.066% vs 4.062% WI

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US set to sell $39 billion in 10-year notes at the top of the hour

How does 4.06% for ten years sound?That's what markets will be grappling with as we count down to the results of the 10-year sale at the top of the hour. I thought we would see more bids as 10s crossed 4% the the sellers continue to have the upper hand as US economic...