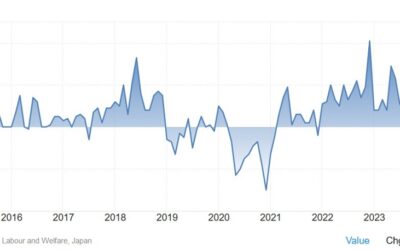

An early update for USD/JPY, which caught another substantial bid after the blockbuster US jobs report on Froday:I had an outlook from Standard Chartered to post, analysts there were looking for 149 ... and here we are. had expected a range of 140 - 149 for the coming...

Goldman Sachs on well above expectations US jobs report, see a 25bp Fed November rate cut

The data is linked from here:The jobs report came in super-string, smashing above even the highest estimates:(as a ps. if you aren't reading such posts from Giuseppe and I prior to significant US economic releases you are going in blind)I already posted a few...

New Zealand – RBNZ shadow board equally divided on 25 or 50bp rate cut this week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

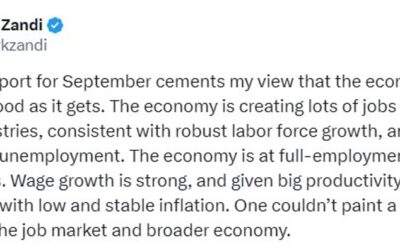

US economy is as good as it ever gets

Last week I posted a glowing assessment of the US economy from Mark Zandi, Chief Economist at Moody's Analytics:In that post I warned:perhaps the FOMC should take the foot off the accelerator, or least lighten its touchAnd here we are. On Friday we got astounding jobs...

Weekend news – Flights from all Iran’s airports cancelled

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

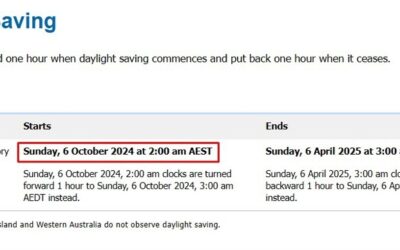

AUD traders heads up – Australia switched to daylight saving over the weekend

The major centres in Australia, Sydney and Melbourne, along with some other areas, moved clocks forward one hour over the weekend to adjust for daylight saving time. If you are trading Australian markets you may need to adjust your trading times. Via the Reserve Bank...

Germany’s economy ministry forecasts a recession

German newspaper Sueddeutsche Zeitung reported over the weekend on a dour forecast from German's economy ministry, planning a downgrade to its 2024 economic growth forecast.The new forecast will be for negative 0.2% growth, i.e. a shrinking economy, for 2024prior...

Economic calendar in Asia Monday, October 7, 2024 – a light data agenda ahead

A very light data agenda ahead for Monday, October 7, 2024.A couple of Asia time zone holidays to note:Mainland China remains on holiday today, markets reopen Tuesday, local timeit's a partial holiday in Australia (Sydney is out)Note also, Australia switched to...

Trade ideas thread – Monday, 7 October, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Saudi Arabia has raised its main oil prices for buyers in Asia, cut price to Europe and US

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Monday morning open levels – indicative forex prices – 07 October 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Newsquawk Week Ahead: US CPI, RBNZ, Minutes from FOMC, ECB and RBA, and Canada jobs

Mon: Mainland China market holidayTue: RBA Minutes, EIA STEOWed: RBNZ Announcement, RBI Announcement, Bank of Israel Announcement, German Trade Balance (Aug), FOMC MinutesThu: ECB Minutes, Norwegian CPI (Sep), US CPI (Sep), French BudgetFri: BoC Business Outlook...

Weekly Market Outlook (07-11 October)

UPCOMING EVENTS:Monday: Eurozone Retail Sales. (China on holiday)Tuesday: Japan Average Cash Earnings, RBA Meeting Minutes, US NFIB Small Business Optimism Index.Wednesday: RBNZ Policy Decision, FOMC Meeting Minutes.Thursday: Japan PPI, ECB Meeting Minutes, US CPI, US...

신청하세요! 소상공인, 자영업자 이제부터 지원대상 확대!

https://www.youtube.com/watch?v=OuakxjXZb6c 요즘 소상공인, 자영업자분들 많이 힘드시죠~ 이번에 기획재정부 장관이 소상공인과 자영업자를 위해 지원을 발표했는데요. 주변에 소상공인이나 자영업자 분들에게 영상을 공유해 주셔서 도움 받을 수 있도록 알려 주시면 좋겠습니다. #속보 #소상공인 #자영업자 MoneyMaker FX EA Trading...

(속보) 월급 받는다면 꼭! 신청하세요!! 직장인(소득무관)

https://www.youtube.com/watch?v=XUOXi7MK0CA 물가는 미친듯이 오르는데 아직까지 제자리인 월급! 저축하기는 더욱 어려운 시대가 되었는데요. 정부에서 이번에 대책을 발표했습니다. 10월부터 진행하는 지원을 자세하게 알려드릴건데요! 직장인 분들에게 공유해 주시면 그분들께 도움이 될 것 같습니다. #속보 #직장인 #뉴스 MoneyMaker FX EA Trading...

Crude oil price forecast 🛢️🚀

Crude Oil Price Forecast: Navigating the Next Moves 🛢️📈Hello traders and investors! This is Itai Levitan, an experienced market analyst at ForexLive.com, tracking crude oil for you today as well as what I am looking at. Let’s dive into the insights you need to make...

인제 용대리 꽃축제장(3.1시골농장tv)#인제여행#가을꽃축제#설악산

https://www.youtube.com/watch?v=XM9To_L-AFY MoneyMaker FX EA Trading Robot

[200만원 소액생계비 지원! 1.5%초저금리 최대1,250만원 정부지원대부사업 7가지! 여기서 신청하세요]#3.1경제독립tv

https://www.youtube.com/watch?v=Sj0rZiZpQsE [200만원 소액생계비 지원! 1.5%초저금리 최대1,250만원 정부지원대부사업 7가지! 여기서 신청하세요]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

[부모가 10년뒤 자녀에게 원망듣지 않으려면 지금 해야하는 딱1가지는 이것! (84년생~74년생 부모 꼭 확인)]#3.1경제독립tv

https://www.youtube.com/watch?v=yATVkzU4DNk [부모가 10년뒤 자녀에게 원망듣지 않으려면 지금 해야하는 딱1가지는 이것! (84년생~74년생 부모 꼭 확인)]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

Saudi Arabia has raised its main oil prices for buyers in Asia, well above expectations

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[200만원 소액생계비 지원! 1.5%초저금리 최대1,250만원 정부지원대부사업 7가지! 여기서 신청하세요]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/10/200eba78cec9b90-ec868cec95a1ec839deab384ebb984-eca780ec9b90-1-5ecb488eca080eab888eba6ac-ecb59ceb8c801250eba78cec9b90-eca095ebb680eca780-400x250.jpg)

![[부모가 10년뒤 자녀에게 원망듣지 않으려면 지금 해야하는 딱1가지는 이것! (84년생~74년생 부모 꼭 확인)]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/10/ebb680ebaaa8eab080-10eb8584eb92a4-ec9e90eb8580ec9790eab28c-ec9b90eba79deb93a3eca780-ec958aec9cbceba0a4eba9b4-eca780eab888-ed95b4ec95bc-400x250.jpg)