Australia Westpac Leading Index for August 2024 -0.05% m/mprior –0.03%Westpac note, in summary: The six-month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine...

El Erian cites ‘The Economist’ – Fed rate cuts “may disappoint “

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan August data shows a big miss for both exports and imports – recap

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC is expected to set the USD/CNY reference rate at 7.0828 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

Japan Machinery orders for July 2024: -0.1% m/m (expected +0.8%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan August exports +5.6% y/y (expected +10.0%) & imports +2.3% y/y (expected +16.6%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Asian markets holidays reminder – Hong Kong is closed today

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

JP Morgan CEO Dimon says FOMC rate cut today is “not going to be earth-shattering.”

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

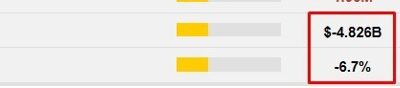

New Zealand data – Current account deficit for Q2 comes in larger than expected

NZD/USD not showing much response. Currently up a few wee tics around 0.6189.The data focus for the week is Q2 GDP due Thursday local NZ time. The current account represents the most comprehensive gauge of a nation's international financial interactions. It...

A 50bp Federal Reserve rate cut coming today? History says ‘No’.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of Canada Rogers still sees work to do on inflation, but core shouold decline

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

North Korea has fired off another ballistic missile

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US to buy 6 million barrels of oil for its Strategic Petroleum Reserve

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

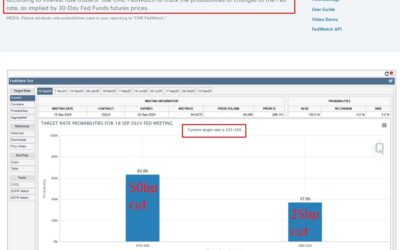

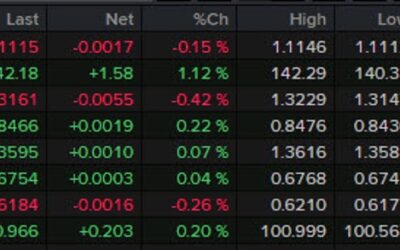

Most analysts expect a 25bp interest rate cut from the Federal Reserve today

This summary screenshot is via Reuters, showing the latest forecasts for the headline Federal Open Market Committee (FOMC) decision due on Wednesday, September 18, 2024 (at 1800 GMT, 1400 US Eastern time)The latest from 'FedWatch' (market pricing) show 30-Day Fed...

New Zealand data – Q3 consumer confidence 90.8 (prior 82.2)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

RBA Assistant Governor (Financial System) Jones speaking today, Wednesday, September 18

RBA Assistant Governor (Financial System) Jones is speaking at 9.20am Melbourne time:2320 GMT1920 US Eastern timeHe is speaking at a Fintech event. I don't expect much, if anything, on his views on the economy or monetary policy, but a heads up on the off chance....

Forexlive Americas FX news wrap: USD/JPY rebounds on solid US retail sales

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

S&P squeezes out a small gain for the 7th consecutive higher close

The major indices are closing with mixed but modest changes. The S&P did trade to a new record intraday high level, above 5669,. but stalled just above that level at 5670.81. The buyers turned to sellers. After trading negative into the last hour of trading,...

Economic calendar in Asia Wednesday, September 18, 2024 –

There is plenty top come on the data agenda but none of it is higher-tier. Note that mainland Chinese markets reopen today after holidays on Monday and Tuesday. Hong Kong is closed today. This snapshot from the ForexLive economic data calendar, access it here.The...

Trade ideas thread – Wednesday, 18 September, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...