BNZ summarise their reasoing:QSBO just awful CPI headed sub 2.0% Soft labour market to subdue non-tradables Rate settings need to move quickly towards neutral 50 basis point cut at October meeting warranted"In our opinion, we think the disinflationary information that...

ByteDance (TikTok owner) plans new AI model trained with Huawei chips

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian dollar a touch higher after better than expected retail sales data

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian August retail sales +0.7% m/m (expected +0.4%)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BNZ forecast a 50bp interest rate cut from Reserve Bank of New Zealand next week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan finance minister Suzuki says forex levels should be determined by markets

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USD/JPY is testing above 144.00 on a cautious BOJ – faces resistance around here

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

New Zealand Treasury don’t expect activity to have picked up much in the latest quarter

Treasury says that while the June quarter GDP fell, more recent evidence suggests we are at or near the bottom of the economic cycle:June quarter GDP fell by 0.2%, less than expected, with population growth masking economic weakness.But,, its not a lock ... Treasury...

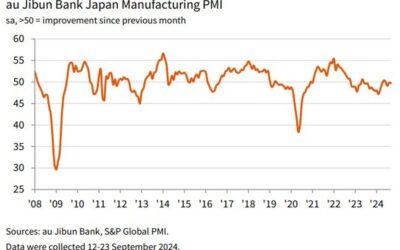

Japan Jibun Bank September Manufacturing PMI (final): 49.7 (prior was 49.8)

Manufacturing PMI from Japan for September 2024, the final from S&P Global / Jibun Bank.Another contraction result. Preliminary is here:The key points in the report:Output levels fall for second time in three months Slowest rise in employment levels in current...

Japan big manufacturers see USD averaging 144.96 yen for FY2024/25

Bank of Japan September quarter 2024 Tankan report, main findings: September big manufacturers index +13 (expected 13)December big manufacturers index seen at +14 (expected 12)September big non-manufacturers index +34 (expected 32)December big non-manufacturers index...

Bank of Japan September meeting ‘Summary of opinions’

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bank of Japan tankan report shows firms expect 2.4% inflation a year from how

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Data – Prices in UK shops fell at the fastest pace in more than three years in September

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian weekly consumer sentiment survey slipped a little to 82.0 (prior 84.9)

ANZ-Roy Morgan Australian Consumer Confidence is not generally an AUD mover.It dribbled a little lower in the week, ANZ citing the RBA on hold decision. Inflation expectations eased 0.3ppt to 4.6%, their lowest since September 2021. Reserve Bank of Australia Governor...

Japan August unemployment rate 2.5% vs. 2.6% expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US dock worker union rejects latest pay offer

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Late “ray of hope” in US port strike – deadline looms though

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Israel announces the start of a ground operation in Southern Lebanon

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

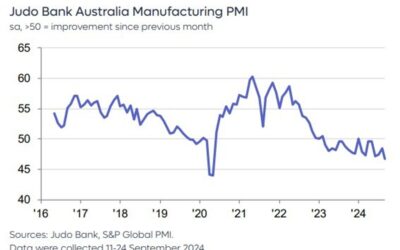

Australian final September manufacturing PMI 46.7 (prior 48.5)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Australian August retail sales data due today, expectations are for a rise m/m

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...