High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

France August final CPI +1.8% vs +1.9% y/y prelim

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Vasle: We are not committed to any predetermined rate path

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Rehn says will continue to base policy decisions on assessment of inflation outlook

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Nagel: Core inflation is going in the right direction

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Boeing US factory workers vote to go on strike, reject pay deal

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Dollar looks to settle lower after some back and forth trading this week

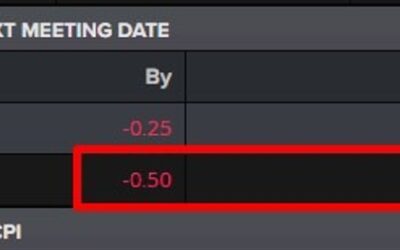

If the Fed wants to organise things in an orderly manner, the market sure isn't letting them do so. The odds of a 50 bps rate cut dwindled after the US CPI report earlier this week but were reignited again in trading yesterday. The odds of that have moved back up to...

BOJ expected to keep rates unchanged this month but hike by year-end – poll

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ForexLive Asia-Pacific FX news wrap: USD/JPY fell back under 140.80

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

China data this weekend: Will housing prices show signs of stabilization?

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Former New York Fed President Dudley sees a strong case for 50bp interest rate cut

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Pricing for a 50bp FOMC rate cut has firmed in just a few hours, 41% now

The Federal Reserve is in its blackout period, which means no communication from Fed officials on their outlook for monetary policy. Going into the blackout Fed officials very much played won anything other than 25bp. And now this, the probability of a 50bp hik has...

China’s 10 year government bond yield has fallen to a record low of 2.0775%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Fitch are forecasting a Bank of Japan rates to 1% (by the end of 2026!)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY reference rate for today at 7.1030 (vs. estimate at 7.1048)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Gold hit a record high price in Asia trade, above US$2562.65

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[추석 연휴!! 꼭~알아두세요!! 모르면 큰일나는…3가지 체크!! ]#3.1경제독립tv

https://www.youtube.com/watch?v=vUgkpfLRQkc [추석 연휴!! 꼭~알아두세요!! 모르면 큰일나는...3가지 체크!! ]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

PBOC is expected to set the USD/CNY reference rate at 7.1048 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

Putin warns that lifting Ukraine missile restrictions will put NATO at war with Russia

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USD/JPY trekking below 141.30

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[추석 연휴!! 꼭~알아두세요!! 모르면 큰일나는…3가지 체크!! ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/09/ecb694ec849d-ec97b0ed9cb4-eabcadec958cec9584eb9190ec84b8ec9a94-ebaaa8eba5b4eba9b4-ed81b0ec9dbceb8298eb8a94-3eab080eca780-ecb2b4-400x250.jpg)