US yields are moving to new session highs with the 2-year yield now back above 5.0% as traders price out rate cuts in 2024 even more. The 2-year yield is trading at its highest level since November 14, 2023. The high-yield in 2023 for the two-year note reached...

Kickstart the FX day for April 25 with a technical look at EURUSD, USDJPY and GBPUSD

Kickstart your Forex trading day with a technical look at the three major currency pairs - the EURUSD, USDJPY and GBPUSD. The US GDP data showed a bad mix with lower growth and higher inflation. That said stocks lower, yields higher, and the US dollar higher as well....

REPORT:BOJ to reportedly consider measures to reduce its government bond purchases

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BOJ to consider measures to reduce its government bond purchases – report

USD/JPY is falling on this report.USDJPY 10 minsAside from USD/JPY, the US dollar is broadly strong as Treasury yields continue to climb. US 10-year yields are up 7.5 bps to 4.72% -- the highest since November.While this report is good for the yen, it's also a drag on...

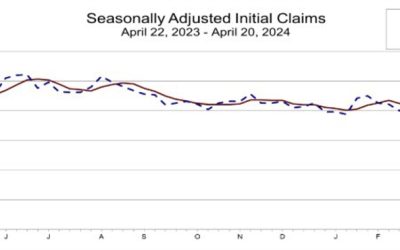

Fed rate hike pricing plunges after GDP data

Before today's US GDP report, the market was pricing in 41.5 basis points in Federal Reserve easing. Afterwards, it sees just 35 bps in cuts.The odds of a cut in July fell from roughly 50/50 to 34%. A cut isn't even fully priced in for November.The shifts are due to...

Stocks/bonds don’t like GDP inflation numbers.Stocks lower. Yield higher. US dollar higher

US stocks have added another like to that outside after US GDP came in weaker but the inflation measures were higher. The core PCE prices for the quarter rose 3.7% higher than the 3.4% estimate. That has investors worried about lower growth/ higher prices. Not good.In...

Canada Feb average weekly earnings 4.53% vs 3.88% prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US March wholesale inventory advanced -0.4% versus 0.4% (revised from 0.5%) last month

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Mayne Ayliffe Joins INFINOX as Global Head of HR

INFINOX is Delighted to announce the appointment of Mayne Ayliffe as the new Global Head of HR, based in the Dubai operations office, overseeing the Group's Human Resources function.Mayne is a seasoned HR professional with a decade of experience across the finance and...

US March advanced goods trade balance $-91.83 billion versus $-91.1 billion estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US Q1 advance GDP +1.6% vs +2.4% expected

Weakest since Q1 2023Final Q4 reading was +3.3% annualized (revised to +3.4%)Q3 was +4.9% annualizedDetails:Consumer spending +2.5% vs +3.3% priorConsumer spending on durables -2.1% vs +3.2% priorGDP final sales 2.0% vs +3.9% priorGDP deflator 3.1% vs 3.0% expected...

US initial jobless claims 207K versus 215K estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The first look at Q1 US GDP is coming up next

It's a busy slate on the US economic calendar today with Q1 GDP kicking things off along with initial jobless claims, advance goods trade balance for March, wholesale inventories and Canadian average weekly earnings.The consensus on GDP is 2.4% while the Atlanta Fed...

ForexLive European FX news wrap: Dollar, stocks down awaiting US GDP data

Headlines:Markets:AUD leads, JPY lags on the dayEuropean equities lower; S&P 500 futures down 0.6%US 10-year yields down 0.4 bps to 4.650%Gold up 0.6% to $2,329.53WTI crude up 0.1% to $82.22Bitcoin down 0.1% to $63,955There wasn't too much action in European...

Japan’s economy minister to attend BOJ policy meeting tomorrow

It is not commonplace for government officials to attend any central bank meeting, so this is definitely a peculiar one. But I guess it speaks to the delicate situation regarding the Japanese yen at the moment. The last time this happened was back in December last...

The Future of Real Estate: Investing in Tokenized Properties with Cryptocurrency

Real estate investment has long been a cornerstone of wealth construction, supplying balance, tangible property, and the potential for appreciation. However, the conventional real estate marketplace has frequently been characterized by boundaries to entry,...

UK April CBI retailing reported sales -44 vs 2 prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

GBPUSD Technical Analysis – We are at a cluster of resistance levels

USDThe Fed left interest rates unchanged as expected at the last meeting with basically no change to the statement. The Dot Plot still showed three rate cuts for 2024 and the economic projections were upgraded with growth and inflation higher and the unemployment rate...

Stocks stay on the cautious side so far on the day

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

IronFX Celebrates an Award-Winning Start to 2024

A global leader in online trading is celebrating a host of remarkable milestones already achieved in the first quarter of 2024 after being recognised for its services with a number of prestigious industry awards.The broker has further solidified its position as a...