The price action in gold lately has been one that has been hovering just under the $2,400 mark mostly. Buyers tried for a firm break of the key level but ultimately failed to hold a daily close above that. The mood music was also helped by recent geopolitical tensions...

I am buying this dip, IMHO, at TSLA stock before its earnings tommorrow. Here’s how.

I am eyeing Tesla stock before tommorow's earnings report, and starting to buy nowAs equity traders, we're always on the lookout for opportunities that promise a good return against measured risk. Tesla Inc. (TSLA), the innovative electric vehicle and clean energy...

What are the things to watch out for in the economic calendar this week?

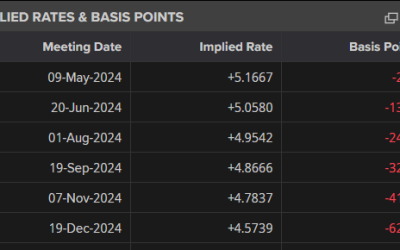

The Fed will only be meeting next week but now we're in the FOMC blackout period. And that means there will be no Fed speakers until the rate decision. With that in mind, markets will have to work with the geopolitical risk mood and events on the economic calendar for...

SNB total sight deposits w.e. 19 April CHF 481.3 bn vs CHF 477.9 bn prior

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

GBP/USD, EUR/GBP Outlooks – Sterling Weakens After Bank of England Commentary

GBP/USD and EUR/GBP Analysis and ChartsMost Read: British Pound Weekly Forecast - Lighter Data Week Could Mean Some RespiteOur brand new Q2 British Pound Forecast is available to download for free below: Recommended by Nick Cawley Get Your Free GBP Forecast Get My...

Risk steady but FX not up to a whole lot for now

The market mood is a better one compared to Friday last week. But this is just a slight breather as there were no significant escalation in geopolitical developments over the weekend. In FX, the changes among dollar pairs leave a lot to be desired:The moves are less...

The NASDAQ Gains As Earnings Gain Momentum, But More Bad News For Tesla

Investors turn their attention to the “magnificent seven” and earnings reports as the countdown begins. The NASDAQ and most global indices trade higher on Monday with the NASDAQ leading gains. Investors concentrating on earnings from Meta, Microsoft, Alphabet and...

European equities in a better mood to start the day

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Bitcoin technical analysis, bulls looking fine

Welcome to my latest BTCUSD technical update at ForexLive.com. In this Bitcoin-focused analysis, we delve into the intricacies of Bitcoin's price movements and provide strategic insights for both traders and investors. Below, we highlight key observations and trading...

SNB raises minimum reserve requirement for banks

The change will go into effect from 1 July 2024. At the same time, the central bank announces that:"Liabilities arising from cancellable customer deposits (excluding tied pension provision) will in future be included in full in the calculation of the minimum reserve...

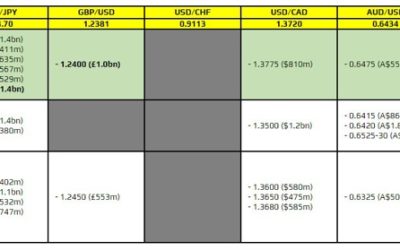

FX option expiries for 22 April 10am New York cut

There are a couple to take note of, as highlighted in bold.The first one is for USD/JPY at the 155.00 mark. Similar to the end of last week, this is one to watch as the pair stays underpinned by higher yields and the easing of geopolitical stress on broader markets....

Germany’s industry lobby warns of production slump to continue this year

The industry lobby also notes that exports will stagnate this year, making for a rather uncertain picture for the industry."Industry in Germany has not yet recovered from the cost and demand shocks, from moments of extremely high energy prices and from inflation....

North Korea fires ballistic missile, appears to have landed outside Japan’s EEZ

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

A light one on the data docket in European trading today

Markets are in a calmer mood, with major currencies not doing too much so far today. Risk is looking on the up, hoping for a bounce back after stuttering towards the end of last week. S&P 500 futures are up 0.3%, while the likes of gold and oil are both down.There...

Market Outlook for the Week of 22-26 April

Starting off on Monday, the FX market will see a relatively light day in terms of scheduled economic events. Tuesday brings a flurry of activity with the release of flash manufacturing and services PMI data for various countries including Japan, France, Germany, the...

A steadier risk mood set to greet European traders today

Are we finally past peak fear with regards to the whole Israel-Iran episode? It still depends but this weekend was a decent start. I mean, the status quo in the region has definitely changed from before and we're in a new geopolitical regime now. But as Iran downplays...

ForexLive Asia-Pacific FX news wrap: A quieter weekend for geopolitics, ‘risk’ up Monday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Gold has been hit lower on Monday in Asia

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Vietnam’s Central Bank is to cancel Monday’s gold auction due to a lack of interest

Vietnam's central bank said on Monday it would cancel its first gold auction in 11 years due to a lack of interest from buyersThe Bank added that the auction was now expected to take place on Tuesday.---This doesn't make a lot of sense to me. If the auction was...

BMO forecast a rate cut from the Bank of Canada, but trim back on the number of cuts

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...