Vandals have damaged around 20 Tesla (TSLA) vehicles at a dealershipJapan finance minister Kato says bond market should determine yield movementsMore on reports an Iranian ship has been sunk - still unconfirmedGold hits an all-time record high above US$3005PBOC sets...

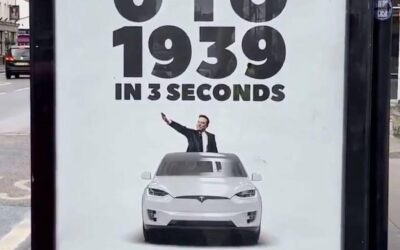

Vandals have damaged around 20 Tesla (TSLA) vehicles at a dealership

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan finance minister Kato says bond market should determine yield movements

Japan’s Finance Minister Katsunobu Kato spoke at his regular press conference on Tuesday. Said that bond markets should dictate yield movements, following a brief spike in the 40-year government bond yield to a record high. Kato emphasized that the government would...

More on reports an Iranian ship has been sunk – still unconfirmed

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Gold hits an all-time record high above US$3005

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Reports an Iranian ship was sunk by US forces as Gaza attacks took place

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

PBOC sets USD/ CNY central rate at 7.1733 (vs. estimate at 7.2264)

The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate system that allows the value of the yuan to fluctuate within a certain...

Reports that the Israel-Hamas ceasefire has collapsed

Israel-Hamas ceasefire has collapsed according to reports.A statement from the Israeli Prime Minister's office says that Israel resumes military operations against Hamas in Gaza after the group rejected U.S. proposals for extending ceasefire.The military followed up...

More TSLA news – competitor BYD reveals new charging system that takes just 5 minutes

BYD has unveiled a new battery and charging system that significantly reduces charging times for electric vehicles, bringing them closer to the convenience of refueling a petrol car. During tests on its new Han L sedan, the system delivered 470 kilometers of range in...

[봄철 시골텃밭 농자재 단돈 1만원대 인터넷 최저가 구입&비닐하우스 짓기 실전꿀팁! 정영성 청년농자재 대표 인터뷰-2탄]#3.1경제독립tv

https://www.youtube.com/watch?v=oxk3SA3Tcpk [봄철 시골텃밭 농자재 단돈 1만원대 인터넷 최저가 구입&비닐하우스 짓기 실전꿀팁! 정영성 청년농자재 대표 인터뷰-2탄]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독 추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마...

Tesla has raised the price for a Y model variant in China, to 313,500 yuan

Tesla raised the price for Long Range All-Wheel variant of the refreshed Model Y in China to 313,500 yuan.Also, TSLA has extended its 8000 yuan insurance subsidy for Model 3 vehicles through to the end of MarchBYD and other competitors have been eating Tesla's lunch...

PBOC is expected to set the USD/CNY reference rate at 7.2364 – Reuters estimate

People's Bank of China USD/CNY reference rate is due around 0115 GMT.The People's Bank of China (PBOC), China's central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate...

Euro EM funds bullish on Chinese consumer stocks, GS report shows

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

HSBC on China policy signals that bolster the case for overweight in Chinese equities

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

RBA’s Hunter says focused on US policy settings, how they’ll impact Australian inflation

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump says authorizing energy production using coal

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

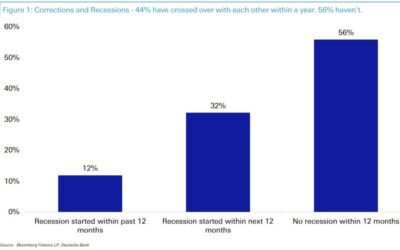

Deutsche Bank on the 10% US equity mkt correction: only leads to recession 44% of the time

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trump says looking forward to call with Putin – “much remains” until final agreement

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US politics – Trump orders an end to US Secret Service protection of Hunter Biden

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan – Buffett’s Berkshire buys more

News overnight ICYMI confirmed Warren Buffett has bought even more in Japan. Buffett's big buying spree of Japan's trading houses began in August 2020 when Berkshire Hathaway revealed that it had acquired just over 5% stakes in five major Japanese trading...

![[봄철 시골텃밭 농자재 단돈 1만원대 인터넷 최저가 구입&비닐하우스 짓기 실전꿀팁! 정영성 청년농자재 대표 인터뷰-2탄]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2025/03/ebb484ecb2a0-ec8b9ceab3a8ed8583ebb0ad-eb868dec9e90ec9eac-eb8ba8eb8f88-1eba78cec9b90eb8c80-ec9db8ed84b0eb84b7-ecb59ceca080eab080-eab5ac-400x250.jpg)