High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Japan’s new ‘top currency diplomat’ Atsushi Mimura said “always watching” yen carry trade

Atsushi Mimura is Japan's vice finance minister for international affairs, AKA 'top currency diplomat'. Japan's finance ministry is the relevant authority in Japan for ordering intervention in the JPY. Mimura has taken over from Kanda in charge of the relevant...

Japanese markets are closed today, Monday, September 23, 2024, for a holiday

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US House announce a stopgap spending bill to fund the government through December 20

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

TSMC and Samsung considering $100bn UAE investment – chip-building plants

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

German state election – exit polls show Chancellor Scholz’s party beats far-right

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Economic calendar in Asia Monday, September 23, 2024 (ps. Japan is closed today)

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trade ideas thread – Monday, 23 September, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US Vice Pres Harris to release new economic policy this week – urges Trump to debate again

The latest from the US presidential campaign is that US Vice President Harris is set to release new economic proposals this week:expected midweeknew set of economic policies would aim to help Americans build wealth and set economic incentives for businesses to aid...

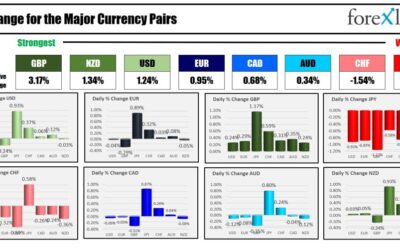

Monday morning open levels – indicative forex prices – 23 September 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Newsquawk Week Ahead: Highlights include US PCE, Global PMIs, RBA, SNB, and Australian CPI

Mon: Market Holiday: Japan (Autumnal Equinox); EZ, UK & US Flash PMIs (Sep), US National Activity Index (Aug)Tue: RBA Policy Announcement; German Ifo (Sep), US Consumer Confidence (Sep), Richmond Fed (Sep)Wed: Riksbank & CNB Policy Announcements; Australian...

2024년 자녀가 2명 있다면 이제부터 신청하세요!

https://www.youtube.com/watch?v=hm0ujqxu42w 주변에 자녀가 둘인 사람이 있으신가요? 그렇다면, 그분께 오늘 정보 공유해 주셔서 이 혜택들을 받을 수 있도록 알려주시면 좋을 것 같습니다. #속보 #뉴스 #다자녀 MoneyMaker FX EA Trading...

Weekly Market Outlook (23-27 September)

UPCOMING EVENTS:Monday: Japan on Holiday, Australia/Eurozone/UK/US Flash PMIs.Tuesday: Japan Flash PMI, RBA Policy Decision, German IFO, US Consumer Confidence.Wednesday: Australia Monthly CPI.Thursday: SNB Policy Decision, US Durable Goods Orders, US Q2 Final GDP, US...

[정부확정발표]65세 이상 고령운전자! 이것 통과 못하면 앞으로 운전 더 못한다!]#3.1경제독립tv

https://www.youtube.com/watch?v=kw7vJ_kGXIE [정부확정발표]65세 이상 고령운전자! 이것 통과 못하면 앞으로 운전 더 못한다!]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

[충격]노인 무임승차 완전 폐지! 65세 어르신 지하철,버스 유료? 이렇게 된다]#3.1경제독립tv

https://www.youtube.com/watch?v=dcxR5e1UYhI [충격]노인 무임승차 완전 폐지! 65세 어르신 지하철,버스 유료? 이렇게 된다]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

Forexlive Americas FX news wrap 20 Sep: The week comes to s close with the USD mostly up.

The economic data today was focusing Canada where retail sales rose by a higher-than-expected 0.9% but you should prices were lower than expectations.In the US, two-days after the FOMC rate decision to cut rates by 50 basis points, Feds Waller – normally a more...

Mixed end to the day for the major indices

The major US stock indices are closing the day with mixed results. It was triple witching hour so there was some end-of-day volatility, that could have impacted the price action. At the ending bell, the Dow industrial average is closing higher. The broader S&P and...

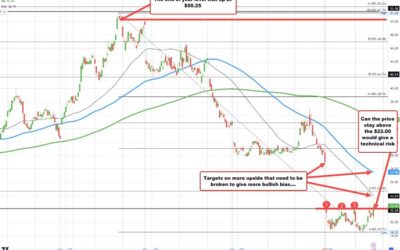

Qualcomm has approached Intel about a takeover in recent days

Shares of Intel are trading up 5.82% after reports from the WSJ that Qualcomm approached the company about a takeover in recent days. The shares of Intel are down in 2024 from an end of year closing level of $50.25. The current price is up $1.23 or 5.82% at $22.37 in...

EURUSD held the support outlined in the morning kickstart video and bounced. What next?

Earlier today, in the kickstart video, I outlined the following key support level for the EURUSD. That level was shown and outlined between 1.1131 and 1.11399. Here is that clip....So what happened?Below is the chart of the price action today. Of not is the low price...

Fed Harker: There is a risk that inflation decline could stall

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

![[정부확정발표]65세 이상 고령운전자! 이것 통과 못하면 앞으로 운전 더 못한다!]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/09/eca095ebb680ed9995eca095ebb09ced919c65ec84b8-ec9db4ec8381-eab3a0eba0b9ec9ab4eca084ec9e90-ec9db4eab283-ed86b5eab3bc-ebaabbed9598eba9b4-400x250.jpg)

![[충격]노인 무임승차 완전 폐지! 65세 어르신 지하철,버스 유료? 이렇게 된다]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/09/ecb6a9eab2a9eb85b8ec9db8-ebacb4ec9e84ec8ab9ecb0a8-ec9984eca084-ed8f90eca780-65ec84b8-ec96b4eba5b4ec8ba0-eca780ed9598ecb2a0ebb284-400x250.jpg)