High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

[9월, 신청하면… 10월 150만원 지급!! 추가 24만원!! 이렇게 받으세요!! ]#3.1경제독립tv

https://www.youtube.com/watch?v=egzEUN_WlX0 [9월, 신청하면... 10월 150만원 지급!! 추가 24만원!! 이렇게 받으세요!! ]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

Euro Forecast: $1.15 by Mid-2025, ECB Rate Cuts Key

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

AUD/USD hits its highest since February 2023, remains UBS’ ‘most preferred’

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Economists says ‘No’ to China’s blitz of economic stimulus measures, its ‘not enough’!

The People's Bank of China and other authorities in China announced multiple stimulus measures on Tuesday, including:People’s Bank of China to cut its benchmark interest ratePBOC to lower the amount of cash that banks need to hold in reserve (this would free up more...

Australian monthly CPI due today, expected to be lower. Does it even matter to the RBA?

The monthly CPI data from Australia does not show all components of the CPI, that'll have to wait for the quarterly data release.The monthly CPI indicator does, however, provide a timelier indication of inflation using the same data collected for use in the quarterly...

NZD traders note – “It’s hard for the Kiwi to fall against a falling dollar”

I had this on Tuesday but am only posting it now.Yes, it would have been much more helpful for me to post it yesterday. I have no excuse. But ... if I did it was that I was snowed under by the news from those scoundrels in China!This is via KiwiBank in New Zealand,...

China Stimulus sparks global growth expecations, but raises inflation risks again

Via a note from JP Morgan on the China stimulus proposals that hit the headlines on Tuesday:The US has been the anchor for global growth, but a China reboot will also benefit the globeIt may create another inflationary pressure, so keep an eye on commodities and bond...

Goldman Sachs predict continued equity buying by CTA systematic traders, in every scenario

Via a note from Goldman Sachs on global equities, they see CTA systematic traders as net buyers for the next 2 weeks. GS says CTA traders are net long equities, around the 65th percentile, but nevertheless they will continue to be buyers "in every scenario" GS model....

Boosting China’s Economy: JP Morgan Outlines Key Policy Needs

JP Morgan analysts have outlined what's needed from China. The stimulus measures intended to be implemented, announced by the People's Bank of China and other authorities on Tuesday, are not enough. JPM say that while policy adjustments in China have been gradual and...

Caroline Ellison has been sentenced to two years in jail

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

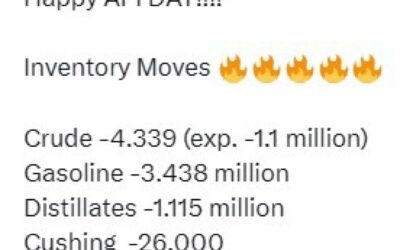

Oil survey of inventory shows huge headline crude oil draw, much greater than expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

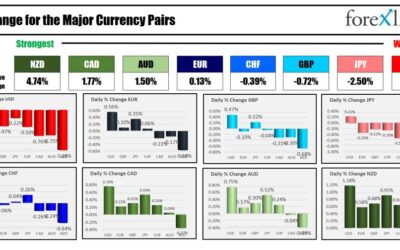

Forexlive Americas FX news wrap 24 Sep: Weaker data sends the USD lower.

The USD is ending the day as the weakest of the major currencies after weaker Consumer confidence and Richmond Fed survey data disappointed to the downside. The Conference Board confidence came in at 98.7 well off the 104.0 estimate. It was the biggest one month drop...

Another record close for the Dow and the S&P

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Economic calendar in Asia Wednesday, September 25 – Australian CPI expected to decline

The inflation data from Australia due today is not the official, complete reading. But, it's a guide, and its expected to show a fall back into the Reserve Bank of Australia target band of 2 - 3%:Australia CPI preview - CBA expect "Headline inflation in August back...

Trade ideas thread – Wednesday, 25 September, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ECB’s Knot says further rate cuts coming through at last H1 of 2025

Klaas Knot is President of De Nederlandsche Bank (DNB) – the central bank of the Netherlands - and thus a European Central Bank (ECB) Governing Council member.He spoke with Dutch TV programme Nieuwsuur: "I would expect us to continue to gradually reduce interest rates...

The USD continues its move lower.

The USD is continuing its run to the downside with the greenback trading at new lows for the day vs ALL the major currencies. EURUSD: The EURUSD is trading to a new intraday high of 1.11661. That is just short of the high from yesterday at 1.11665. Move above and the...

Friday has PCE data in the US, but Thursday is full of Fedspeak

On Friday, the Fed's favored measure of inflation PCE will be released with expectations of:Core PCE, est 0.2% vs 0.2% last monthPCE headline, Est 0.1% vs 0.2% last monthCore PCE YoY, Est 2.7% vs 2.6% last montPCE headline, Est. 2.3% vs 2.5% last monthThat will be...

Is a new banking crisis looming in the United States?

While Silicon Valley Bank and Signature Bank's failures may seem like old news, concerns about deeper problems in the banking sector that could harm the overall economy and S&P 500 are still alive.Despite the growth in the sector's stocks following last week's...

![[9월, 신청하면… 10월 150만원 지급!! 추가 24만원!! 이렇게 받으세요!! ]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/09/9ec9b94-ec8ba0ecb2aded9598eba9b4-10ec9b94-150eba78cec9b90-eca780eab889-ecb694eab080-24eba78cec9b90-ec9db4eba087eab28c-ebb09bec9cbc-400x250.jpg)