Broadcom will announce earnings after the close. What is expected?EPS $1.22Revenues $12.979THe price of Broadcom - like other chip stocks - has been hit over the last few weeks of trading. From the high on August 22 and $172.42, the price has move down to a low of...

Preview: Why August non-farm payrolls frequently disappoint

Consensus estimate +160K versus +175K prior (range +100K to +246K)July was +114K Private consensus +139K versus +148K priorUnemployment rate consensus estimate 4.2% versus 4.3% priorPrior participation rate 62.6%Prior underemployment U6 7.8% vAvg hourly earnings y/y...

GOP Nominee Trump: Will easily end 10 regulations for every new one

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

10 Tips Most Investors Wish They Heard Sooner

Investment mistakes are always expensive, which is why it’s best to learn from the experiences of others. With that in mind, here are the top ten tips that most investors really wish they had heard (and believed) sooner.1. Start Early The power of compounding means...

What’s the Catch? Risks in Today’s Market

Most companies have reported their earnings for the past quarter; overall, things look pretty solid. Despite a few big tech disappointments, market sentiment has stayed upbeat—things keep climbing.There's strong optimism and ongoing demand for riskier assets, and any...

Watch GOP nominee Trump live at the NY Economic Club

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

GOP nominee Trump to propose a 15% tax rate for companies that manufacture goods in the US

The Wall Street Journal is reporting that GOP nominee and former president Trump is to propose a 15% corporate tax rate for companies that make products in the US. The current low tax rate is 21%. Trump will be speaking in front of the New York economic club shortly....

Uh oh! Nasdaq index stalls the rally at the 200 hour MA today

Uh-Oh!The rise in the NASDAQ index today took the price to a high of 17295. That also extended briefly above its 200-hour moving average at 17284.26 (at the time - the current level is a little lower at 17281.12), but the momentum quickly reversed and traders started...

Treasury Secretary Yellen: US labor market has become less tight. Still creating jobs.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

European indices closing mixed on the day

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US treasury auction off 3, 10, and 30 year coupon issues next week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

NZDUSD stalls the rally today at the 200 hour MA

The NZDUSD moved higher earlier today, and in doing so, moved above the 100-hour moving average at 0.6209. The momentum price up-to-date 200-hour moving average of 0.62252. Getting above that moving average would have given the buyers more control. However, instead...

Weekly US crude oil inventories -6.873M vs -0.993M estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Crude oil is trying to rebound. The high price extended back above the $70 level

Crude oil prices are trying to rebound today with the price currently trading at $70 up $0.80 or 1.15%. The high price extended to $70.54. The low price was at $69.17. OPEC+ decided to delay the October output increase which was rumored yesterday.At the TOP of the...

USDCAD waffles above and below the 100 hour MA today. Traders await await the next shove.

The Bank of Canada cut rates by 25 basis points yesterday, but despite that cut, the CAD strengthened vs the USD (USDCAD lower). The move lower in the USDCAD cracked below the 100-hour moving average currently at 1.35136, but could not sustain downside momentum to the...

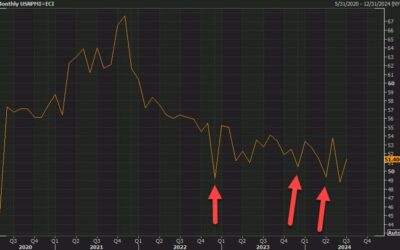

US August ISM services 51.5 vs 51.1 expected

Business activity index 53.3 versus 54.5 priorEmployment 50.2 versus 51.1 priorNew orders 53.0 versus 52.4 priorPrices paid 57.3 versus 57.0 priorSupplier deliveries 49.6 versus 47.6 priorInventories 52.9 versus 49.8 priorBacklog of orders 43.7 versus 50.6 priorNew...

OPEC+ agrees to delay October oil output increase – report

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Three reasons why the ISM services index has become an unreliable indicator

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

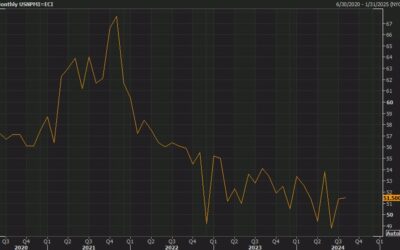

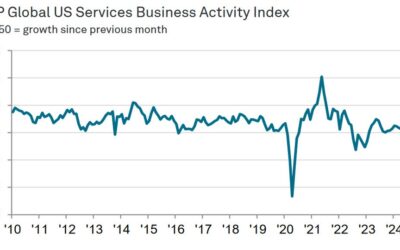

US August final S&P Global Services PMI Aug 55.7 vs 55.2 prelim

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Broader US indices bouncing to the upside

The market is transitioning today with the NASDAQ index rising while the Dow industrial average falls. The S&P is also higher but less so versus the Nasdaq.Nine minutes into the open,: Dow industrial average -142.87 points or -0.35% at 40832.11S&P index up...