High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

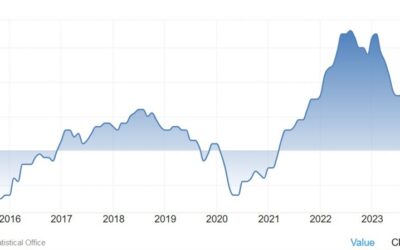

ICYMI – China’s official August manufacturing PMI fell to its lowest since February

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

CME Globex Labor Day holiday hours – open Sunday evening for Tuesday trade date

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Reserve Bank of Australia Governor Bullock is speaking twice in the week ahead

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

ICYMI – Goldman Sachs raised their Q3 US GDP estimate to 2.7% (q/q annualized), from 2.5%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

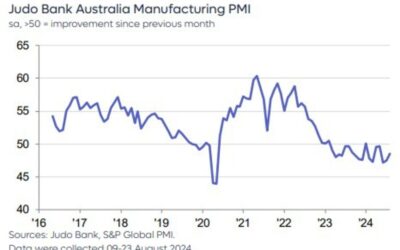

Economic calendar in Asia Monday, September 2, 2024 – China manufacturing PMI

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trade ideas thread – Monday, 2 September, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Politics – Germany’s far-right party AfD set to win one state election

The far-right Alternative for Germany (AfD) party looks set to win in a regional election, according to exit polls. AfD is projected to secure 33.5% of the vote in the Thuringia state parliamentary electionsahead of the conservative Christian Democrats (CDU), who are...

Monday morning open levels – indicative forex prices – 02 September 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Newsquawk Week Ahead: US NFP & ISMs; BoC, Canada jobs; Australian GDP; Swiss CPI

Mon: US & Canada (Labor Day), EZ & UK Final Manufacturing PMIs (Aug), Chinese Caixin Manufacturing PMI Final (Aug)Tue: Swiss CPI (Aug), Swiss GDP (Q2), Turkish CPI (Aug), US ISM Manufacturing PMI (Aug), Final Manufacturing PMI (Aug)Wed: BoC & NBP Policy...

Weekly Market Outlook (02-06 September)

UPCOMING EVENTS:Monday: US/Canada Holiday, China Caixin Manufacturing PMI, Swiss Manufacturing PMI.Tuesday: Swiss CPI, Swiss Q2 GDP, Canada Manufacturing PMI, US ISM Manufacturing PMI.Wednesday: Australia Q2 GDP, China Caixin Services PMI, Eurozone PPI, BoC Policy...

2024년 추석 명절지원금! 이렇게 신청하세요~ (저소득층, 국가유공자 정부와 지자체 지원 방법이 달라요!)

https://www.youtube.com/watch?v=z59Yly3PDMk 민족 대명절, 추석이 다가오고 있는데요. 모두가 행복하기를 바라는 명절이지만 사실 그렇지 않은 경우도 있죠. 경제적으로 어려움을 겪고 있는 경우에는 가족들끼리 얼굴 한 번 보기가 힘들기도 합니다. 그런 분들을 위해서 정부가 지급하는 지원금이 있다는 사실 알고 계셨나요? 지원금 신청 방법까지 설명해 드리겠습니다. #추석지원금 #명절지원금 #뉴스 MoneyMaker FX EA Trading...

[충격] 몰라서 못 받았다!! 혼자 살면..35만원 통장 입금 되는데!! 4가지 지원 체크]]#3.1경제독립tv

https://www.youtube.com/watch?v=vS3DrdbxF3k [충격] 몰라서 못 받았다!! 혼자 살면..35만원 통장 입금 되는데!! 4가지 지원 체크]]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

3.1시골농장tv 가을이 오는 길목에서^^~

https://www.youtube.com/watch?v=1Dff8TDNSEc MoneyMaker FX EA Trading Robot

뜨거운 여름 날~~하늘,구름 멍때리기ㅎㅎ#여름#구름#멍때리기#사곻농장

https://www.youtube.com/watch?v=1oTCbMUBfa0 MoneyMaker FX EA Trading Robot

[속보]기초연금40만원+생계급여 윤대통령 충격발표! 2025년 이렇게 된다! 195만원+최대@지급 시점은?]#3.1경제독립tv

https://www.youtube.com/watch?v=rLgIV421nQU [속보]기초연금40만원+생계급여 윤대통령 충격발표! 2025년 이렇게 된다! 195만원+최대@지급 시점은?]#3.1경제독립tv [3년뒤 10억부자 3.1경제독립tv필독추천영상] [1]정기예금 꼭~이렇게 가입하세요~ 이자 40만원~100만원! 더 받아요! https://youtu.be/6U8BR4kcPAo [2]통장에 이 돈 당장 빼세요! 만65세, 기초연금탈락! 통장에 얼마 있으면 못받나?...

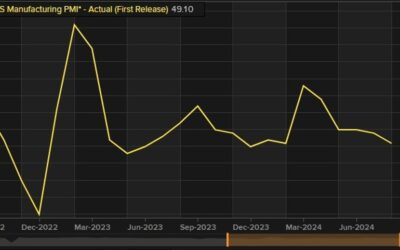

China August Manufacturing PMI 49.1 (expected 49.5), Services 50.3 (expected 50.0)

August 2024 official Chinese PMIs from the National Bureau of Statistics (NBS):Composite is 50.1August Manufacturing PMI 49.1 expected 49.5, prior49.4Services 50.3 expected 50.0, prior 50.2--The Chinese economy has been showing, and continues to show, a patchy and...

Forexlive Americas FX news wrap: US dollar strengthens despite slightly cooler PCE report

Markets:Gold down $19 to $2501WTI crude oil down $2.47 to $73.44US 10-year yields up 4.3 bps to 3.81%S&P 500 up 0.6%USD leads, JPY lags.It was tough to tie the fundamentals to the market moves today, as is often the case at month end. Tokyo CPI was hot earlier and...

US stock markets catch a sizzling late-day bid but Nasdaq ends three-week winning streak

SPX daily chartThere was no lack of drama in the final day of equity trading in what was a wild ride in August. The S&P 500 opened strongly and then gave it all back to trade in negative territory at midday. However some steady bids emerged in the afternoon before...

US dollar specs turn short for the first time since February

The main driver of US dollar strength over the past number of years was 'US exceptionalism'. That's meant stronger growth and higher US interest rates.The stronger growth narrative is still in place -- even if it requires a deficit at 7% of GDP -- but Fed Chairman...

![[충격] 몰라서 못 받았다!! 혼자 살면..35만원 통장 입금 되는데!! 4가지 지원 체크]]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/09/ecb6a9eab2a9-ebaab0eb9dbcec849c-ebaabb-ebb09bec9598eb8ba4-ed98bcec9e90-ec82b4eba9b4-35eba78cec9b90-ed86b5ec9ea5-ec9e85eab888-eb9098-400x250.jpg)

![[속보]기초연금40만원+생계급여 윤대통령 충격발표! 2025년 이렇게 된다! 195만원+최대@지급 시점은?]#3.1경제독립tv](https://my.blogtop10.com/wp-content/uploads/2024/08/ec868debb3b4eab8b0ecb488ec97b0eab88840eba78cec9b90ec839deab384eab889ec97ac-ec9ca4eb8c80ed86b5eba0b9-ecb6a9eab2a9ebb09ced919c-2025-400x250.jpg)