Bitcoin dailyIt's an ugly one for bitcoin as it fell nearly 7% on the day to $65,239 at the lows. It's since recovered slightly as nearby support from the April low helps out.The halvening is coming up and the bitcoin bulls hope that's a catalyst around April 20 but...

WTI crude settles up 64-cents as Middle East angst dominates

Fear is the most-powerful emotion and war is one of the greatest fears.When that kind of emotion grips a market, it's tough not to get swept up in it but nearly-invariably, the futures is better than feared. So it was with the war drums beating earlier today and...

Fed’s Schmid Q&A: We’re at a bumpy stage now with inflation

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Iran signals ‘calibrated’ retaliation against Israel – report

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Goldman Sachs boosts year-end gold prices target to $2700

Gold 10 minsGold has taken a $70 nosedive after hitting an all-time high of $2431 earlier today. The spike-and-reversal has come with increasing angst in broad markets and a nearly 2% decline in the Nasdaq. The market is concerned about a war in the Middle...

KC Fed President Schmid: Current stance of US monetary policy is appropriate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Reports of 30-50 missiles launched from Lebanon at Israel

The US has been warning about a large, coordinated attack on Israel and the worry in markets is that this is it, or this is the first silo with more to come over the weekend. The latest report is that 30-50 missiles -- likely Katyusha rockets -- were launched by...

US weekly Baker Hughes oil rig count -2

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDCAD up sharply on the week and runs away from broken resistance. What next?

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Chicago Fed Pres. Goolsbee: US is in an environment of “cross currents”

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

WSJ Timiraos: Core PCE probably rose 0.27% in March according to forecasters

WSJ Timiraos is on X saying that the core PCE probably rose 0.27% in March according to forecasters given CPI and the PPI numbers for their models.. That would lower the YoY to 2.7% from 2.8%. The market knows the Fed does not want to tighten. The market knows that...

AUDUSD and NZDUSD move lower on “risk-off” selling. What next technically?

The AUDUSD and the NZDUSD are lower on the day as "risk off" flows from geopolitical tension weighs on the pairs.For the NZDUSD it has reached the lows from last week at 0.59364. So far buyers are leaning against the level. The price is bouncing marginally.The AUDUSD...

Sen Rubio: “Barring some last-minute development, Iran is going to attack Israel”

There have already been a number of different reports about Iranians attack on Israel in response to killing of officials in Damascus. Now US Sen. Rubio is on the wires saying:Barring some last-minute development, Irene is going to attack IsraelUS stocks are lower...

Weekly Market Recap (08-12 April)

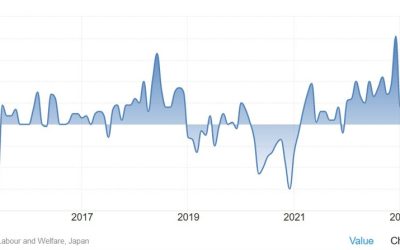

The Japanese February Wage data came in line with expectations:Average Cash Earnings Y/Y 1.8% vs. 1.8% expected and 2.0% prior.Real Wages Y/Y -1.3% vs. -1.4% expected and -0.6% prior.Japan Average Cash Earnings YoYThe Switzerland Unemployment Rate ticked higher in...

A technical look at the EURUSD, USDJPY and GBPUSD for April 12, 2024

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

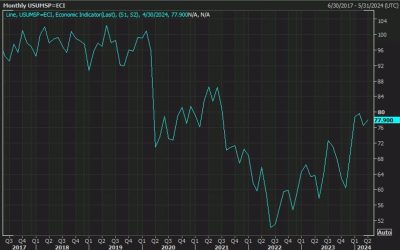

University of Michigan consumer sentiment 77.9 vs 79.0 estimate

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US stocks lower at open project

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Crude oil futures now up over two dollars on the day

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Feds Collins: Inflation will come down even with a healthy labor market,but will take time

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US stocks in premarket trading are moving lower

US stocks in premarket trading are moving more to the downside over the last few minutes of trading as markets prepare for the possibility of increased military engagement in Israel. Stock index futures are not implyingDow industrial average -237 pointsS&P index...