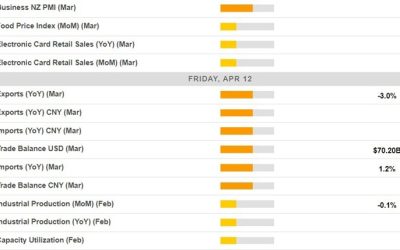

Chinese trade data is the focus for the data calendar this session. Exports have been improving, but the estimate for March is for a drop y/y. The Chinese economy has been showing signs of improvement, but the People's Bank of China is still very nervous about the...

US equities bounce back bigtime

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Trade ideas thread – Friday, 12 April, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

The US is looking like an outlier in the global inflation picture. Why that matters.

There is a raging debate about US inflation right now and whether it will be sticky. But more importantly, there's a debate about the inflation regime that we're in right now. We spent 20 years before covid in an era of disinflation and many believe we're in a new era...

온누리10% + 농할30% 장볼 때 혜택 더 보는 꿀팁 알려드려요!!

https://www.youtube.com/watch?v=PDpNAoWWaGs 농할상품권 + 온누리상품권 더 싸게 식재료를 구입할 수 있는 꿀팁을 소개해 드리겠습니다. 도움이 되셨으면 좋겠습니다. 링크 - https://naver.me/FDjrMhAI #꿀팁 #할인정보 #정부지원 MoneyMaker FX EA Trading...

BofA: Reevaluation of Fed rate cut timeline following the March CPI report

Bank of America reexamines the Federal Reserve's potential rate cut timeline after the March Consumer Price Index report surpassed expectations, marking the third consecutive month of higher-than-anticipated core inflation rates. Despite retaining a tentative...

US stocks extend to new highs

The major US stock indices are trading to new session highs. The gains are led by the Nasdaq index which is up 256 points or 1.58% at 16425.45. The S&P is up 0.86%. The small cap Russell 2000 is up 0.77%.The gains are being helped by relief from the PPI data...

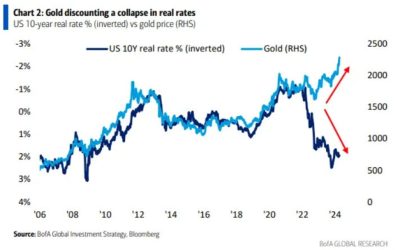

Gold passes another test

I hated this trade when it was being reposted every day and now we've all seen why.Correlation does not equal causation.Gold is a chameleon. Yes, at times it competes with bonds and yield is a factor but it's also a currency. What happened when those diverged?Russia...

Dip buyers pounce on stocks, chipmakers lead the way

There has been an impressive turn in US equity markets, particularly from the pre-market lows. Eminis are now up 24 points on the day and up 50 points from the daily lows.There isn't a clear catalyst for the move and there hasn't been any help from the bond market as...

U.S. Treasury auctions all $22 billion of 30 year bonds at a high-yield of 4.671%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

U.S. Treasury to auction off 30-year bonds at the top of the hour

The U.S. Treasury will auction off $22.0 billion a 30-year bond at the top of the hour. The six-month averages of the major components shows:Bid to cover 2.38XTail 0.8 basis pointsDirects (a measure of domestic demand) 16.4%.Indirects (a measure of international...

Nomura: There is no sense that the BOJ is going to intervene soon

The Nikkei is reporting that Nomura is saying that:despite a notably covered home from officials since late March as the Yen hovered above the 152 level, "there is no says that they are going to intervene anytime soon"The Mitsubishi Trust in banking added:The JPY...

ECB sources: We heard from Lagarde. What about the others? Expect to cut in June still.

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Boston Fed Pres. (voting member) Collins: Economic uncertainty is elevated

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Boston Fed Pres. Collins: Recent data argue against imminent need to change rates

Boston Fed Pres. Susan Collins is on the wires saying:Recent data argue against imminent need to change rates.Still expects rate cuts this year.May take more time for economy to moderate as needed.Economic strength may auger fewer rate cuts.Disinflation likely to...

AUDUSD corrects higher today, but into MA resistance where sellers lean.

The AUDUSD corrects higher today but into a cluster of MAs including the 100/200 bar MAs on the 4-hour chart and the 200-day MA. Although the price gets above the 200 day MA and the 100-bar MA on the 4-hour chart, it cannot extend above the 200-bar MA on the 4-hour...

ECB sources report: ECB policymakers still expect to cut rates in June

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

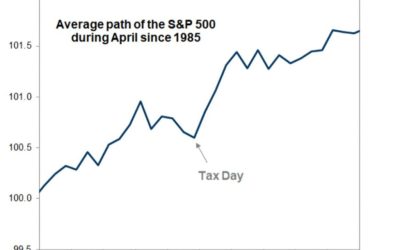

The US is approach tax day, why it matters for the stock market

Here is a good chart from Goldman Sachs illustrating daily seasonals in April. It's a sizzling month but the days up-to and including the US April 15 tax-filing deadline are sluggish. "Tax Day is a seasonal weak period, on the day by day chart, but April remains...

The USD is trading higher with the greenback making new highs vs EUR, GBP, CAD leading.

The decline in the US yields has now been retraced with the yields further out the curve, now up on the day again. 5-year yield 4.615%, +0.2 basis points10 year yield 4.572%, +1.2 basis points30-year yield 4.666%, +3.2 basis pointsThe U.S. Treasury will optional...

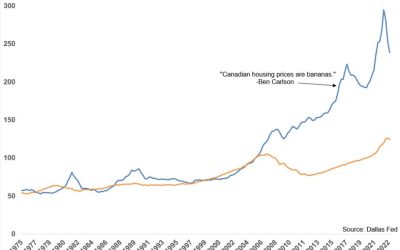

Gotta keep the Canadian ponzi scheme going

This extends amortizations from 25 years.Without home price appreciation and insane amounts of immigration, I'm not even sure Canada has a functioning economy.The new rules will apply to first-time homebuyers purchasing newly built homes via insured mortgages. The...