US Dollar (DXY), USD/JPY, and Gold LatestUS dollar weakens further ahead of key Fed chair speechUSD/JPY looks technically weakGold consolidating Friday’s record high.This year’s Jackson Hole Symposium – “Reassessing the Effectiveness and Transmission of Monetary...

Markets pensive awaiting US PPI data

Will we get to see some fireworks today? The US PPI data coming up later will be the one to watch. And it might take on much more importance, in terms of impact, considering that markets have been rather sidelined for over a week now. It's all about how the US data...

OPEC leaves world oil demand growth forecast unchanged in latest monthly report

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

USDJPY Technical Analysis – All eyes on the US inflation figures

Fundamental OverviewThe generally positive risk sentiment continues to weigh on the JPY as the carry trade remains in cruise control. The market is also less fearful of an intervention before the 160.00 handle as it’s been pretty clear that the Japanese can’t do...

US April NFIB small business optimism index 89.7 vs 88.5 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Inflation Fears Grip the Market: DJIA Eyes Data Amid Recent Upsurge!

The Dow Jones reaches a 45-day high before investors cash-in profits ahead of this afternoon’s inflation reading. Producer and Consumer inflation has risen for 3 consecutive months, but investors hope for a “cool-down” in April. 73% of the Dow Jones’ stocks trade...

US unveils steep tariff hikes on Chinese chips, cars

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Germany May ZEW survey current conditions -72.3 vs -75.8 expected

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

What are the main events to look out for today?

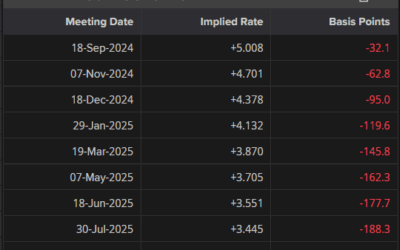

The market today will focus mostly on the US PPI figures even though we will also get the latest US NFIB report and hear from Fed Chair Powell. The US Core PPI Y/Y is expected at 2.4% vs. 2.4% prior, while the Core M/M measure is seen at 0.2% vs. 0.2% prior. US PPI...

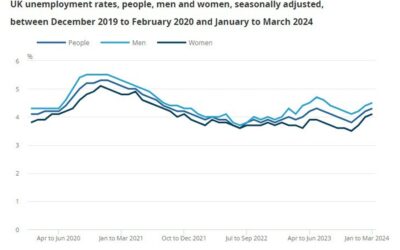

Sterling Steady as UK Jobless Rate Rises, Wage Pressures Keep BoE Vigilant

UK Unemployment Rate Rises to 4.3%, While Earnings Remain ElevatedThe UK unemployment rate rose to 4.3% in March from a prior 4.2% as tight monetary conditions are slowly having an effect on the real economy. One area where contractionary policy is not having as much...

BOE’s Pill: We can cut interest rates while maintaining restrictive policy stance

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

BOE’s Pill: There is still some work to do on inflation persistence

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

DailyForex Reveals the 5 Top-Rated Scalping Forex Brokers

DailyForex analysts have unveiled the best trading platforms for scalping Forex in 2024. Scalping is a popular trading strategy in the Forex market and is one of the key trading strategies for 2024, but not all brokers allow it. Trading specialists at DailyForex have...

GBPUSD Technical Analysis – The focus switches to the US PPI data

Fundamental OverviewToday the UK labour market report showed job losses and an uptick in the unemployment rate, although wage growth remained sticky at high levels. The data hasn’t changed anything for the market though as the focus remains on the two UK CPI reports...

Russian president Putin to visit China later this week

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

Spain April final CPI +3.3% vs +3.3% y/y prelim

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

What has changed after the UK jobs data?

The UK labour market report showed once again job losses and another uptick in the unemployment rate. On the other hand, wage growth remained sticky at high levels with the data beating expectations. Nonetheless, the data was consistent with the BoE's forecasts and...

BOJ to hold off next rate hike until September, says former central bank executive

Momma says that the BOJ is likely to want to wait until September at least before hiking rates again. That is so policymakers can gather more information from the government's monthly wage data for July and August, to confirm whether or not the stronger wage hikes...

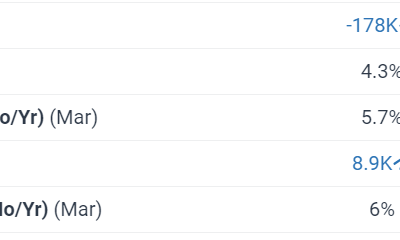

UK March ILO unemployment rate 4.3% vs 4.3% expected

Prior 4.2%Employment change -177k vs -220k expectedPrior -156kApril payrolls change -85kPrior -67k; revised to -5kAverage weekly earnings +5.7% vs +5.5% 3m/y expectedPrior +5.6%; revised to +5.7%Average weekly earnings (ex bonus) +6.0% vs +5.9% 3m/y expectedPrior...

Germany April final CPI +2.2% vs +2.2% y/y prelim

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...