Analysts at PIMCO have issued a note with what's ahead for the US dollar as the US Federal Reserve begins it rate cut cycle. They highlight that since the 1990s, the dollar has typically weakened, albeit temporarily, following initial rate cuts by the Federal Reserve....

Broader US stock indices up for the fourth consecutive day

After a sharp declines last week when they NASDAQ index fell by -5.77% and the S&P fell by -4.25%, each of those indices are up for four consecutive days this week. The NASDAQ index is now up 5.27%, while the S&P index as rebounded by 3.46% this week.Looking...

Economic calendar in Asia Friday, September 13, 2024 – a light one

The day might be spent digesting the European Central Bank decision and spitballing the FOMC one.This snapshot from the ForexLive economic data calendar, access it here.The times in the left-most column are GMT.The numbers in the right-most column are the 'prior'...

Trade ideas thread – Friday, 13 September, insightful charts, technical analysis, ideas

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

CPI and PPI data point to a tame ore PCE next month

Nick Timiraos from the WSJ has tweeted that economists who map the CPI and PPI to the core PCE, are forecasting a rise of 0.13% to 0.17% for the August PCE. A reading of 0.13% would round to 0.1%, while 0.17% would round up to 0.2%.In either case (0.1% or 0.2%), it...

Was the CItigroup trader the best trader in the world? He thinks so.

The Financial Times has published a fascinating article about Gary Stevenson, a former Citibank trader who boldly claims to have been the best trader in the world. The piece, titled "Gary Stevenson claims to have been the best trader in the world. His old colleagues...

EURUSD runs to the 200 hour MA.

The EURUSD is running to a new high for the day up to 1.10597. That has now taken the price of the pair above its 200-hour MA at 1.10563. Traders will be looking for more upside momentum on the break.The price is also moving away from the 100-hour MA AND the broken...

WSJ Timiraos: Fed has a rate cut dilemma. Go big or go small

The WSJ Timiraos is out with an analysis of the upcoming Fed rate decision. The title of the article says it all with the author calling the decision a dilemma. That is does the Fed go big or small (or by 25 basis points or 50 basis points). Some of the highlights;Fed...

Reuters IPSOS poll: Harris 47%. Trump 42%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US Treasury auctions off $58 billion of 30 year bonds at a high yield of 4.015%

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...

US household net worth rose to record $163.8 trillion in Q2 2024

Underscoring some analysts view that the US economy will not go in to a prolonged recession and may continue to have the soft landing. The Federal Reserve is reporting that US household net worth rose to a record $163.8 trillion in Q2 2024.Stock market values rose by...

ECB sources: ECB officials have not ruled a rate cut at the October meeting, but…

ECB sources via Bloomberg reports: Given the downside risk in economic growth in the EU, ECB officials are keeping the door open for a cut at the October meetingReuters is now reporting:Policymakers see an interest rate cut in October as unlikely, unless there's a...

Higher close for European major indices

The major European indices are closing higher in the day led by Spain's Ibex which is higher by 1.08% today: German DAX, +0.97%France's CAC +0.52%UK's FTSE 100 +0.57%Spain's Ibex +1.08%Italy's FTSE MIB +0.84%As London/European traders head for the exits, US indices...

USDCAD finds buyers near the rising 100 hour MA today. Upside work is still needed.

The USDCAD is finding buyers against its rising 100 hour moving average currently at 1.35756 (see rising blue line on the chart below). Stay above that moving average will keep the buyers more in control. Also in play is a 200 day moving average at 1.35889.On the...

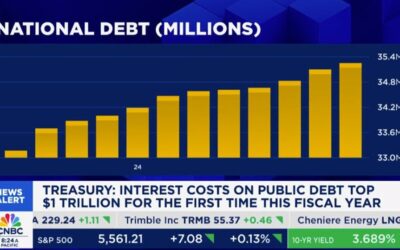

US August budget deficit -$380 billion versus estimate -$317.3 billion deficit

US national debtThe August US budget deficit data was released early. It was expected later this afternoon. US August 2024 budget deficit $-380 billion versus $-317.3 billion estimateAugust 2023 surplus was $89 billionFiscal 2024 year-to-date deficit $1.897 trillion...

Gold is precious in the eyes of investors. The precious metal breaks to new all-time highs

The price of gold has been trading between $2471 and $2531 since August 16. There have been a number of different times the price low has been tested and a number different times the price high has been tested.Today, however, the price made a break for it above the...

USDCHF moves above the 38.2% of the last move lower from the mid-August high.

Yesterday, the USDCHF moved above its 100 hour moving average, eight 200 hour moving average, and its 100 bar moving average on the four hour chart. All those breaks help the pair move up toward the 38.2% retracement of the move down from the mid August high. That...

Kickstart the FX trading day for Sept 12 w/a technical look at the EURUSD, USDJPY & GBPUSD

In the kickstart video for September 12, I take a look at three the major currency pairs from a technical perspective - the EURUSD, USDJPY and GBPUSD.The USD is lower after they PPI data and the ECB rate decision to cut interest rates. All was much as expected so the...

Tech stocks wobble: Communication services shine while energy holds steady

Stock heatmap by FinViz.com Thu, 12 Sep 2024 13:46:12 GMT📊 Sector OverviewThe US stock market showcased a mixed bag today, with a notable divergence across sectors. A close look reveals that communication services led the charge with robust performances, while the...

US stocks opened modestly higher

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives,...